Plan to lift capital controls: crunching the numbers… again

In the case of Glitnir there was a retrade – the numbers have been renegotiated since the June plan. The government has talked effusively about clarity and transparency in liberalising capital controls but the process of introducing such a plan has been characterised by obfuscation and opacity. The plan seems sensible but earlier promises by the prime minister’s party, the Progressives, of gigantic windfall seem to have pushed the government to play a game of make-believe, smoke and mirrors. Selling the banks will prepare for the coming years: drumming up the fear of foreign investors masks the fact that the greatest danger is the mind-set of the boom years.

The press conference October 28, to introduce the assessment made by the Central Bank of Iceland, CBI of the draft proposals from Glitnir, Kaupthing and LBI, was a very low-key event held at Hannesarholt, a small culture house in the centre of 101 Reykjavík – nothing like the hugely publicised and carefully staged June event at Harpan, the glass palace by the harbour.

In June, when the plan to lift capital controls was formally introduced, the emphasis was on the large funds, altogether ISK850bn or 42.5% of Icelandic GDP, which could be recovered by the planned stability tax. There was albeit to be some deduction, the number was closer to ISK660bn but yet, the tax was the thing and the numbers astronomical.

Already then, it was heard from all directions that in spite of the tax rhetoric, minister of finance Bjarni Benediktsson was not keen on the stability tax. He preferred a negotiated stability contribution, seeing it as best compatible with his goal of the least legal risk and taking the shortest time, as the International Monetary Fund, IMF, also recommended.

Lo and behold, the CBI now recommends stability contribution, as governor Már Guðmundsson presented last week (full version in Icelandic; a short one in English) firmly supported by Benediktsson at last week’s press conference. The stability contribution mentioned is ISK379bn but plenty of numerical froth was whirled up, as so-called counter-active measures, pumped up to a sum of ISK856bn, no doubt meant to trump the tax of ISK850.

With the booming Icelandic economy luckily there are strong indications that the economy can well cope with the measures planned; getting rid of the controls will be a big leap forward for Iceland. What leaves a lingering irritation is the illusion and mis-information used, no doubt to make the Progressive party’s election campaign promises look less outrageous now that the plan goes in an entirely different direction compared to its earlier promises.

A bank or two

Due to the toxic legacy of Icesave, the Left government (2009-2013) was forced to take over the new Landsbankinn. What now came as a surprise was to see the government accepting to take over Íslandsbanki as part of the Glitnir solution.

Clearly, Glitnir with its large share of ISK assets was always going to be a tricky situation to solve but well, this turn of event was a surprise.

Until the announcement, Glitnir’s winding-up board, WuB, had bravely tried to convert its largest Icelandic asset, Íslandsbanki, into foreign currency by selling it to foreigners paying in foreign currency. Time and again there was news about an imminent sale, to outlandish elements – Arabic and Chinese investors were mentioned.

Cough cough, getting such investors accepted as fit and proper by Icelandic authorities was never going to be trivial though getting the Icelandic political class agreeing to foreign owners was a no less daunting task. After all, Iceland is the only European Economic Area, EEA, country where the banks are entirely under domestic ownership.

It is still unclear what the price tag on Íslandsbanki is. At first I understood that the bank would be acquired for a fraction of its book price of ISK185bn, of which Glitnir owns 95%, ie. ISK176bn. Now I’m less sure; apparently the price might be as much as ISK164bn.

Glitnir number crunching

According to previously published information, the stability contribution amounted in total to ISK334bn. The recent changes to the Glitnir contribution are not entirely easy to decipher.

As I pointed out earlier the new Glitnir agreement was indeed a retrade since Íslandsbanki was unable to honour previous plans. With the new plan Glitnir gives up 40% of the planned FX sale of Íslandsbanki, valued in ISK at ISK47bn as well as Íslandsbanki dividend of ISK16bn, meant to be paid in FX, in total ISK63bn. In return creditors are allowed to exchange more ISK into FX than earlier planned.

This seems to rhyme with the Ministry of finance press release: “According to the above-described proposal, the transfer of liquid assets, cash, and cash equivalents will be reduced by 16 b.kr. because of the proposed foreign-denominated dividend to Glitnir, which will not be paid, and 36 b.kr. due to other changes provided for in the amended proposal from the Glitnir creditors.”

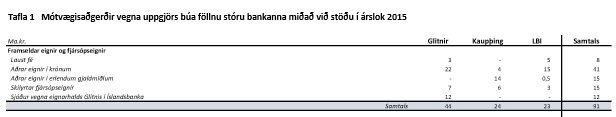

(From the Oct. 28 Icelandic CBI report; counter-active measures related to the estates of the three big banks, at end of 2015; 1. line Cash; 2. Other ISK assets; 3. Other assets in FX; 4. Cash-sweep assets)

The interesting thing is that the CBI report seems to indicate that this has negative impact on the CBI currency reserve, by ISK51bn

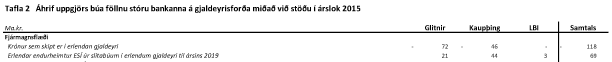

(From the Oct. 28 Icelandic CBI report; counter-active measures related to the estates of the three big banks, at end of 2015; 1. ISK converted into FX; 2. FX recovery by ESÍ, Assets held by CBI, from the estates, in FX until 2019)

Smoke and mirrors

It has been my firm opinion that since the estates, because of capital controls, can’t be resolved as a private company normally would, i.e. without a state interference, the outcome should be negotiated. This has now happened, a welcome and wise approach.

The smoke-and-mirrors events that the government has chosen in introducing the latest step towards lifting the controls is however neither wise nor welcome. Considering the emphasis in June on the stability tax the step taken now towards stability contribution can’t be said to be a logical step on from the June plan though an entirely sensible plan. Indeed, the June emphasis on the tax was a deviation from what Benediktsson seems to have intended for quite some while, i.e. a negotiated contribution and not a one-sided tax.

