Lessons from Iceland: the SIC report and its long lasting effect / 10 years after

The Bill passed by the Icelandic parliament in December 2008 on setting up an independent investigative commission, the Special Investigative Commission did not catch much attention at the time. The goal was nothing less than finding out the truth in order to establish events leading up to the 2008 banking collapse, analyse causes and drawing some lessons. The SIC report was an exemplary work and immensely important at the time to establish a narrative of the crisis. But in hindsight, there is yet another lesson to be learnt: its importance does not diminish with time as it helps to counteract special interests seeking to rewrite history.

There were no big headlines when on 12 December 2008 Alþingi, the Icelandic parliament, passed a Bill to set up an investigative commission “to investigate and analyse the processes leading to the collapse of the three main banks in Iceland,”which had shaken the island two months earlier. The palpable lack of enthusiasm and attention was understandable: the nation was still stunned and there was no tradition in Iceland for such commissions. No one knew what to expect, the safest bet was to not expect very much.

That all changed when the Commission presented its results in April 2010. Not only was the report long – 2600 pages in print in addition to online-only material – but it did actually tell the real story behind the collapse: the immensely rapid growth of the banks, from one GDP in 2002 to ten times the GDP in 2008, the stronghold the largest shareholders, incidentally also the largest borrowers, had on the banks’ managements, the political apathy and lax regulation by weak regulators, stemming from awe of the financial sector.

Unfortunately, the SIC report was not translated in full into English; see executive summary and some excerpts here.

With time, the report’s importance has not diminished: at the time, it clarified what had happened thus preventing those involved or others with special interest, to reshape the past according to their own interests. With time, hindering the reshaping of the past has become of major importance, also in order to draw the right lessons from the calamitous events in October 2008.

What was the SIC?

According to the December 2008 SIC Act (in Icelandic), the goal was setting up an investigative commission, that would, at the behest of Alþingi, seek “the truth about the run-up to and the causes of the collapse of the Icelandic banks in 2008 and related events. [The SIC] is to evaluate if this was caused by mistake or neglect in carrying out law and regulation of the financial sector in Iceland and its supervision and who could be held responsible for it.” – In order to fulfil its goal the SIC was inter alia to collect information on the financial sector, assess regulation or lack thereof and come up with proposals to prevent the repetition of these events.

In some countries, most notably in South Africa after apartheid, “Truth Commissions,” have played a major part in reconciliation with the past. Although the remit of the Icelandic SIC was to establish the truth, the SIC was never referred to as a “truth commission” in Iceland though that concept has been used in foreign coverage of the SIC.

The SIC had the power to make use of a vast array of sources, both by calling in people to be questioned and documents, public or private such as bank data, including data on named individuals, data from public institutions, personal documents and memos. Data, normally confidential, had to be shared with the SIC, which was obliged to operate as any other public body handling sensitive or confidential information.

Although the SIC had to follow normal procedures of discretion on personal data the SIC could “publish information, normally subject to discretion, if the SIC deems this necessary to support its conclusions. The Commission can only publish information on personal matters of named individuals, including their financial affairs, if the public interest is greater than the interest of the individuals concerned.” – In effect, this clause lift banking secrecy.

One source close to the process of setting up the SIC surmised the political intentions behind the SIC Act did not include lifting banking secrecy, indicating that the extensive powers given to the SIC were accidental. Others have claimed the SIC’s extensive powers were always part of the plan. I am in two minds about this but my feeling is that the source close to the process was right – the powers to scrutinise the main shareholders were far greater than intended to begin with.

Naming the largest borrowers, incidentally also the largest shareholders

Intentional or not, the extensive powers enabled naming the individuals who received the largest loans from the banks, incidentally their largest shareholders and their closest business partners. This was absolutely essential in order to understand how the banks had operated: essentially, as private fiefdoms of the largest shareholders.

In order to encourage those called in for questioning to speak freely, the hearings were held behind closed doors; there were no public hearings. The SIC had extensive powers to call people in for questioning: it could ask for a court order if anyone declined its invitation, with the threat of taking that person to court on grounds of contempt in case the invitation was declined.

