Archive for October, 2016

Elections in Iceland: voters seem to prefer new to old as never before

After remarkably large swings in opinion polls it seems that the old and largest party, Independence Party, is picking up support from voters, shown in one poll to pick up 27% of votes. The Pirate Party, which has at times touched 40% in polls is now settling at just above 20%. With nine parties running country-wide and twelve parties in total offering their ideas to the voters Icelanders have enough to choose from in the elections October 29. The big news is that the four old parties, or the “four-party” as Icelanders call them are now only polling at fifty or sixty per cent, the lowest in the roughly one century old history of the old parties, meaning that the new parties are taking forty to fifty per cent.

Iceland provides a clear argument that the economy isn’t everything in elections; Icelandic voters seem to choose leaders they find trustworthy, regardless of policies. In spite of strong economy a new party untested in government like the Pirate party has held a strong appeal, robbing some of the old parties of support. The old parties are the Independence Party, the Progressives, the SD Alliance and the Left Green but the new ones are the Pirates, Bright Future Viðreisn and some smaller parties unlikely to get into parliament.

Now, as the day of reckoning October 29 looms opinion polls indicate that the tried and tested are attracting voters again. That helps the Independence party and to some degree the Progressive party that after the hapless Winstris affair of its leader chose a new leader, Sigurður Ingi Jóhannsson, who has been serving as a prime minister since Sigmundur Davíð Gunnlaugsson resigned in April due to the Panama Papers. Yet, nothing is like it once was – the old parties are appealing to fewer voters than ever.

The latest figures

The latest figures out Friday October 28 vary quite a bit but still show a jump for the Independence party. The Independence Party has the greatest success in a Gallup poll, at 27% with Pirates at 17.9%, Left Green 16.5%, the other government coalition party the Progressives at 9.3%, Viðreisn (“Restoration,” a new liberal centre-right party) 8.8%, the Social Democratic Alliance 7.4% and Bright Future 6.8%. Other parties are below the 5% threshold needed to get into parliament. All these parties except Viðreisn are already in parliament.

MMR poll shows the Independence party at 24.75%, Pirates 20.5%, Left Green 16%, Progressives 11.4%, Viðreisn 8.9%, Bright Future at 6.7% and the Social Democratic Alliance 6.1%.

Morgunblaðið, the daily, also published today its last poll before the election, putting the Independence party at 22.5%, Pirates 21.2%, Left Green 16.8%, Viðreisn 11.4%, Progressives 10.2%, Bright Future 6.7% and the SD Alliance 5.7%.

On the whole the Pirates have lost their incredible popularity a year ago but are still competing with the Independence party for the highest amount of votes – a remarkable success for a young party, only running for the second time.

