Gunnlaugsson goes solo on the abolition plan: beginning of an action plan or end of coalition?

In an “overview speech” at his party’s annual conference prime minister Sigmundur Davíð Gunnlaugsson announced today an outline of an abolition plan, short on content – only stability tax mentioned – but long on scaremongering of creditors and their wealth amassed in Iceland, with strikingly wrong numbers. From earlier statements by Bjarni Benediktsson minister of finance, whose remit the capital controls are, it is difficult to imagine he condones Gunnlaugsson’s views. Apart from whether this is a good plan or not it is worrying that the prime minister has lately been quite “statement-happy,” expressing views, which neither Benediktsson nor others have heard of until reported on in the media.

Before the Parliament’s summer recess the government will present a Bill to lift capital controls. This is what prime minister Sigmundur Davíð Gunnlaugsson leader of the Progressive party announced at the party’s annual conference Friday.

The only concrete measure Gunnlaugsson announced is “stability tax” that according to the prime minister will bring billions of Icelandic króna to the state coffers. As earlier, Gunnlaugsson emphasised the financial gain and the need to remove the new bank’s ownership from creditors. Worryingly, Gunnlaugsson presented wrong numbers and statements, which do not quite seem to make sense or at least rest on some fairly particular interpretation of reality.

From earlier statements by minister of finance Bjarni Benediktsson on capital controls it is difficult to see how Gunnlaugsson’s statements fit Benediktsson’s prerequisites of an orderly process based on classic measures, as outlined in Benediktsson’s last status report on the controls (see my take on it here). In addition, Gunnlaugsson has now taken the initiative from Benediktsson. The question is if he did at all discuss his speech with Benediktsson beforehand – allegedly, the two do not spend much time and effort communicating.

This in addition to some recent statements from Gunnlaugsson, which have not been discussed with Benediktsson or in the government. Also, there is the report by his fellow party member Frosti Sigurjónsson on monetary systems, another solo initiative by the prime minister.

With Gunnlaugsson’s latest statement there have been some speculation if Benediktsson and his party feel to stay in this coalition much longer. However, it might prove tricky for the party to leave without making it look as if they are somehow caving into creditors whereas Gunnlaugsson is gallantly fighting them.

Icelanders are slowly learning that whenever the prime minister speaks they glimpse the world according to his “Weltanschuung” – and it does not always seem to rhyme with reality.

Wrong numbers, remarkable calculations

In his speech Gunnlaugsson said, according to Icelandic media (I have so far not found a link to the speech), that most of the creditors were hedge funds that having bought the claims in a fire sale had profited quite enormously. The claims in the collapsed banks are so high, he said, that it is difficult to imagine it – as much as ISK2500bn (which being ca 1 ½ Icelandic GDP is not that hard to imagine). “Were this sum invested it would be possible to hold Olympic games, just for the interests, every four years, for eternity.”

This is wrong. The claims themselves are around ISK7000bn, the assets of the three estates are at ISK2250bn. As to the interests of this sum possibly being a sort eternity machine to finance the Olympics this hardly adds up. If we postulate that half of the assets are in cash at 1% interest rates and other assets carry 5% interest rates the annual interest rates would amount to ISK67.5bn or ISK270bn, just under $2bn, over four years. Would that be enough to finance the Olympics? The cost of the London games amounted to $14.6bn, ISK2000bn, the cost of Sochi $51bn, ISK7000bn.

This is worryingly wrong and far beyond reality. The fact that the prime minister does not know the correct numbers is bad but almost worse that he does not have advisers to enlighten him and find the correct numbers for him. Whoever tried to impress him with the Olympics parallel if clearly not fit to be an adviser on financial matters.

Tellingly, all these numbers and the Olympics calculations were diligently reported on Morgunblaðið’s front page today.

The spying conniving creditors

With all these assets (albeit a wrong number) Gunnlaugsson concluded that creditors would be prepared to go to some length to protect their assets. Who wouldn’t? he asked, considering the sums.

