Le bras de fer between the Eurogroup and the IMF – or more precisely between Schäuble and Lagarde

Le bras de fer is how the Belgian newspaper Le Soir described the battle between the Eurogroup and the IMF and it has been going on for weeks and months. Tuesday morning, talking to someone who was at the meeting, I got some colours to this battle story.

When Jean-Claude Juncker opened the meeting he said that those present were not leaving until an agreement had been found. And from the IMF point of view it had to be a realistic and sustainable agreement.

Mainly, it was the German minister of finance Wolfgang Schäuble and Christine Lagarde director of the IMF, who discussed the issues. The others were onlookers to this discussion. There were three breaks during the meeting when these two parties had to calculate different option. The Dutch and the Finnish ministers, who had earlier together with their German colleague expressed worries and discontent with further financial support to Greece, did not say much. The two sensed Schäuble arrived with the purpose on finding a compromise.

The Eurogroup met well prepared for negotiating with the IMF. During its teleconference this weekend, where Lagarde wasn’t on the line, the Eurogroup thoroughly discussed her arguments and how to encounter them.

Monday it was reported that before the Monday meeting Samaras had told Juncker that if an agreement would not be reached the Greek coalition Government would collapse. Both parties denied the story. However, I’m told that Juncker made it clear that the Greek Government faced great difficulties if yet another inconclusive meeting would come to an end. – The Greeks are now essentially tied to a ten year plan, well beyond any government’s lifespan.

As to the agreement, have some lines been crossed, which have not been crossed before? Yes, here it counts to observe what the Eurogroup has done, not what they say. No one in the Eurogroup is publicly uttering these three most fearful words – Official Sector Involvement, meaning a haircut or write-downs on loans from the states and official institutions – but OSI has now happened: the official sector – ie the EU member states, the IMF and the ECB – will not get paid on time and in full what they lent to Greece.

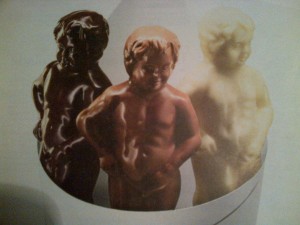

The Official Sector will make losses on loans to Greece. That is the naked truth, as naked as the Manekin Pis but not as sweet as this version:

Various classic measures are used to bring down Greece’s debt to GDP. Interest rates on loans to Greece are lowered by 100bp, maturities extended by 15 years and Greece gets an interest free grace period of 10 years. The IMF had to sway from its aim of 120% debt to GDP in 2020: the aim for 2020 is now 124% but “substantially lower than 110%” in 2022.

The Greek debt buy-back seems the least clear action. Juncker said the Greeks were considering it, Lagarde said it would definitely happen but she was noticeably tongue-tied when asked about it, answering that the less there is said about it the better. This is what the statement says: “The Eurogroup was informed that Greece is considering certain debt reduction measures in the near future, which may involve public debt tender purchases of the various categories of sovereign obligations. If this is the route chosen, any tender or exchange prices are expected to be no higher than those at the close on Friday, 23 November 2012.”

The fund, which collects money to repay loans, has been a soar issue for the Greeks. The Germans, wanting to guarantee that the fund would be used for nothing except the designated purpose, almost seemed to be insisting on an escrow account, which ia Züd-Deutsche Zeitung felt was offensive to the Greeks. Here is what the agreement stipulates on this issue: “Greece has also significantly strengthened the segregated account for debt servicing. Greece will transfer all privatizations revenues, the targeted primary surpluses as well as 30% of the excess primary surplus to this account, to meet debt service payment on a quarterly forward-looking basis. Greece will also increase transparency and provide full ex ante and ex post information to the EFSF/ESM on transactions on the segregated account.” – The word is now “segregated,” not an outright escrow account.

In addition, the Greek Government is subjected to a demanding (or heavy-handed) monitoring. I’m told that at the Eurogroup meeting last night, the Greeks were told in no uncertain terms that should they stray from the narrow path of sustainability, disgruntled nations such as the Finns and the Dutch would be quick to declare an end to the Greek programme (but ugh, will they risk a Greek default and a euro collapse? Another story.)

Is the Monday agreement the final plan to put Greece on a sustainable path? As an economist explained to me today: it’s much more realistic than anything done before. Antonis Samaras’ Government has really worked miracles, compared to before. But questions remain, as is clearly spelled out in this paper by the Bruegel economist Zsolt Darvas. – Earlier, agreements have fallen apart when unclear wording was in the end interpreted differently by different parties. There is also some scope for that happening here but if the Eurogroup’s sincere will is in this agreement it will put an end to the Greek debt issue.

Being indebted means losing independence – that is the bitter truth – and it counts both for individuals and nations. The Greeks have been living with that painful fact for three years now. Now, they are hopefully out of their three-year limbo of uncertainty and can work more constructively on rebuilding their society.

The question I’ve heard echoing today here in Brussels is what the new agreement on Greece – OSI and everything – means for the other two bailout countries, Portugal and Ireland. The future of Portugal and Ireland may look decidedly rosier if the Greek solution is calculated into their economy forecast – but the harsh terms and supervision, bordering on encroaching on Greek sovereignty, must make the Greek solution most unappealing to these two countries. Bailouts don’t come in one size fits all – for those as badly indebted as the Greeks are, with as woefully dysfunctional public sector and plain corruption, the harsh measures correspond to the harsh realities of Greece.

*Here is an article from the English version on Kathimerini, a Greek newspaper, on the Greek political prospects post-agreement.

Follow me on Twitter for running updates.

I really wanted to send a small comment so as to express gratitude to you for all of the splendid points you are writing at this site. My prolonged internet research has now been recognized with beneficial concept to talk about with my classmates and friends. I would mention that we readers actually are undeniably blessed to dwell in a perfect place with many awesome individuals with very helpful principles. I feel extremely grateful to have come across your entire web pages and look forward to really more thrilling times reading here. Thank you once more for all the details.

curry 6 shoes

25 Jul 23 at 5:49 am