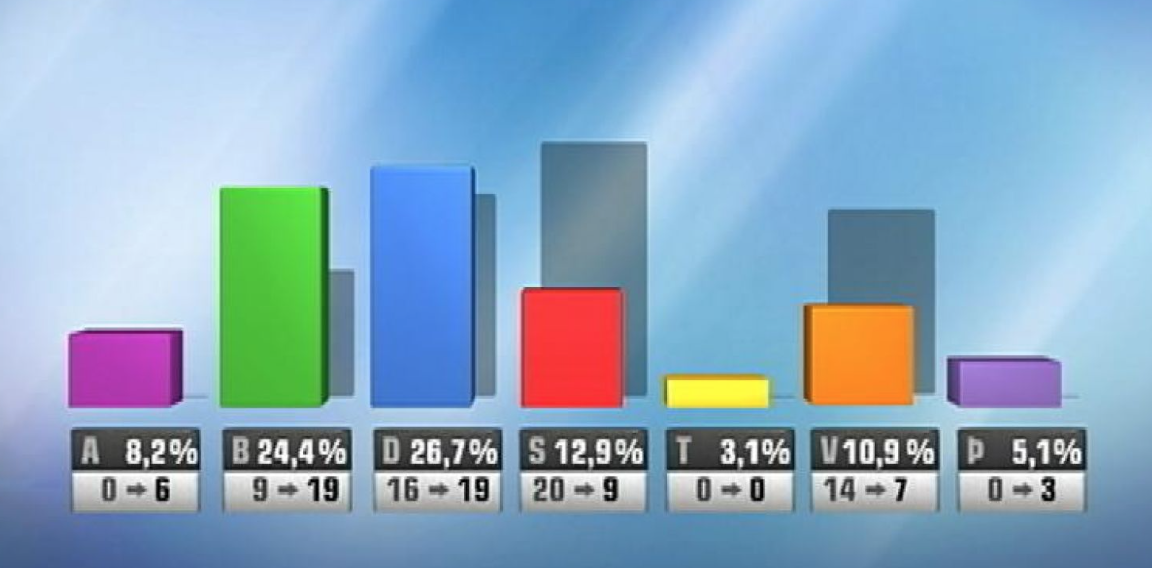

The outcome 2013

The 2013 elections resulted in the largest losses ever for any parties when the two left parties in government, the Left Green (V above) and the SD Alliance (S) went from being two big parties to two small parties, from jointly having 34 members to 16. The Left Greens have, according to the recent polls, been gaining strength under their young energetic leader, Katrín Jakobsdóttir, minister of education and culture in the 2009-2013 left government. The SD Alliance seems to be stuck in spite of a new leader recently elected, Oddný Harðardóttir, who has only made things worse for the party according to the polls.

In the 2013 elections Bright Future (A) literally lived up to its name, as the new darling in the hood and got 6 members, a phenomenal success for a new party. Now it’s hovering just above the 5% limit. The Pirates (Þ), another new party, got 3 members. The present coalition partners, the Independence Party (D) and the progressives (B) got the same amount of MPs; the Independence Party got a greater numbers of votes but the Progressives made a larger jump and against the tradition of giving the largest party the mandate to form a government the then president Ólafur Ragnar Grímsson gave the Progressives the mandate for form a government.

The Pirate party: not as wild as the name suggests

Since early this year I’ve heard foreign analysts and other pundits worry that the rise and rise of the Pirate party bode ill for political and financial stability in Iceland. That is however not the perception in Iceland. The main reason for their popularity is their measured and reasonable performance in Alþingi, the Icelandic parliament. Making big and broad promises is for example not their way of doing politics.

Their main focus has been on the new constitution, on finishing the work in progress, and they are very much wedded to the idea of the Alþingi sitting for only enough time to pass a new constitution and then vote again as is needed; a new constitution needs to be agreed on by two parliaments. This might very well drive other parties away from a Pirate-led coalition, even if they might otherwise be positioned to lead a new government. Other parties just want to get things done and not be tied up by a short-term constitution-only Alþingi.

Apart from the constitution the Pirates reject the left right dualism but support left-wing welfare issues like free health-care, not the case in Iceland, public ownership of natural resources, direct democracy and fight against corruption – all issues that have loomed large in the election debate.

What colour of coalition?

If the Independence Party turns out to be the biggest party come Sunday morning its leader will start to ask around for support among other parties. Nothing indicates that the Progressives will be strong enough for a two-party coalition. In addition, it would be difficult to sideline Sigmundur Davíð Gunnlaugsson who will almost certainly be elected to Alþingi in spite of having resigned as a party leader and prime minister.

The feeling is however that none of the other parties are keen to be with him in government, which means that the Progressives are unlikely to be in government however things go. In politics “never say never” but suffice it to say that a government including the Progressives seems unlikely.

The new liberal conservative party Viðreisn doesn’t seem to be much of a help. Incidentally, its leader Benedikt Jóhannesson was earlier active in the Independence Party and is, as most well-informed Icelanders know, closely related to Benediktsson in a family where blood certainly is thicker than water, as the saying goes in Iceland.

Viðreisn portrays itself as more liberal, less wedded to old power and old money and is EU-friendly, hardly relevant in Iceland these days. Many voters see Viðreisn as all too ready to jump into bed with the Independence Party but it seems to have attracted many SD Alliance members on the party’s right side. SD Alliance, earlier often in coalition with the Independence party, has hardly any political strength to be in government and would in any case provide too few if any MPs.