“It is known that most if not all larger legal firms in Iceland have worked on behalf of these parties or their representatives. It would be hard to find a PR firm, operating in Iceland that has not worked for these same parties in addition to a large number of advisers in various fields. This activity is almost frightening and it is impossible to tell how far they reach but according to recent news creditors have bought services to protect their interests in this country for ISK18bn in recent years.”

Again, there is no reference to where this number comes from but it seems farfetched, to say the very least. Further, Gunnlaugsson stated:

“We know that representatives of creditors have gathered personal information on politicians, journalists and others who have expressed views on these issues or are likely to do so. And in some cases people have been psychoanalysed in order to better understand how best to deal with them. Secret reports are written regularly in this country for creditors, which inform on how things are going in Iceland, on the politics, public debate, the financial system and so on. In one of the first reports it was stated that the greatest threats to the hedge funds reaching their goals, the main obstacle for them to do as they pleased, was called the Progressive party.”

Exactly what creditors have done to collect information in Iceland I don’t know but what the prime minister describes here is normal proceedings for doing business in a country (though the psychoanalysis might be rare though by far not unknown): they want to follow what is going on, how it affects their interests and so on. The alarmist tone is somewhat misplaced – creditors would not be pursuing their interests well if they did not keep a close eye on Iceland. It does not matter if it is Argentina, Greece of Iceland: firms want to understand the environment they operate in.

“One has to give it to these guys (creditors): they get the main facts right,” said Gunnlaugsson. – Getting the facts right is something less accurate people might try to learn from creditors.

The government’s turnaround in lifting capital controls

According to Gunnlaugsson it was a narrow escape that there were not major mistakes made in 2012 with regard to creditors. He especially thanked “our Sigurður Hannesson,” the MP banker who heads one of the party’s committees, is also on the capital controls’ advisory committee and known to be a close friend of Gunnlaugsson. – Gunnlaugsson did not clarify what heroic deeds were won in 2012; could be the decision to send the Icesave case to the EFTA Court or change in the currency controls legislation, which placed the foreign assets under the controls.

Gunnlaugsson stated that after the present government came to power there had been a real turnaround with regard to the capital controls and all earlier plans had been revised. – This work may ongoing but the only official plan in place is the plan presented by the Central Bank of Iceland, CBI, in 2011.

According to Gunnlaugsson, creditors worked diligently for having Iceland joining the European Union, EU, which would have forced Iceland to follow the bailout path of the euro-crisis countries. This would have forced Iceland to “pay all creditors in full and the whole overhang, not only at full price but at the overprice inherent in the creditors’ paper profit being financed by the Icelandic public through loans. This would have left Icelanders with the debt and no mercy shown. For this government this was always out of the question.”

I am somewhat at loss to understand the remarks about overprice etc. so I leave it to the reader to find the logic here. I am also unaware that creditors have been trying to drag Iceland into EU but they prime minister may well know more on this than mere mortals.

When the road towards the EU had been closed, stated Gunnlaugsson, the government told the representatives of the winding-up boards and the hedge funds that it could not wait any longer. Action will be taken in the following weeks and they will bring the state hundreds of billions of króna, he said.

Again, it is difficult to marry this statement with facts. Just recently, the government sent a letter to the EU, apparently intending to break off negotiations. However, the EU says nothing has changed. According to Icelandic officials briefing foreign diplomats in Iceland the letter does not materially change anything. And so on. Linking the recent moves on the EU and the government driving a harder bargain is not obvious, to say the very least.

The need to act

Gunnlaugsson claims the creditors are not putting forth any realistic solution, which now forces the government to act on lifting capital controls. The plan is to do it before the Parliament’s summer recess. – No mention here of winding-up boards sending composition drafts to the CBI without getting answers.

As often pointed out on Icelog it is clear that government advisers have for over a year been trying to come up with a plan that could suit the two coalition leaders. Tax is one of the points of disagreement: the prime minister wants to make money on the estates; Benediktsson wants to lift the capital controls according to practice in other countries.

