Archive for April, 2012

The fall-out of the Haarde trial

As could be expected, there has been hefty debate in Iceland following the trial of ex-PM Geir Haarde. Haarde and many others from his party, the Independence Party, say the trial was a game of politics and have accused the High Court judges of having succumbed to political pressure. A former High Court judge says these allegations are preposterous. Four of the five High Court judges who were on the case ruled in favour of sentencing Haarde, with no punishment, for being in breach of the Constitution. One judge was against.

The trial is part of a process that was set in motion after the collapse of the Icelandic banks in October 2008 to clarify what had happened and how. The SIC report pointed at the role of politicians – but in the end, the Icelandic Althing voted on sending only Haarde on trial. Most people thought that former Minister of Finance Arni Matthiesen, former Minister of Banking Bjorgvin Sigurdsson and former Minister of Foreign Affairs and leader of the Social Democrats (in coalition with the Independence Party at the time) should also have been put on trial. Quite surprisingly, some MPs changed that course of events and in the end only Haarde was charged.

The ruling on Monday made news all over the world. This was also debated on al Jazeera’s Inside Story, where I was on the panel. One of the points I made was that although not saying that Iceland is a leading example in handling its crisis, there has at least been some efforts made to explain and clarify. Losing main banks – or saving them as others have done – is not a natural catastrophe like an earthquake or a volcanic eruption but happens slowly slowly due to human actions.

Follow me on Twitter for running updates.

The Haarde trial, politicians and accountability (updated)

Ex-PM Geir Haarde used harsh words to criticise the Court that found him guilty of one charge, but without a punishment. Claiming the verdict was “laughable, he compared Iceland to Ukraine and the trial of Julia Tymochenko now that he had been held victim to this process, which has taken two years.

There are various views in Iceland regarding the trial. But whatever the opinion, Althingi has at least attempted to place the political accountability for the crash. Ex-PM Gordon Brown can be grateful that the British Parliament isn’t doing anything as drastic to investigate who is to blame for the 5% of GDP that the UK bank collapse in October 2008 cost the UK. The same counts for the US and many European countries.

Follow me on Twitter for running updates.

Geir Haarde acquitted – except for one charge, but no punishment (updated)

Ex-PM Geir Haarde is acquitted by the Court convened by Althingi to judge his ministerial actions related to his actions during 2007 and 2008 – but the majority, 9 out of 15, rule that he broke law on ministerial duty to hold cabinet meetings on important issues. No punishment is given.

The charges were:

(1 A serious omission to fulfil the duties of a prime minister facing a serious danger)

(2 Omitting to take the initiative to do a comprehensive analysis of the risk faced by the state due to danger of a financial shock)*

3 Omitting to ensure that the work of a governmental consultative group on financial stability led to results

4 Omitting to guarantee that the size of the Icelandic banking system would be reduced

5 For not following up on moving the Landsbanki UK Icesave accounts into a subsidiary

Follow me on Twitter for running updates.

Ruling in the Haarde trial 2 pm Icelandic time

The ruling in the trial over former Prime Minister Geir Haarde is expected today at 2pm Icelandic time. This court can only be convened to judge ministers and can only be set in operation by the Icelandic Parliament, Althingi. The prosecutor in the case prosecutes on the behalf of Althingi. The judges are fifteen in total. Five of them are High Court judges and two with a judge competence – in this case, one is an academic in law and the other a County Court judge. The remaining eight are nominated by Althing.

This court is called “Landsdómur” in Icelandic and is, as so many things in the Icelandic constitution, based on a Danish example, “Rigsret,” last convened in 1995 in a case against Minister of Justice Erik Ninn-Hansen. In the Danish “Rigsret” there are 15 High Court judges and 15 MPs.

It’s the first time this court is convened Iceland.

Follow me on Twitter for running updates.

Ongoing OSP investigations in Luxembourg

Staff of the Office of the Special Prosecutor is still at work in Luxembourg. According to Ruv, ten Luxembourg citizens have been questioned today. It would be interesting to know exactly what they are being questioned about but as reported earlier on Icelog, the topics relate to cases already known to be under investigation in Iceland.