It has happened in Icelandic politics that the Independence Party, in most governments in Iceland since the founding of the republic in 1944, has cooperated with the far left. Jakobsdóttir has not been flirting with that idea at all, underlining that there is little if any political harmony between the two parties. Bar something unexpected it’s difficult to imagine that any of the four old parties could form a coalition lead by or together with the Independence Party.

All of this, in addition to the polls, many think that a left government is more likely than a centre-right government. That again would probably require at least three parties to form a government, even four. Needless to say the greater the number the more potential for splits and a politically lame government. The next PM could be a lady, most likely Jakobsdóttir. The Pirate Birgitta Jónsdóttir has indicated that she would be more interested in being president of the Alþingi, rather than a prime minister but there are some popular Pirates around her.

Strong economy isn’t enough

The turmoil in Icelandic politics since the winter of 2008 to 2009 is over in the sense that the pots and pans stay in the kitchens. Yet, the political distrust is still palpable and strong economy and what’s best described as boom doesn’t change the fact that voters seem more ready than ever to embrace new parties and, except for the Left Green, keep the old “fourparty” at bay.

Follow me on Twitter for running updates.

Further to the Iceland Watch campaign

For the second day, the Iceland Watch, watching over the interest of the four largest offshore króna holders, has published an ad in Iceland warning Icelanders of corruption and claiming that an official at the Central Bank of Iceland is under investigation at the CBI for insider trading. The whole page ad is under a big portrait of the governor of the CBI Már Guðmundsson, see my yesterday blog.

This morning, the governor met with prime minister Sigurður Ingi Jóhannsson, Lilja Alfreðsdóttir minister of foreign affair and minister of finance Bjarni Benediktsson. After the meeting Guðmundsson said that no Icelandic action is being planned. He said the CBI was certain the measures taken regarding the offshore króna in order to protect the Icelandic economy were sound. “Of course there might be a reason to worry that people get the idea to put out statements like these but there is no reason to worry that any of the statements (in the ad) is based on fact because it isn’t,” Guðmundsson said to Rúv.

Negative response from the EFTA Surveillance Authority

The four funds holding offshore króna and contesting the measures taken earlier this year are Eaton Vance, Autonomy Capital, Loomis Sayles and Discovery Capital Management. This summer, two of the funds, Eaton Vance, brought the Icelandic offshore króna measures to the attention of the EFTA Surveillance Authority, ESA. Already in August ESA answered the complaint pointing out that it had already dealt with a number of complaints regarding the Icelandic capital controls.

The ESA conclusion was:

“It follows from the assessment set out above that an EEA State enjoys a wide margin of discretion as regards the adoption of protective measures as long as the (sic) comply with the substantive and procedural requirements of Articles 43(4) and 45 EEA. Once compliance with these requirements has been established, the exercise of the powers conferred on an EEA State pursuant to Article 43 EEA precludes the application of primary provisions in the sector concerned (such as Article 40 EEA).

Having taken account of the information on the facts of this case and the applicable EEA law, the Directorate cannot conclude that the Icelandic Government has erred in its application of Article 43 EEA.”

Eaton Vance was invited to submit its observations, which it did in September. ESA is now considering this last submission but given the earlier answer and previous ESA cases regarding the capital controls it now seems unlikely that Eaton Vance’s argument will win ESA over. That decision will then be final; there is no other instance to appeal to. So far, the EFTA Court has dismissed ruling on ESA decisions.

Who is behind the ads and the offshore króna holders?

Over the years, Icelanders have furiously speculated that there are large Icelandic stakeholders among the offshore króna holders. Nothing that I have seen or heard so far indicates that this is the case.

I’ve said earlier that there may well be Icelanders owning or having owned offshore króna but I find it highly unlikely that any of them hold large interests in the four main funds who own the largest part of the remaining funds, now ca. 10% of Icelandic GDP (see here for a recent overview of the capital controls and offshore króna from the CBI).