It might be difficult to join Benediktsson’s many statements on orderly lifting to the Progressive’s money making scheme. Politically, the Independence party does not feel it owes much to the other coalition party after Benediktsson masterminded the “correction,” Gunnlaugsson’s great election promise of debt relief.

By the time the deadline for handing in new parliamentary Bills expired end of March the coalition parties had not found a common ground on important issues regarding a plan to lift capital controls. A government can always make use of exemption to get Bills into parliament but now the thorny topics are being discussed – reaching an agreement has so far eluded the government.

With his speech Gunnlaugsson might intend to bring pressure on Benediktsson – as did Benediktsson try to do, albeit unsuccessfully, last year with repeated statements on a plan by the end of the year.

The only measure announced: stability tax

According to Gunnlaugsson, with no realistic plans from creditors there is no other way for the government is now forced to launch a plan to lift credit controls before the Parliament ends. The plan is a special stability tax that will bring hundreds of billions to the state, stated Gunnlaugsson. Exactly how it will be applied is unclear but it seems to replace ideas of an exit tax.

This tax, together with other action will enable the government to lift controls without endangering financial stability. “It is unacceptable,” said Gunnlaugsson, “that the Icelandic economy is held hostage by unchanged conditions and to have ownership of the financial systems as it is now (i.e. that the two new banks, Íslandsbanki and Arion Bank are owned by creditors).” – This fits with Gunnlaugsson’s earlier ambitions of both getting money out of creditors and ownership of the two new banks.

The left government would have made “terrible mistakes” of all this, contrary to the Progressive party, which has been remarkable prescient time and again, said Gunnlaugsson:

“It is indeed remarkable how often we (i.e. Progressive party) experience that when we point out opportunities, warn against threats or urge that something is more closely explored or in a new light it is at first met with derision. Then it is fought but in the end viewed as common sense that should have been obvious to all. The main thing is that we Icelanders do not forget that for us everything is possible.”

“Pinch of butter” policies

During his years in office the prime minister has time and again made unfounded allegations and presented views he has not discussed with the government. In a recent article in Morgunblaðið MP Vilhjálmur Bjarnason pointed out how unfortunate it was when ministers thought aloud. One characteristic of the prime minister’s statements that sometimes he is not heard or seen for weeks for then suddenly to burst on the scene with views on everything.

Gunnlaugsson has accused the CBI of being engaged in politics. And he has accused ministries officials of leaking information, almost on a daily basis, he said. Neither allegations have been clarified or substantiated. He also worried about import of foreign food to Iceland because it could carry with it something that was changing the character of whole nations; he did not name it but seemed to be talking about toxoplasma, which luckily has not had this drastic effect in foreign lands.

Then there are all the “plans” Gunnlaugsson has announced without carrying them out or having sought any anchoring in the government. Just after coming into office he was going to appoint a capital controls “abolition manager.”

Most recently, Gunnlaugsson has announced plans to extend the Parliament house by a building sketched by Iceland’s most famous architect, Guðjón Samúelsson (1887-1950) – a house that only exists in a sketch from 1918, the year Denmark acknowledged Iceland’s sovereignty. Gunnlaugsson made this statement of Facebook April 1; when reported in the media it was widely thought to be April fools’ news.

Around that time, Gunnlaugsson also said he thought it was a good idea to build a new hospital – a long-running plan and matter of great debate in Iceland – by the Rúv building, thereby introducing a wholly new direction for the hospital. No previous discussion with minister of health or Landspítali management.

The Icelandic media has now found a name for these unexpected ideas of Gunnlaugsson: “smjörklípa” or “pinch of butter,” meaning that something is thrown into the debate to divert attention. Around the time Gunnlaugsson aired his most recent views one of his party member ministers had been unable to introduce a new housing policy, planned in four new bills. It will come at a great cost, is uncosted, and apparently the Independence party is wholly against it.

Another “pinch of butter”: new monetary system in Iceland?