Criminal investigation was not part of the SIC remit but its power to call for material or call in people for questioning was parallel to that of a prosecutor. As stated in the report, the SIC was obliged to inform the State Prosecutor if there was suspicion of criminal conduct:

The SIC’s assessment, pursuant to Article 1(1) of Act no. 142/2008, was mainly aimed at the activities of public bodies and those who might be responsible for mistakes or negligence within the meaning of those terms, as defined in the Act. Although the SIC was entrusted with investigating whether weaknesses in the operations of the banks and their policies had played a part in their collapse, the Commission was not expected to address possible criminal conduct of the directors of the banks in their operations.

As to suspicion of civil servants having failed to fulfil their legal duties, the SIC was supposed to inform appropriate instances. The SIC was not obliged to inform the individuals in question. As to ministers, the SIC was to follow law on ministerial responsibility.

The three members

The SIC Act stipulated it should have three members: the Alþingi Ombudsman, then as now Tryggvi Gunnarsson, an economist and, as a chairman, a Supreme Court Justice. The nominated economist was Sigríður Benediktsdóttir, then lecturer at Yale University (director of Financial Stability at CBI 2012 to 2016 when she returned to Yale). The chairman was Páll Hreinsson (since 2011 judge at the EFTA Court).

In addition to the Commission there was a Working Group on Ethics: Vilhjálmur Árnason professor of philosophy, Salvör Nordal director of the Centre for Ethics, both at the University of Iceland and Kristín Ástgeirsdóttir director of the Equal Rights Council in Iceland. Their conclusions were published in Vol. 8 of the SIC report.

In total, the SIC had a staff of around 30 people. As with the Anton Valukas report, published in March 2010, on the collapse of Lehman Brothers, organising the material, especially the data from the banks, was a major task. The SIC had access to the databases of the three collapsed banks but had only limited data from the banks’ foreign operations.

There were absolutely no leaks from the SIC, which meant it was unclear what to expect. Given its untrodden path, the voices expressing little faith were the most frequently heard. I had however heard early on, that the SIC had a firm grip on turning material into searchable databases, which would mean a wealth of material. With qualified members and staff, I was from early on hopeful that given their expertise of extracting and processing data the SIC report would most likely prove to be illuminating – though I certainly did not imagine how extensive and insightful it turned out to be.

Greed, fraud and the collapse of common sense

After the October 2008 collapse, my attention had been on some questionable practices that I heard of from talking to sources close to the failed banks.

One thing I had quickly established was how the banks, through their foreign subsidiaries, had offshorised their Icelandic clients. This counted not only for the wealthy businessmen who obviously understood the ramifications of offshorising but also people with relatively small funds. These latters had in many cases scant understanding of these services.

In the last few years, as information on offshorisation has come to the light via Offshoreleaks etc., it has become clear that Iceland was – and still is – the most offshorised country in the world (here, 2016 Icelog on this topic). Once the “art” of offshorisation is established, with all the vested interests accompanying it, it does not die easily – this might be considered one of the failed banks’ more evil legacies.

Another point of interest was how the banks had systematically lent clients, small and large, funds to buy the banks’ own shares, i.e. Kaupthing lent funds to buy Kaupthing shares etc. Cross-lending was also a practice: Bank A would lend clients to buy Bank B shares and Bank B lent clients to buy Bank A shares. This was partly used to hinder that shares were sold when buyers were few and far behind, causing fall in market value. In other words, massive market manipulation had slowly been emerging. Indeed, the managers of all three failed banks have in recent years been sentenced for market manipulation.

It had also emerged, that the banks’ largest shareholders/clients and their business partners had indeed been what I have called “favoured clients,” i.e. enjoying services far beyond normal business practices. One side of this came to light in the banks’ covenants in lending agreements: in the case of the “favoured clients,” the lending agreements tended to guarantee clients’ profit, leaving the banks with the losses. In other words, the banks took on far greater portion of the risk than these clients.