Funds as these four organise their investments normally in separate offshore funds as the maturity of underlying assets vary etc. Some of these funds may well have Icelandic names but I would imagine the names relate to the place of investment rather than the owners being Icelandic.

As I’ve pointed out earlier the funds have allied with Institute for Liberty, mostly dormant since it fought the Obama care some years ago and now revived with the offshore króna cause. The PR company DCI Group, based in Washington, is advising the funds. As far as I can see these are the entities driving the campaign against Iceland.

Baseless claims of Iceland in breach

The bombastic claims by Iceland Watch that Iceland is somehow breaching international rules and regulations have so far been shown to be baseless. As pointed out earlier, the International Monetary Fund has not criticised the measures taken in Iceland and these measures, as others, have been taken with the full knowledge of the IMF.

That said, the funds may well have success in litigating Icelandic authorities somewhere sometime but so far it seems the ESA challenge will not have a successful outcome for the four funds.

As to the ad campaign in Iceland it’s as ill advised and as unintelligent as can be.

Updated: I’ve been made aware that Loomis Sayles is not at all involved in the Iceland Watch campaign against Iceland. I’m sorry that my earlier information here was not correct.

Follow me on Twitter for running updates.

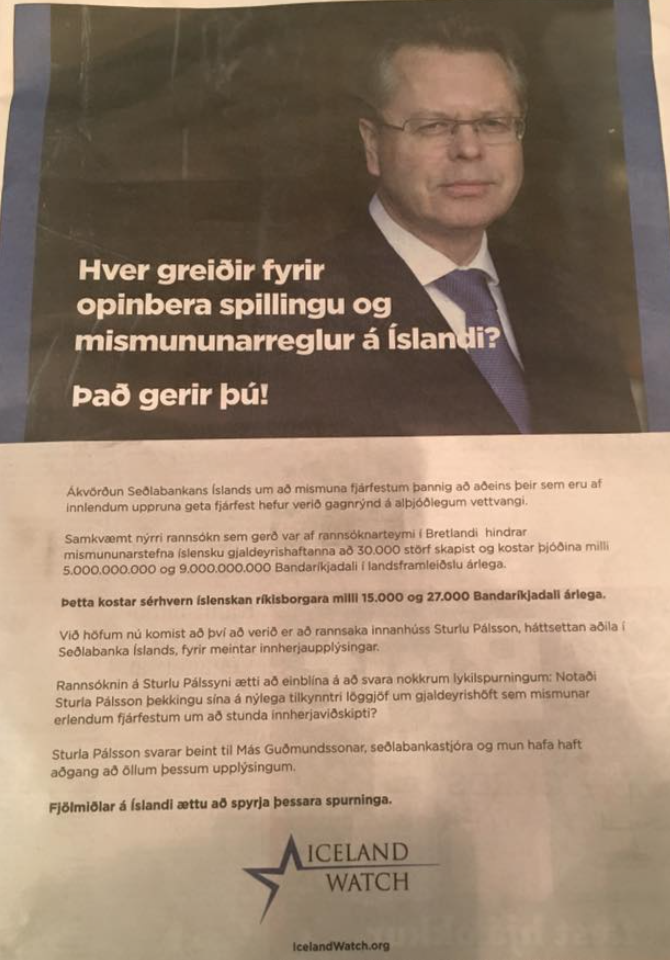

A weird ad in bad Icelandic against the Central Bank of Iceland

The libertarian Iceland Watch has posted quite a remarkable ad in Icelandic media insinuating serious corruption by a named individual at the Central Bank of Iceland with a large photo of the governor of the Central Bank Már Guðmundsson. If the four largest offshore króna holders, on whose behalf Iceland Watch seems to be campaigning, think they are winning friends in Iceland with these serious and unfounded insinuations, they should think again: the few who seem to notice it ridicule it or find it hugely upsetting.