Follow me on Twitter for running updates.

OSP still searching at the Landsbanki estate, Luxembourg

The Office of the Special Prosecutor is still conducting searches and collecting documents at the Landsbanki estate, Luxembourg, at 2-4 rue Beck. Searches are over at the two other places searched yesterday, April 17. It’s not clear how long the operation at Landsbanki will continue. When the premises of Kaupthing Luxembourg, at Banque Havilland, were searched last year the operation took about a week. It might be the same this time – most likely quite a pond of Landsbanki documents to fish in.

Follow me on Twitter for running updates.

House searches in Landsbanki Luxembourg

Today (April 17), thirty people – six of them from the Office of the Special Prosecutor in Iceland – have conducted house searches in Luxembourg on behalf of the OSP. The searches have been ongoing at the office of the Landsbanki estate and at two addresses in Luxembourg. According to special prosecutor Olafur Hauksson the searches are connected to nine cases, which surfaced in the media after searches in Iceland in January last year.

As reported on Icelog earlier, the cases under investigation are thought to relate to the following:

1. Alleged market manipulation related to shares in Landsbanki.

2. Loans to four companies Hunslow S.A., Bruce Assets Limited, Pro-Invest Partners Corp and Sigurdur Bollason ehf. to buy shares in Landsbanki.

3. Landsbanki Luxembourg’s sale of loans to Landsbanki only a few days before the bank collapsed in Oct. 2008.

4. The buying of shares by eight offshore companies that supposedly were set up to hold shares related to employees’ options.

The loans to the four companies follow a well-known pattern from the Icelandic banks: huge loans, no collaterals or only the underlying shares being bought in the bank itself – and no apparent intention to have the investors shoulder any risk. All on the bank. It’s always interesting to observe who the benefactors of such loans are since such loans often reveal special relationships behind the banks’ choice of investors.

As pointed out earlier, “Hunslow S.A. was registered in Panama in Feb. 2008. In November 2009 two Novator companies (Novator is the investment fund of Bjorgolfur Thor Bjorgolfsson who was a major shareholder in Landsbanki and Straumur investment bank together with his father) were registered in Panama with the same law firm as Hunslow. The same five directors are on the board of the two Novator companies and Hunslow but there are probably hundreds of companies registered at this one law firm.” This doesn’t prove anything but it’s an intriguing fact.

According to Stoed 2, which broke the news today, Hunslow is owned by Stefan Ingimar Bjarnason, an Icelandic investor, who apart from having profited from Landsbanki’s generosity just before its demise, isn’t a well-known name in Iceland. Bruce Assets is owned by brothers, both known investors in Iceland but no high-flyers, Olafur Steinn and Kristjan Gudmundsson. Only last year did they appear as surprisingly big borrowers at Landsbanki. Interestingly, they invested in companies where Bjorgolfsson was a major investor. The brothers hadn’t been noticed because the loans, in total ISK23bn, all went to offshore companies they owned. The loans to the brothers seemed to have been issued against no collaterals or guarantees. As far as I can see, Bruce Assets is neither registered in Panama nor Luxembourg, can’t see where it’s registered (but would like to know, in case anyone knows).

Prior to the collapse, Sigurdur Bollason was an investor who frequently appeared alongside Jon Asgeir Johannesson and Baugur-related investments. Bollason was a big borrower, without any apparent merit except for strong relations to the banks’ favored circle.

Pro-Invest Partners belongs to a certain Georg Tsvetanski, a long-time business partner of Bjorgolfsson. Tsvetanski is an ex-Deutsche Bank banker. In 2004, he set up the investment fund Altima Partners in the UK together with other Deutsche bankers who specialised in Eastern Europe and who had, during their Deutsche time, cooperated with Bjorgolfsson. Among these are Radenko Milakovic and Dominic Redfern. This group was from from early on involved in Eastern European privatization from 2000, led by or done with Bjorgolfsson: Bulgartabak (which they didn’t get), Balkanpharma (later merged with Actavis), Bulgaria Telecom and in the Czech Republic, Cesky Telecom and Ceske Radiokomunkace.