Icelog blogs I wrote in February 2010, before the publication of the SIC report, give some sense of what was known at the time. Already then, it seemed fair to conclude that greed, fraud and the collapse of common sense had been decisive factors in the event in Iceland in October 2008.

Monday morning 12 April 2010 – when time stood still in Iceland

The excitement in Iceland on Monday morning 12 April 2010 was palpable. The press conference was transmitted live. All around Iceland employers had arranged for staff to watch as the SIC presented its conclusions.

After Páll Hreinsson’s short introduction, Sigríður Benediktsdóttir gave an overview of the main findings regarding the banks, presenting “The main reasons for the collapse of the banks,” followed by Tryggvi Gunnarsson’s overview of the reactions within public institutions (here the presentations from the press conference, in Icelandic).

The main reason for the collapse of the three banks was their rapid growth and their size at the time they collapsed; the three big banks grew 20-fold in seven years, mainly 2004 and 2005; the rapid expansion into new/foreign markets was risky; administration and due diligence was not in tune with the banks’ growth; the quality of loans greatly deteriorated; the growth was not in tune with long-time interest of sound banking; there were strong incentives within the banks grow.

Easy access to short-term lending in international markets enabled the banks’ rapid growth, i.e. the banks’ main creditors were large international banks. With the rapid expansion, also abroad, the institutional framework in Iceland, inter alia the Central Bank and the FME, quickly became wholly inadequate. The under-funded FME, lacking political support, was no match for the banks, which systematically poached key staff from the FME. Given the size of the humungous size of the Icelandic financial system relative to GDP there was effectively no lender of last resort in Iceland; the Central Bank could in no way fulfil this role.

This had no doubt be clear to the banks’ management for some time. In his book, “Frozen Assets,” published in 2009, Ármann Þorvaldsson, manager of KSF, Kaupthing’s UK operation, writes that he “always believed that if Iceland ran into trouble it would be easy to get assistance from friendly nations… despite the relative size of the banking system in Iceland, the absolute size was of course very small.” (P. 194). – A breath-taking recklessness, naivety or both but might well have been the prevalent view at the highest echelons of the Icelandic financial sector at the time.

The banks’ largest shareholders and their “abnormally easy access to lending”

When it came to “Indebtedness of the banks’ largest owners” the conclusions were truly staggering: “The SIC concludes that the owners of the three largest banks and Straumur (investment bank where the main shareholders were the same as in Landsbanki, i.e. Björgólfur Thor Björgólfsson and his fater) had abnormally easy access to lending in these banks, apparently only because their ownership of these banks.”

The largest exposures of the three large banks were to the banks’ largest shareholders. “This raises the question if the lending was solely decided on commercial terms. The banks’ operations were in many ways characterised by maximising the interest of the large shareholders who held the reins rather than running a solid bank with the interest of all shareholders in mind and showing reasonable responsibility towards shareholders.” – Creative accounting helped the banks to avoid breaking rules on large exposures.