Iceland Watch, earlier fighting Obama care and now fighting for the cause of the offshore króna holders that feel they have been wronged by the Icelandic government and the Central Bank of Iceland, CBI, has topped its earlier ads. It is now directly addressing Icelandic voters, claiming they are losing out due to the bad policies and corruption at the CBI. Whereas earlier ad was placed in media in Iceland, Denmark and the US, the latest one has, as far as I can see, only been posted in Iceland.

The four funds holding offshore króna are Eaton Vance, Autonomy Capital, Loomis Sayles and Discovery Capital Management.

So what is the Iceland Watch message, accompanied by a photo of CBI governor Már Guðmundsson, to Icelandic voters?

“Who is paying for public corruption and discriminating rules in Iceland? You do!

The decision taken by the Central Bank of Iceland to discriminate between investors so that only those of domestic origin can invest there has been criticised internationally.

According to a new study done by a research team in Britain the discriminatory policy of the Icelandic capital control hinders the creation of 30.000 new jobs and costs the nation between 5.000.000.000 and 9.000.000.000 US dollars in GDP annually.

This costs each Icelandic citizen between 15.000 and 27.000 US dollars annually.

We have now discovered that Sturla Pálsson, a highly placed individual at the Central Bank of Iceland, is being investigated in-house for alleged insider information.

The investigation of Sturla Pálsson should focus on answering some key questions: Did Sturla Pálsson use his knowledge of the recently announced legislation on capital control that discriminate foreign investors in carrying out insider trading?

Sturla Pálsson answers directly to governor Már Guðmundsson and is believed to have had access to all this information.

Media in Iceland should be asking these questions.

Capital controls and booming economy

Corruption is not an unknown theme in Icelandic politics but it will come as a surprise to most Icelanders that Icelandic officials are acting in a corrupt way to punish the four foreign funds holding offshore króna. We should keep in mind that the International Monetary Fund has followed and scrutinised policies in Iceland since October 2008.

The policy that’s such a thorn in the side of the four funds that they are willing to go to these lengths in advertising their pain internationally has also been passed with full acceptance of the IMF. Yes, the IMF isn’t infallible and perhaps the EFTA Surveillance Agency will indeed find Iceland at fault. But to think that the measures in summer came about because of corruption in Iceland seems pretty far-fetched. Shouting it from the roof tops won’t add to the arguments the funds have presented with the ESA and possibly in courts.

Saying that only domestic investors can invest in Iceland isn’t correct. This does no doubt refer to measures re offshore króna holders but it’s not a correct presentation.

Why doesn’t the Iceland Watch quote the UK research? As far as I know it comes from the Legatum Institute, connected to the Dubai-based Legatum Group established in 2006 by Christopher Chandler. The Legatum Institute recently had a discussion on Iceland and capital controls and has also published research of capital controls and anti-competitive policies. What is wholly missing is how the easing of capital controls has been done; it only focuses on the perceived harm caused by the most recent measures that has so upset the four funds.

Eh, creating 30.000 jobs in an economy with close to full employment in a country of 332.000 that needs to import people to fill jobs? And let’s put the figures in context: $5bn to $9bn amounts to 25-40% of Icelandic GDP. Is it credible that these latest measures hurting the four funds are really costing the Icelandic economy these sums annually? Intelligent readers can figure out the answers on their own.

If Iceland Watch intended to clarify to Icelanders the enormous losses they are suffering it would have helped to publish these losses in Icelandic króna, not in US dollars.

Serious allegation against a CBI official

It will be news to Icelanders that the CBI is investigating Sturla Pálsson for using his knowledge of the recent measures for his own gain via insider trading. Again, this is a statement with no verification. Given that the Icelandic media mostly ignores the ad and the reaction in Iceland is not to take this seriously at all it’s not certain that the CBI will see any reason to answer.

Pálsson has however recently been named in the Icelandic media related to breach of trust over the weekend October 4 to 5 2008: he told his wife, who was at the time the legal council at the Icelandic Banking Association (and is in addition closely related to Bjarni Benediktsson leader of the Independence Party and minister of finance) of the imminent Emergency Act. – The Iceland Watch allegation could possibly be a misunderstood echo of this recent reporting in the Icelandic media or indeed a new and much more serious allegation, unknown in Iceland.