Value of Íslandsbanki v Arion

With news that investors are seeking to buy Arion it seems that the p/b in question is 0.6-0.8, where the lower estimate may turn out to be the more realistic one.

However, this is in stark contrast to the p/b that the state seems to be paying for Íslandsbanki, i.e. 0.93. Considering the banking sector in Iceland – probably still too big and still miraculously gaining from one-off legacy windfall – this price for Íslandsbanki would be nothing less than staggering and could well be seen as a total failure on part of those negotiating for the government.

Arctica Finance and Virðing – ties to politics and the past

It comes as no surprise that the pension funds are buyers in spe of the Icelandic banks. According to news in Iceland, it seems there are two finance firms – Virðing and Arctica Finance – vying for buying Arion. As could be expected, both have ties to politics and the past.

Virðing is run by ex-Kaupthing bankers i.a. Kaupthing Singer & Friedlander manager Ármann Þorvaldsson, owned by investors with various ties to the boom times and very active during the last few years. Arctica Finance was set up by bankers mostly from old Landsbanki, i.a. Bjarni Þórður Bjarnason, seen to be strongly connected to the Independence Party, Benediktson’s party. Unsurprisingly, both firma are courting the pension funds, the source of the greatest financial power in Iceland.

The really worrying aspect here is that the pension funds have all clung religiously to their mantra of being non-interfering non-active owners. During the boom years the pension funds were closely aligned with the banks and in the end lost heavily because of these ties and their unquestioning and uncritical attitude to the banks. There were clear indications of clustering: certain pension funds seemed particularly close to certain banks and certain large shareholders.

The billionaire-makers of Iceland: the pension funds

In most countries such ties exist to a certain degree but in Lilliputian Iceland these ties of friendship, kinship and political ties, border on the incestuous.

If we are now seeing these old ties revived among owners of one or more banks Iceland is set for round two of running the banks as during the boom years: with a chosen group of what I have called “preferred clients” and their fellow-travellers, i.e. clients who got collateral-light or no-collateral loans, who got bullet loans that were continuously rolled on, never classified as non-performing – and then all other clients who just got the professional scrutiny any normal person can expect from a bank.

Indeed, the pension funds are not only king-makers in the new Iceland but billionaire-makers. This has to a certain degree started, though on a minor scale so far: the pension funds are already investing with groups of investors who are doing very well from these ties. Clearly, investors chosen as the funds’ co-investors are pre-destined to do exceedingly well.

Indeed, the pension funds are not only king-makers but billionaire-makers.

The fight against foreign ownership – to control Iceland

This possible danger of the pension funds repeating past mistakes is compounded in an Icelandic-owned banking system with no foreign competition and no foreign ownership, a wholly exceptional situation in Europe.

Seen from this point of view it is utterly fascinating to notice that many in power in Iceland, both in politics and business, have for decades fought with all their might against foreign ownership of banks or any sort of important businesses in Iceland – and still do.

From the point of view of these old bastions of power Iceland needs to be connected to the outer world but only to the degree that Icelandic entities can make use of connections abroad, not the other way around, i.e. no foreign ownership in Iceland. Needless to say, these powers fiercely oppose closer connection to the European Union – nothing more than the EEA, thanks!

The fight to link with the pension funds and to buy banks is the latest apparition of interest politics in Iceland: it is a battle of the soul of Iceland and the weapons are fear of foreigners and foreign ownership though the real danger is entirely domestic: the danger of the same mind-set that ruled the banks during the boom years and eventually pushed them off a cliff in October 2008.

Follow me on Twitter for running updates.

If your web page passes the test, after that Google counts it as mobile-friendly, which is a bonafide ranking aspect.

rankerx review

22 Jun 21 at 12:18 am

I do agree with all the concepts you have offered in your post. They are really convincing and will definitely work. Thank you for the post.

a vet

24 Jul 22 at 4:03 pm

Thank you so much for giving everyone an extremely pleasant possiblity to read articles and blog posts from here. It’s always so great and as well , full of a good time for me and my office friends to visit your blog particularly 3 times every week to read through the newest guides you have. Of course, we’re at all times fulfilled for the cool tips served by you. Selected 4 tips in this posting are indeed the simplest we’ve had.

kd 15

25 Jul 23 at 6:45 am

I’m just commenting to make you be aware of what a really good encounter my princess found studying your web site. She even learned a wide variety of details, which included how it is like to have a great helping heart to let certain people effortlessly master a number of tricky issues. You undoubtedly exceeded visitors’ desires. I appreciate you for showing the important, dependable, informative and also unique thoughts on this topic to Sandra.

bapesta shoes

19 Jan 24 at 4:47 pm

I precisely had to say thanks once again. I’m not certain the things that I would have worked on in the absence of these tricks revealed by you regarding my area. It actually was a very intimidating condition in my opinion, nevertheless coming across a specialised way you dealt with the issue made me to jump over contentment. I will be happy for this help and pray you really know what a great job you were providing teaching men and women via your web site. I am sure you haven’t come across all of us.

kyrie irving

20 Jan 24 at 6:18 pm

Needed to post you one tiny word to finally give many thanks yet again on the exceptional secrets you’ve shared here. It’s really surprisingly generous of people like you to present openly exactly what many of us could possibly have supplied for an ebook to get some cash for their own end, most importantly seeing that you could possibly have tried it if you wanted. The secrets likewise worked like a good way to realize that other individuals have the same desire just as my own to learn a good deal more on the subject of this problem. I’m sure there are several more pleasurable times ahead for those who look over your blog post.

kyrie 9

21 Jan 24 at 9:00 pm