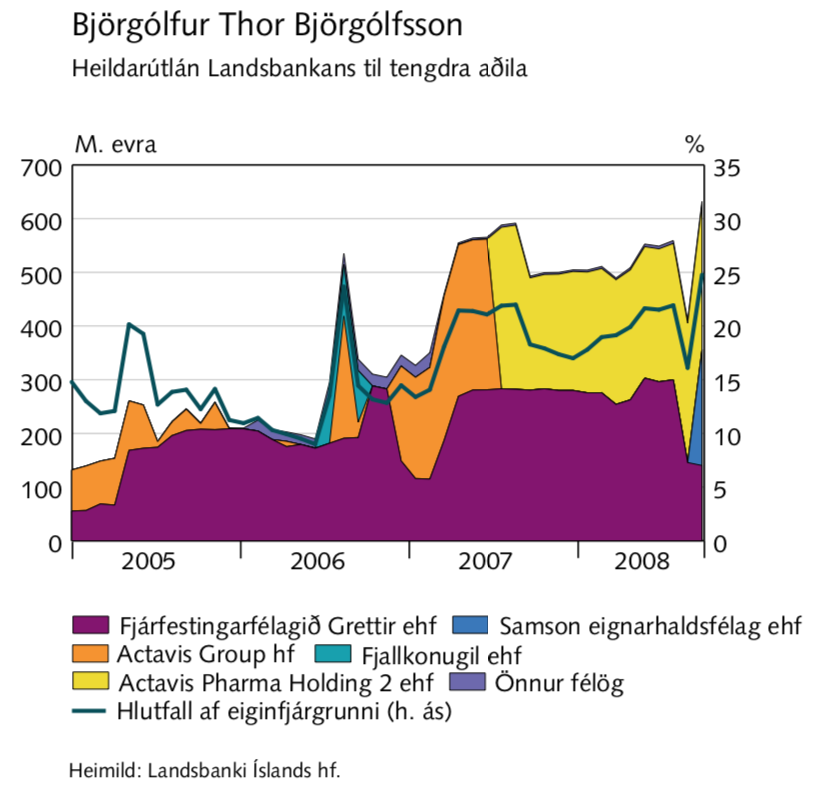

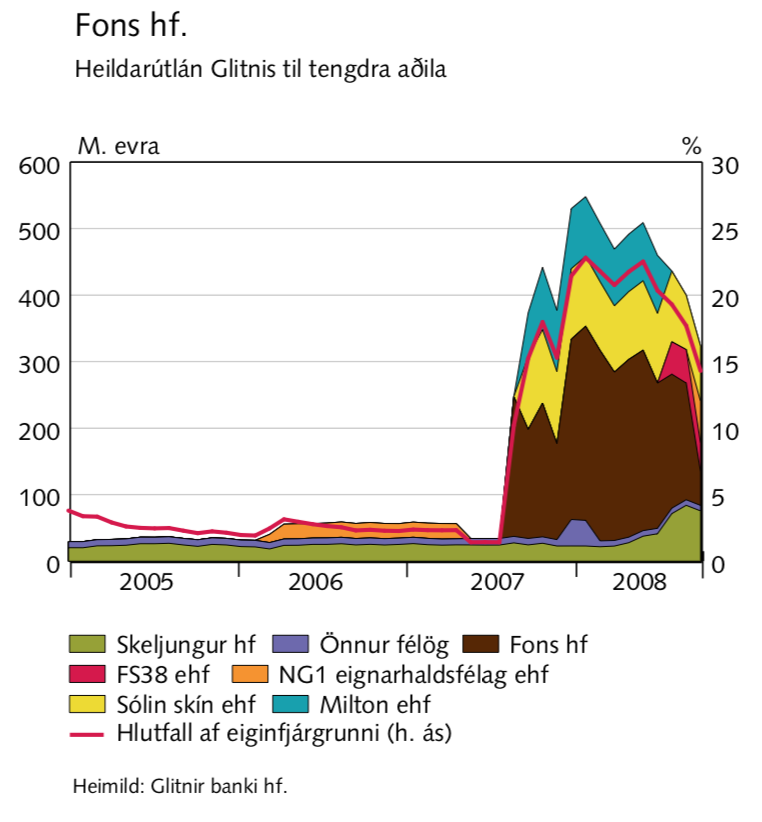

Benediktsdóttir showed graphs to illustrate the lending to the largest shareholders in the various banks. It is worth keeping in mind that these large shareholders all had foreign assets and were all clients of foreign banks as well. In general, the Icelandic lending shot up in 2007 when international funding dried up. At this point, the Icelandic banks really showed how favoured the large shareholders were because these clients were, en masse, getting merciless margin calls from their foreign lenders.

In reality, the Icelandic banks were at the mercy of their shareholders. If the large shareholders and/or their holding companies would default, the banks themselves were clearly next in line. The banks could not make margin calls where their own shares were collateral as it would flood the markets with shares no one wanted to buy with the obvious consequence of crashing share prices.