Regardless of the basis for the allegation against Pálsson the question as it is put is ambivalent: Did Sturla Pálsson use his knowledge of the recently announced legislation on capital control that discriminate foreign investors in carrying out insider trading? – I guess this is insinuating Pálsson used his information to carry out insider trading but the sentence is so muddled that this isn’t clear at all. (The Iceland Watch text is: “Did Palsson use his position of knowledge about the recently announced capital controls legislation which discriminates against foreign investors to make insider trades?”)

Losing friends and influence… in Iceland

I’ve earlier expressed surprise that the funds think they are gaining friends and influence in Iceland through their alliance with Iceland Watch. This latest ad, apparently only directed at Icelanders, indicates a profound lack of understanding of the country they are trying to influence (tough I can’t imagine this approach will indeed work anywhere).

The photo of the ad above is my screenshot of a post on Facebook by minister of foreign affairs Lilja D. Alfreðsdóttir. Her comment to the ad is: “This attack on Icelandic interests is intolerable and what’s the aim of those behind it?” There are only few comments to the ad but some mention that this will hardly help the cause of those sponsoring it.

The ad is now also on the Iceland Watch website in English. The translation above is my translation as it gives some sense of what it looks like in Icelandic. The story is that this remarkable ad addressed to Icelandic voters is written in a version of Icelandic that resembles a Google translate text. Given that Icelanders are often quite pedantic about their language this will hardly induce Icelanders to take the ad seriously. Or as it says in one comment on Alfreðsdóttir’s Facebook page the ad is “a crime against the Icelandic language” – and that’s a serious offence in Iceland.

Updated: I’ve been made aware that Loomis Sayles is not at all involved in the Iceland Watch campaign against Iceland. I’m sorry that my earlier information here was not correct.

Follow me on Twitter for running updates.

Iceland – lessons from an offshored country

Iceland is, in my opinion, the most offshorised economy in the world, from the point of view of how pervasive it was. The banks diligently sold offshore solutions as an everyman product. I talked about this topic as a Tax Justice Network workshop in spring. This was also the topic of an interview Naomi Fowler from the TJN recently did with me.

After the collapse of the Icelandic banks in October 2008 my attention turned to the role of offshorisation in Iceland. The banks operated in London, the Channel Islands and most important of all, in Luxembourg.

The widespread offshorisation, its effect and general lessons of offshorisation in Iceland was the topic of the interview Naomi Fowler did with me for Tax Justice Network recently, see here.

After my talk at the TJN spring workshop I wrote an article on the TJN see here.

The general lesson is: offshore creates an onshore shelter from tax, rules and regulation and thus creates a two tier society where tax, rules and regulation becomes optional for those offshored while living onshore, wether it’s in Iceland, the UK, US or elsewhere…

Follow me on Twitter for running updates.

International ad campaign and un-worried Icelanders

The offshore króna holders have now taken to the international media to cry out over the unfair treatment they have been submitted to by the Icelandic government. As earlier, they have allied with a strongly libertarian organisation, Institute for Liberty, a think-tank of sort. Perhaps the ads will shake international investors but the effect in Iceland seems to be next to none and the move is clearly not intended to win them friends in Iceland. Perhaps it’s too early to tell but so far, the International Monetary Fund does not seem to side with offshore króna holders and rating agencies seem forgiving. All of this is taking place as Iceland has taken yet another step to lift capital controls, which are now almost entirely lifted for both businesses and individuals.

After placing articles in various international media recently, “Iceland Watch,” an initiative organised by a so-called think tank, Institute for Liberty with the slogan “Defending America’s Right To Be Free” has now taken a new step: placing an ad in US, Danish and Icelandic media. As mentioned earlier, DCI Group, a political PR group based in Washington acts on behalf of the funds involved.*

If Iceland will be hit with a full-force international legislation the offshore króna holders may be the last to laugh but so far Icelanders are just shrugging their shoulders at the ad campaign they don’t really understand.

A clever campaign?