Early on, Tsvetanski was for while on the board of Pharmaco, the owner of Balkanpharma. As the CEO of the state-owned Balkanpharma he had been a strategic partner. There seems to be an untold story in the privatisation process. Now and then there have been Bulgarian spurts to investigate the matter but so far, it’s never been done. Bjorgolfsson and Altima have also co-invested in Bulgarian properties, through their Luxembourg fund, Landmark.* A rather spectacular golf club and resort, Thracian Cliffs, seems to be a Landmark investment. One of Landmark’s board members is Arnar Gudmundsson, who is at Arena Wealth Management, run by Icelandic ex-bankers, with a very uninformative website. At the end of September 2008, only a week before the bank collapsed, Tzvetanski got an overdraft of ISK4.5bn.

It seems that some of these Landsbanki loans, now being investigated, were issued in Luxembourg. Many of my sources have mentioned that the Landsbanki saga can’t be understood except by mapping out the Luxembourg loans – the source of the dodgiest loans. And that’s where the OSP is at today.

*There is a small galaxy of Landmark companies registered in Luxembourg and some are attached to offshore companies with Icelandic names, ia Keldur Holding Limited, a BVI company and Gort Holding, a Guernsey company.

Follow me on Twitter for running updates.

Monday April 23 – the verdict in the Haarde trial

The verdict in the Althing trial against ex-Prime Minister Geir Haarde will be announced next Monday at 2pm, Icelandic time (GMT). The ruling will be transmitted live. Yes, I will be watching.

Follow me on Twitter for running updates.

Bruno Iksil, the $100bn bet and JP Morgan’s CDS

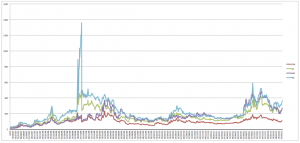

Is Iksil betting on the JP Morgan CDS spread? Well, at least JP Morgan’s CDS looks enviously better than the spread of the other Three Big banks. Their graphs separated late last summer.

Earlier, I toyed with the idea that JP Morgan’s Bruno Iksil might be making these humongous bets to lower JPM’s CDS spreads. Here is some more data – comparing JP Morgan’s CDS with that of the three other big banks: Bank of America, Morgan Stanley and Goldman Sachs. Let’s look at the (illuminating?) graph:  It shows that before the enormous fluctuations in autumn 2008 the four banks had more or less been on the same road. Following the great quakes of autumn 2008, JP Morgan has slowly slowly separated itself from the other three. From last summer the three have been hovering together, ever rising and/or fluctuating more wildly than JP Morgan. True, this doesn’t prove anything – but it’s intriguing.

It shows that before the enormous fluctuations in autumn 2008 the four banks had more or less been on the same road. Following the great quakes of autumn 2008, JP Morgan has slowly slowly separated itself from the other three. From last summer the three have been hovering together, ever rising and/or fluctuating more wildly than JP Morgan. True, this doesn’t prove anything – but it’s intriguing.

JP Morgan might have been seen to have more prudent – though recent CFTC fines of $20m and various other things don’t seem to support that theory – and/or it might have been more clever at managing perceptions. Or, just possibly, it might have done like Kaupthing did, on Deutsche Bank’s advise, and made some clever trades to influence its CDS. Some question marks hanging in the spring air.

Follow me on Twitter for running updates.

Could Bruno Iksil’s $100bn bet be related to JP Morgan’s own CDS?

Sounds like a crazy idea? Kaupthing, advised by Deutsche Bank, organised trades in 2008 to lower its own CDS. Deutsche co-invested in the scheme.

JP Morgan’s trader Bruno Iksil is the latest banker to gain unwanted fame for trading astronomical sums. He’s now even famous enough to have nicknames – the London Whale or Voldemort, after the Harry Potter villain. Iksil seems to have been betting investing in corporate CDS, ie Markit CDX IG (Investment Grade) 9 credit index, an index of investment grade corporate CDS, based on 121 (previously 125) big US corporations, financial and others.