Two of the graphs from the SIC report, shown at the press conference in April 2010, exposed the clear drift in lending at a decisive time: to Björgólfur Thor Björgólfsson, still an active investor based in London and to Fons, a holding company owned by Pálmi Haraldsson, who for years was a close business partner of Jón Ásgeir Jóhannesson, once a king on the UK high street with shops like Iceland, Karen Millen, Debenhams and House of Fraser to his name.

The lending related to Fons/Haraldsson is particularly striking since Haraldsson was part of the consortium Jóhannesson led in spring of 2007 to buy around 40% of Glitnir: after the consortium bought Glitnir, the lending to Haraldsson shot up like an unassailable rock.

Absolution of risk

The common thread in so many of the SIC stories was how favoured clients – and in some cases bank managers themselves – were time and again wholly exempt from risk. One striking example is an email (emphasis mine), sent by Ármann Þorvaldsson and Kaupthing Luxembourg manager Magnús Guðundsson, jokingly calling themselves “associations of loyal CEOs,” to Kaupthing’s chairman Sigurður Einarsson and CEO Hreiðar Sigurðsson.

“Hi Siggi and Hreidar, Armann and I have discussed this (association of loyal CEOs) and have come to the following conclusion on our shares in the bank: 1. We set up a SPV (each of us) where we place all shares and loans. 2. We get additional loans amounting to 90% LTV or ISK90 to every 100 in the company which means that we can take out some money right away. 3. We get a permission to borrow more if the bank’s shares rise, up to 1000. It means that if the shares go over 1000 we can’t borrow more. 4. The bank wouldn’t make any margin calls on us and would shoulder any theoretical loss should it occur.We would be interested in using some of this money to put into Kaupthing Capital Partners [an investment fund owned by the bank and key managers] Regards Magnus and Armann”

This set-up, where the borrower is risk-free and the bank shoulders all the risk, has lead to several cases where bankers being sentenced for breach of fiduciary duty, i.e. lending in such a way that it was from the beginning clear that losses would land with the bank. (Three of these Kaupthing bankers, Guðmundsson, Einarsson and Sigurðsson, not Þorvaldsson, have been charged and sentenced in more than one criminal case).

The “home-knitted” crisis

Due to measures taken in October 2008 in the UK against the Icelandic banks, there was a strong sense in Iceland that the Icelandic banks had collapsed because of British action. The use of anti-terrorism legislation by the British government against Landsbanki greatly contributed to these sentiments.

A small nation, far away from other countries, Icelanders have a strong sense of “us” and “the others.” This no doubt exacerbated the understanding in Iceland around the banking collapse that if it hadn’t been for evil-meaning foreigners, hell-bent on teaching Iceland a lesson, all would have been fine with the banks. Some leading bankers and large shareholders were of the opinion that Icelanders had been such brilliant bankers and businessmen that they had aroused envy abroad: British action was a punishment for being better than foreign competitors (yes, seriously; see for example Þorvaldsson’s book “Frozen Assets”).

The story told in the SIC report showed convincingly and in great detail how wrong all of this was: the banks had dug their own grave. Icelandic politicians and civil servants had tried their best to fool foreign countries and institutions how things stood in Iceland. Yes, the turmoil in international markets toppled the Icelandic banks but they were weak due to bad governance, great pressure by the largest shareholders and then weak infrastructure in Iceland, as I pointed out in a blog following the publication of the SIC report.

This understanding is at times heard in Iceland but the convincing and well-documented story told in the SIC report has slowly all but eradicated this view.

Court cases and political controversies

Some, but by far not all, of the dubious deals recounted in the SIC report have ended up in court. The SIC brought a substantial amount of cases deemed suspicious to the attention of the Office of Special Prosecutor, incidentally set up by law in December 2008. However, most if not all of these cases had also been spotted by the FME, which passed them on to the Special Prosecutors.

CEOs and managers in all three banks have been sentenced in extensive market manipulation cases – the bankers were shown to have directed staff to sell and buy shares in a pattern indicating planned market manipulation. In addition, there have been cases involving shareholders, most notably the so-called al Thani case (incidentally strikingly similar to the SFO case against four Barclays bankers) where Ólafur Ólafsson, Kaupthing’s second largest shareholder, was sentenced to 5 1/2 years in prison, together with the bank’s top management.