It’s not clear to me who this campaign is supposed to stir and shake. Here in Iceland, very few people have any particular understanding of the issues at stake. After the very unexpected outcome of the EFTA Court Icesave ruling in January 2013 most Icelanders will feel there is little to fear from international courts.

Of course an erratic opinion, the offshore króna case is a different problem but in addition to lacking the insight the words “international litigation” will not sound frightening in Iceland. Given how few Icelanders understand the issues at stake the ads look bizarre to most Icelanders.

There is now an election campaign going on in Iceland, election on October 29 and the offshore króna situation doesn’t figure at all. Nor are the capital controls an issue since they have now been lifted on domestic entities and individuals. I’ve earlier pointed out that Icelanders didn’t really seem to notice when measures to lift capital controls were announced.

I’m not sure the campaign rocks the boat among international investors. Anyone with a nuanced understanding of the Icelandic situation will sense that the Iceland Watch claims are not really fitting the situation in Iceland but bombastic, unintelligent and wide off the mark.

Select default? Doesn’t sound like it according to IMF or rating agencies

I have earlier expressed surprise at the action taken in Iceland. Iceland is clearly exposing itself to a legal risk – there is a question of discrimination, as the offshore króna holders claim and given the good times in Iceland it’s difficult to argue for the haircut.

That said, it’s interesting to observe that neither the IMF nor rating agencies, have so far admitted to the haircut potentially being a case of selected default. The offshore króna holders might have wanted the international community to kick Iceland in place but no one is moving for them except those the króna holders muster to speak their case.

Choosing Institute for Liberty as an ally is intriguing but perhaps not surprising given that many large players in the hedge fund world have libertarian leanings.

The offshore króna saga according to the CBI

In its latest Financial Stability report the CBI spells out the offshore króna problem:

Important steps have been taken towards lifting the capital controls in recent months. In May, Parliament passed legislation on the treatment of offshore krónur, providing for amendments designed to ensure that the special restrictions applying to offshore krónur under the capital controls will hold even though large steps are taken to lift controls on individuals and businesses. In June, the Central Bank of Iceland held a foreign currency auction in which it invited owners of offshore krónur to exchange their krónur for euros before general liberalisation begins. Although most of the bids submitted in the auction were accepted, large owners submitted bids at an exchange rate higher than the Central Bank could accept, and the stock of offshore krónur was therefore reduced by one-fourth. During the summer, the Central Bank set the Rules on Special Reserve Requirements for New Foreign Currency Inflows, and afterwards there was a reduction in new investment in domestic Treasury bonds, which can prove to be a source of volatile capital flows. With the passage of a bill of legislation in October, most of the capital controls on individuals and businesses have been lifted.

This is of course the offshore problem according to the CBI and Icelandic authorities, so far neither challenged by the IMF nor, perhaps more surprising, the rating agencies. The four large offshore króna holders will beg to differ.

Follow me on Twitter for running updates.

European FX loans revisited – the wandering curse

The Polish “Stop BankingInjustice Association” is one of many grass root organisations that have sprouted in many European countries in the last few years, due to FX loans: retail lending to people only with income and assets in their domestic currency. Today, the Polish organisation held a meeting in the Polish Parliament in order to explain the politicians and others the status of FX loans affairs in Poland and elsewhere in Europe, with speakers inter alia from Italy, Spain, Ukraine, Hungary and Iceland. – Interestingly, only in Iceland have the FX loans been dealt with, fairly speedily though never without pain for the borrowers.

The problems of FX loans in Iceland came up fairly quickly after the banking collapse in October 2008. No wonder, the króna had collapsed and everything linked to the currency rates was rapidly rising. To begin with, I was not particularly interested, felt that the borrowers should have been aware of the risk, not much to do. However, after getting an email from a Croatian FX borrower, telling me of the plight of FX borrowers in her country, I started looking at these loans in a wider perspective.

FX loans: a wandering curse for more than 40 years

In short, FX loans have been a wandering curse, going from one country to another, for over forty years. There is abundant evidence that FX loans are utterly unsuited as a standard financial product for ordinary people with no income in FX and no buffer.