Plans to revolutionise the Icelandic monetary system has made news abroad recently but less so in Iceland. The news spring from a new report, written at the behest of the prime minister (as I have already explained in detail in comment to FT Alphaville). In short, this report seems more of a favour to a Progressive party member than a basis for a new and revolutionary monetary system in Iceland.

It is indicative of the lackadaisical attitude to form and firm procedures that this report was written at the behest of the prime minister and not the minister of finance, who indeed has never expressed any interest for this topic and has not commented on the report.

All those who have been hyper-ventilating in excitement at this bold Icelandic experiment now starting should find some other source of excitement: this experiment has no political backing in Iceland. The Progressive party, whose following has collapsed from 25% in the 2013 election to ca. 10% in the polls, has little political credibility and force to further this cause.

Political risk: the major risk in Iceland

I have earlier pointed out that the greatest risk in Iceland is the political risk. It is intriguing that Gunnlaugsson chose to break the secrecy of the capital controls plan at a party conference, where he has to confront a total collapse in voters’ support is intriguing. His rhetoric of fights and battles against the conniving creditors and the party’s and his own earlier prescience is an important element in this respect.

With the two party leaders at loggerheads on major topics like the capital controls it is unavoidable that it will come to a confrontation at some point if the government is to take action. The outcome is far from clear.

There is great unhappiness among many of Benediktsson’s MPs, whom he incidentally has not trusted recently with cabinet seats. The general feeling is that it is the Independence party, which so far has been carrying out the policies of the coalition partner.

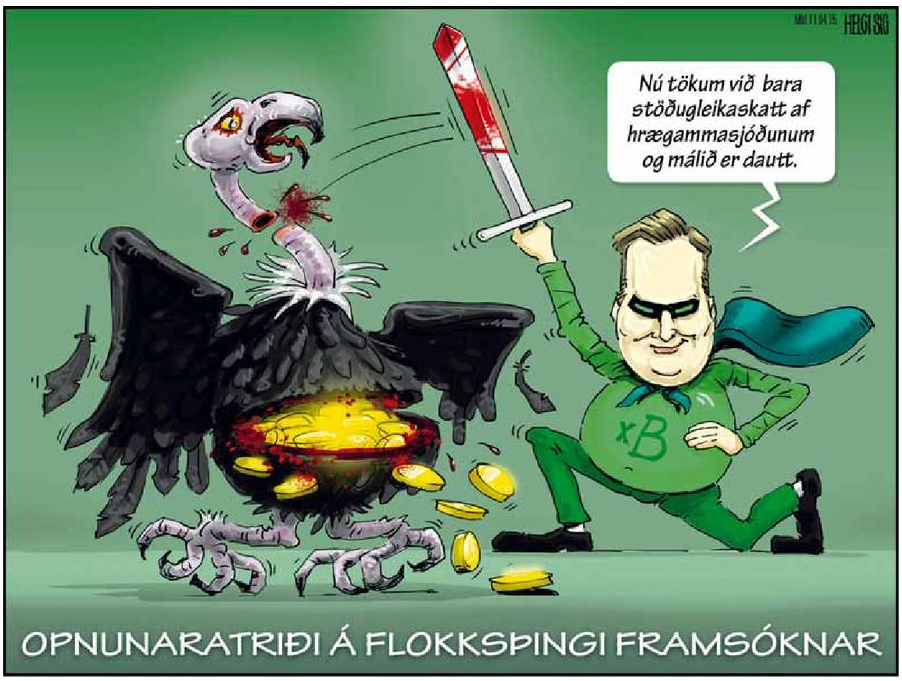

Whatever Benediktsson chooses to do he will need great political skill to steer the party through the coming months. Inaction might not help since creditors may well lose patience and explore their own possibilities, i.a. legal possibilities. If Benediktsson chooses to break away from the Progressive party he will need a clever scheme if he is not to give the coalition party and Gunnlaugsson the role that Morgunblaðið’s cartoonist has given Gunnlaugsson after his speech on Friday:

“Now we just put stability tax on the vulture funds and that will kill the problem”

“Now we just put stability tax on the vulture funds and that will kill the problem”

– – – –

Update: minister of finance Bjarni Benediktsson has not yet made himself available to the Icelandic media on his view regarding stability tax. Some members of the opposition have expressed surprise that there is now talk of stability tax instead of the earlier much discussed exit tax. Guðmundur Steingrímsson leader of Bright Future pointed out both the legal risk and risk to the economy were this plan to be pursued.