In total, close to thirty bankers and major shareholders have been sentenced in cases related to the old banks, the heaviest sentence being six years. The cases have in some instances thrown an interesting light on operations of international banks, such as the CLN case on Deutsche Bank.

The SIC’s remit was inter alia to point out negligence by civil servants and politicians. It concluded that the Director General of the FME Jónas Fr. Jónsson and the three Governors of the CBI, Davíð Oddsson, Eiríkur Guðnason and Ingimundur Friðriksson, had shown negligence as defined in the law “in the course of particular work during the administration of laws and rules on financial activities, and monitoring thereof.” – None of them was longer in office when the report was published in April 2010 and no action was taken against them.

The Commission was of the opinion that “Mr. Geir H. Haarde, then Prime Minister, Mr. Árni M. Mathiesen, then Minister of Finance, and Mr. Björgvin G. Sigurðsson, then Minister of Business Affairs, showed negligence… during the time leading up to the collapse of the Icelandic banks, by omitting to respond in an appropriate fashion to the impending danger for the Icelandic economy that was caused by the deteriorating situation of the banks.”

It is for Alþingi to decide on action regarding ministerial failings. After a long deliberation, Alþingi voted to bring only ex-PM Geir Haarde to court. According to Icelandic law a minister has to be tried by a specially convened court, which ruled in April 2012 that the minister was guilty of only one charge but no sentence was given (see here for some blogs on the Haarde case). Geir Haarde brought his case to the European Court of Human Rights but the judgment went against him. Haarde is now the Icelandic ambassador in Washington.

The SIC lacunae

In hindsight, the SIC was given too short a time. With some months more, the role of auditors in the collapse could for example have been covered in greater detail. It is quite clear that the auditing was far too creative and far too wishful, to say the very least. The relationship between the banks and the four large international auditors, who also operate in Iceland, was far too cosy bordering on the incestuous.

The largest gap in the SIC collapse story stems from the fact that the SIC had little access to the banks foreign operations. Greater access would not necessarily have altered the grand narrative. But court cases have shown that some of the banks’ criminal activities, were hidden abroad, notably in the case of Kaupthing Luxembourg. – As I have time and again pointed out, it is incomprehensible that authorities in Luxembourg have not done a better job of investigating the banking sector in Luxembourg. The Icelandic cases are a stern reminder of this utter failure.

As mentioned above, only excerpts of the report were translated into English. To my mind, this was a big error and extremely short-sighted. Many of the stories in the report involve foreign banks and foreign clients of the Icelandic banks. The detailed account of what happened in Iceland throws light on not only what was going on in Iceland but also in other countries where the banks operated. The excerpts are certainly better than nothing but by far not enough – publishing the whole report in English would have done this work greater justice and been extremely useful in a foreign context.

Why the SIC report’s importance has grown with time

It is now just over eight years since the publication of the SIC report. Whenever something related to the collapse is discussed the report is a constant source and the last verdict. The report established a narrative, based on extensive sources, both verbal and written.

Some of those mentioned in the report did not agree with everything in the report. When they sent in their own reports these have been published on-line. However, undocumented statements amount to little compared to the report’s findings. Its narrative and conclusions can’t be dismissed without solid and substantiated arguments to counter its well-documented conclusions.

This means the story of the 2008 banking collapse cannot easily be reshaped. This is important because changing the story would mean undermining its conclusions and lessons to be learnt. In a recent speech, Tory MP Tom Tugendhat mentioned the UK financial crisis as the “forces of globalisation.” These would be the same forces that caused the collapse of the Icelandic banks – but from the SIC report Icelanders know full well that this is far too imprecise a description: the banks, both in the UK and Iceland, collapsed due to lack of supervision and public and political scrutiny, following year of lax policies.

Lessons for other countries

In order to learn from the financial crisis, countries need to know why there was a crisis – with no thorough analysis no lessons can be learnt. Also, not only in Iceland was criminality part of the crisis. Though not a criminal investigation, many of these stories surfaced in the SIC report, another important aspect.