Iksil works in the bank’s chief investment office, which manages and hedges “the firm’s foreign-exchange, interestrate and other structural risks,” according to the bank’s spokesman, focusing on long-term “structural assets and liabilities.” Iksil has placed such hefty bets, guessed to have reached $100bn, that he seems to be moving the index and that’s been irritating some hedge funds that are affected.

Trading in that index surged 61 percent the past three months, according to data from Depository Trust & Clearing Corp.

The net amount of wagers on the index, which is tied to the creditworthiness of companies such as Wal-Mart Stores Inc. and now-junk-rated bond insurer MBIA Insurance Corp., soared to almost $145 billion at the end of March from $90 billion three months earlier, according to DTCC, which runs a central registry for credit-default swaps and reports weekly aggregate volumes.

Perhaps the hedgies have been muttering to Bloomberg, first out with the story April 5, just because Iksil is affecting their positions. More pondering, info and graphs re Iksil’s trades on the wonderfully informative FT Alphaville. And there is speculation if this type of trades will become part of financial history when the Volcker rules come to rule, in July.

Iksil seems to be doing all of this not as a rogue trader but with the blessing from JP Morgan’s commanding heights. Maybe this is a clever long-time hedge. Perhaps perhaps… At least, the management doesn’t seem to mind Iksil risking/investing $100bn moving the market.

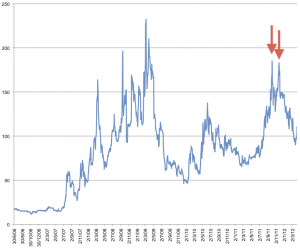

But what market are JP Morgan’s commanding heights glad he is moving? Just the index? Or might it be JP Morgan’s own CDS? Perhaps this is a completely freakish development but JP Morgan’s CDS was painfully high at the end of last year, almost as high as in autumn 2008, when all financial CDS shot up:

The most recent peaks, indicated by the arrows, are Oct. 4 and Nov. 25 2011.

From the beginning of this year the JP Morgan CDS has been steadily falling, as the graph shows. Interestingly, it has fallen in the last three months, when the trades in the CDS index has surged, apparently due to Iksil’s diligence. As pointed out earlier: possible just a freak development. Other forces than Voldemort’s might certainly be at large.

But can anyone be so hubristic/daring/foolhardy/foolish to manually influence its own CDS? Well, the know-how to influence one’s own CDS has been out there for a while. In the summer of 2008 Kaupthing was suffering from murderously high CDS – the management felt it was all horribly unjust since the bank was, according to the key figures, doing incredibly well.

Kaupthing seems to have aired their concerns with Deutsche Bank, which came up with a brilliant solution: companies should be created to buy CDS on Kaupthing. Deutshce seems to have thought it was a brilliantly viable plan – it even invested in it. Kaupthing implemented the idea – not via its prop trading, a la JP Morgan, but by getting favoured clients (some of whom the bank was lending heavily to invest in Kaupthing shares so as to keep the share price from crashing) to lend their names as owners of companies, which Kaupthing and Deutshce lent into – and then these companies did the trades. Did it help? Well, for whatever reason Kaupthing’s CDS did move… downwards.*

The interesting tail to both to the Kaupthing and Iksil trades would be to know who is on the other end. In Kaupthing’s case we don’t know but whoever it was did very very well.

Kaupthing did meet its end in October 2008 – bankrupt, as happens when the wrong decisions are taken over some time. JP Morgan can happily bet in whatever crazy way. Its management has tried and tested the ground – so far, a bank like JP Morgan won’t have to face the results of bad/insane decisions and hubris. Will banks be able to bank on that forever?

*Deutsche’s plan is outlined in the SIC report, chapter 7.3.6.3 (only in Icelandic).: Deutsche put up a loan of €125m and harvested handsomely: it got a fee of €5m for the package. In June 2010 Reuters reported that the Serious Fraud Office was investigating this scheme but nothing has been heard of it since. More here from Icelog on the scheme and those involved in it, ia Kevin Stanford and Karen Millen.

Follow me on Twitter for running updates.