Follow me on Twitter for running updates.

“The main thing is that we Icelanders do not forget that for us everything is possible.”

Wow! Sounds to me remarkably like the infamous ‘Kaupthinking’ (and we all now how that ended):

“An in-house Kaupthing pep video made its way online shortly after the collapse. It is a bombastic video, featuring a thick soup of images depicting major historical events, interspersed with clips from Hollywood blockbusters, accompanied by U2’s “Where The Streets Have No Name.” The clip introduces the concept of “Kaupthinking,” a peculiar way of thinking that’s somehow “beyond normal thinking.” Reminiscent of Yoko Ono’s conviction that peace can be realized by imagining it, Kaupthinking is based on the idea that in order to achieve something “we just have to think we can.” Another in-house video teaches us that “we can choose to see the difficulty in every opportunity, or the opportunity in every difficulty.” ”

http://grapevine.is/mag/column-opinion/2015/04/07/beyond-normal-thinking-the-possibilities-and-impossibilities-of-kaupthinking/

anrigaut

11 Apr 15 at 5:05 pm

A good observation, Anrigaut!

Sigrún Davídsdóttir

11 Apr 15 at 10:03 pm

I intended to send you the bit of observation just to give thanks yet again relating to the incredible knowledge you’ve contributed above. It has been simply shockingly generous of you to make openly all that a few people could have made available for an e book to earn some bucks on their own, principally seeing that you might have done it if you ever desired. Those tactics as well acted to be a fantastic way to know that some people have similar eagerness like my very own to realize many more on the topic of this problem. I’m certain there are several more pleasurable times up front for individuals who go through your site.

bape

25 May 23 at 3:24 pm

I want to convey my love for your kind-heartedness supporting men and women that must have guidance on the area. Your personal commitment to getting the solution up and down ended up being extremely insightful and have continually empowered individuals just like me to arrive at their targets. Your new warm and friendly useful information denotes a great deal to me and especially to my office workers. Many thanks; from everyone of us.

golden goose

24 Oct 23 at 4:35 am

Thanks so much for providing individuals with such a pleasant chance to read in detail from this web site. It is often very great and also stuffed with a good time for me personally and my office co-workers to search your blog not less than 3 times a week to read through the fresh secrets you will have. And definitely, I’m always fulfilled with the sensational thoughts served by you. Certain 1 ideas in this post are completely the most beneficial we have all had.

golden goose

17 Nov 23 at 8:08 am

I and also my guys ended up looking at the excellent techniques found on your website and instantly got a horrible suspicion I had not thanked the site owner for them. My ladies ended up consequently passionate to see them and have in effect truly been tapping into these things. We appreciate you really being quite accommodating and also for figuring out variety of magnificent subjects most people are really wanting to discover. My sincere apologies for not expressing gratitude to earlier.

steph curry shoes

21 Jan 24 at 12:35 am

I and also my buddies were actually following the nice advice located on your website and then all of a sudden I had an awful feeling I never expressed respect to the site owner for those strategies. The boys had been so joyful to study them and have in effect really been tapping into these things. Thanks for getting indeed thoughtful as well as for deciding on variety of essential guides millions of individuals are really desirous to be informed on. Our own honest apologies for not saying thanks to earlier.

off white

22 Jan 24 at 3:08 am

Thanks so much for providing individuals with an extremely breathtaking opportunity to read critical reviews from here. It is always very amazing and stuffed with a good time for me personally and my office mates to visit your blog at the very least thrice in a week to see the newest guidance you have. And definitely, I am also at all times fulfilled considering the gorgeous tips served by you. Selected 1 tips in this posting are basically the very best we have all had.

bape

23 Jan 24 at 5:50 am