Greece, Cyprus, UK, Ireland, US – five countries shaken and upset by overstretched banks, which needed to be bailed out at great expense and pain to taxpayers. However, all of these countries have kept their citizens in the dark as to what happened apart from some tentative and wholly inadequate attempts. The effect of hiding how policies and actions of individuals, in politics, banking etc, caused the calamities has partly been the gnawing discontent and lack of trust, i.a. visible in Brexit and the election of Donald Trump as US president.

Although Iceland enjoyed a speedy recovery (Icelog Sept. 2015), I’m not sure there are any particular economic lessons to be learned from Iceland. There were no magic solutions in Iceland. What contributed to a relatively speedy recovery was the sound state of the economy before the crisis, classic but unavoidably painful economic measures, some prescribed by the IMF, in 2008 and the following years – and some luck. If there is however one lesson to learn it is the importance of a thorough analysis of the causes of the crisis.

The SIC was, and still is, a shiny example of thorough investigative work following a major financial crisis, also for other countries. It did not alleviate anger; anger is still lingering in Iceland. An investigative report is not a panacea, nothing is, but it is essential to establish what happened and why, with names named.

There are never any mystical “forces” or laws of nature behind financial crisis and collapse. They are caused by a combination of human actions, which can all be analysed and understood. Without analysis and investigations it is easy to tell the wrong story, ignore the causes, ignore responsibility – and ultimately, ignore the lessons.

This is the second blog in “Ten years later” – series on Iceland ten years after the 2008 financial collapse, running until the end of this year.

Follow me on Twitter for running updates.

After I initially commented I clicked the -Notify me when new feedback are added- checkbox and now every time a remark is added I get four emails with the same comment. Is there any method you may remove me from that service? Thanks!

supreme clothing

20 Oct 23 at 3:16 pm

It抯 hard to search out knowledgeable people on this topic, but you sound like you already know what you抮e speaking about! Thanks

off-white

23 Oct 23 at 12:30 pm

BTC may be the latest or last chance to get rich in this era. It will reach $200000 next year or the next year.

BTC has increased 20 times in the last year, and other coins have increased 800 times!!!

Think about only $2 a few years ago. Come to the world’s largest and safest virtual currency exchange Binance to Get free rewards. Don’t miss the most important opportunity in life!!!

https://hi.switchy.io/91xl

wypihomgote340

20 Nov 23 at 4:34 am

I wanted to post you that very small remark to finally thank you so much once again with the great views you have shown in this article. It’s incredibly open-handed of people like you to offer unreservedly what exactly some people would have advertised as an e-book to get some money for themselves, notably considering that you might have tried it if you ever considered necessary. These suggestions as well worked to be a good way to be sure that most people have similar fervor just like my personal own to grasp good deal more with respect to this condition. I’m certain there are numerous more pleasant times ahead for those who look into your blog.

bape

24 Nov 23 at 7:50 pm

I wish to show thanks to this writer just for rescuing me from this type of scenario. Right after looking throughout the the net and seeing concepts which are not helpful, I believed my entire life was over. Existing devoid of the answers to the issues you have sorted out as a result of this report is a serious case, as well as the ones that could have negatively damaged my career if I had not encountered your blog. Your primary knowledge and kindness in maneuvering all the pieces was excellent. I’m not sure what I would’ve done if I hadn’t discovered such a thing like this. I am able to at this point look forward to my future. Thanks for your time so much for the high quality and effective help. I won’t hesitate to recommend the sites to any individual who would need direction about this area.

bape

22 Dec 23 at 10:43 pm

Thanks so much for providing individuals with remarkably pleasant opportunity to discover important secrets from this website. It is usually very brilliant plus stuffed with a good time for me and my office acquaintances to search your web site the equivalent of 3 times in 7 days to learn the newest tips you will have. And definitely, I’m certainly motivated for the special ideas served by you. Some 4 ideas in this post are truly the most effective I’ve ever had.

jordan travis scott

21 Jan 24 at 4:27 am