I have earlier pointed out this wandering curse element of FX loans, how they have wandered from country to country – Australia in 1980s, New Zealand in the 1990s, also in Austria, Germany, Italy and then after 2000 in Iceland and many countries of Central and Eastern Europe – is quite remarkable and also the fact that the pattern is always the same: it ends in tears. This is not a case of this time it’s different; indeed, it’s always the same.

Lessons learnt long time ago, yet banks keep offering FX loans

This statement from the Australian FX loan saga, captures the risk perfectly: “…nobody in their right mind, if they had done a proper analysis of what could happen, would have gone ahead with it (i.e. FX loans).” And in 2013 the Austrian National Bank warned: “Foreign currency loans to private consumers are not suitable as a mass product…” This was the lesson that the Austrian Finance Market Authority, FMA had already drawn in 2008 but only in 2013 did it state this so clearly and unequivocally.

The FX lending pattern is always the same: the banks have the need to hedge themselves, for various reasons (usually because their financing is in some way FX linked) so they offer retail FX loans. Because the interest rates are lower than the domestic rates people can borrow more, thus in a certain sense creating sub prime lending, from the point of view of the capacity to service loans in the domestic currency.

FX loans, sub prime aspects and the unavoidable shock

Given that the loans normally stretch over years and even decades and FX fluctuations happen quite frequently, it’s clear that the circumstances at the time when the loan is issued are unlikely to stay unchanged. It can be argued that borrowers with FX assets or available funds can profit from FX loans over the lifetime of the loan. That however is not the situation for the majority of FX borrowers who at the outset borrow what they at most can service.

In all countries, where FX retail loans have become widespread, the pattern has always been the same: first, the borrowers are castigated for taking loans they then can’t service. Then, the sub prime lending aspects appear: banks haven’t really informed the clients properly, minimised the risks etc and haven’t done the due diligence as to what would happen to these clients should the currency rates change. The question how far authorities should go in protecting people is certainly justified but all European countries do indeed have a strong focus on consumer rights and scrutinising the banks’ information and behaviour with regard to FX loans should be obvious.

The ruling of the Árpad Kásler case, in the European Court of Justice, ECJ, ECJ C?26/13 in 2014 turned the tables against the banks and in the favour of borrowers. Slowly slowly, the sub prime aspect, the insufficient information and the fact that these loans are normally not really FX loans but FX indexed loans has also mattered.

Iceland and elsewhere: FX indexed loans illegal, not FX loans per se

Iceland is the only country in the recent FX loan saga where the loans have sytematically been written down. In that sense, the Icelandic FX loan saga is success from the point of view of hard-hit borrowers. But it didn’t happen over night, it took time: the króna collapsed in 2008 and kept falling until late 2009. The two first Supreme Court rulings, testing the validity of the loans came in summer of 2010. Only by the end of 2014 and after ca. 30 Supreme Court rulings had the loans been recalculated.

The Supreme Court ruled that FX loans are not illegal but the FX lending isn’t really a FX lending but lending in domestic currency where another currency or a combination of more than one currency set the interest rate.

At the conference there were FX loan stories from different European countries, reflecting the state of affairs in the respective countries. In general it can be said that courts, taking note of the Kásler ECJ case, have at times ruled in favour of borrowers but it differs how willing courts are to take note of the precedence.

In Italy, FX loans cases have been in the courts for five years but have yet to reach a verdict in the lowest court. In Ukraine, there has been a moratorium on enforcing FX loans collaterals since 2014.

All in all, what is generally needed is an acknowledgement of the fact that FX loans all follow a similar pattern, no matter if it’s Australia in the 1980s or Spain in the 21st Century. FX loans are a type of sub prime lending and not a product fit as a general product. Until banks and authorities draw the same conclusion as the Austrian central bank and the Austrian Financial Services Authority in 2013 banks can go on selling these poisonous product and pretend to be surprised when it goes, so predictably, wrong.

FX loans are a great interest of mine, see my earlier blogs on FX loans, inter alia here and here.

Follow me on Twitter for running updates.