Archive for April, 2021

Greensill’s 2014 private loans to related parties

Having learned about finance from the collapse of the three largest Icelandic banks in 2008, I’m always curious to see companies rapidly enjoying an incredibly rapid success only to drop into ignominious bust. The latest is Greensill Capital. Lex Greensill was clearly good at building relationships and generosity is one way of doing it. Buried in Greensill Group’s accounts are generous loans to people connected to Greensill.

To begin with, Greensill’s companies were just like thousands of others UK companies registered in Company House, i.e. not much going on. The annual accounts for 2013 were filed as “accounts for a small company,” signed by Grant Thornton. The auditor for the first two Greensill companies, Grant Thornton resigned in July 2015, no reason given.

The auditors for the accounts of Greensill’s main UK company, Greensill Capital (UK) Ltd, for the following years, from 2014 to 2019, the last one available, was Saffery Champness, a top 20 firm of Chartered Accountants and Registered Fiduciaries but nowhere near the Big Four.

There are thirteen companies registered in the UK, related to Lex Greensill, three of which are in administration according to Company House. And in one of these is a story of very generous loans to people related to the Greensill sphere.

The story of the London beginnings: private loans

According the 2014 accounts, Lex Greensill was the ultimate controlling party of the Greensill Capital (UK) Ltd and his Australian Greensill Capital Pty. Ltd the ultimate parent company.

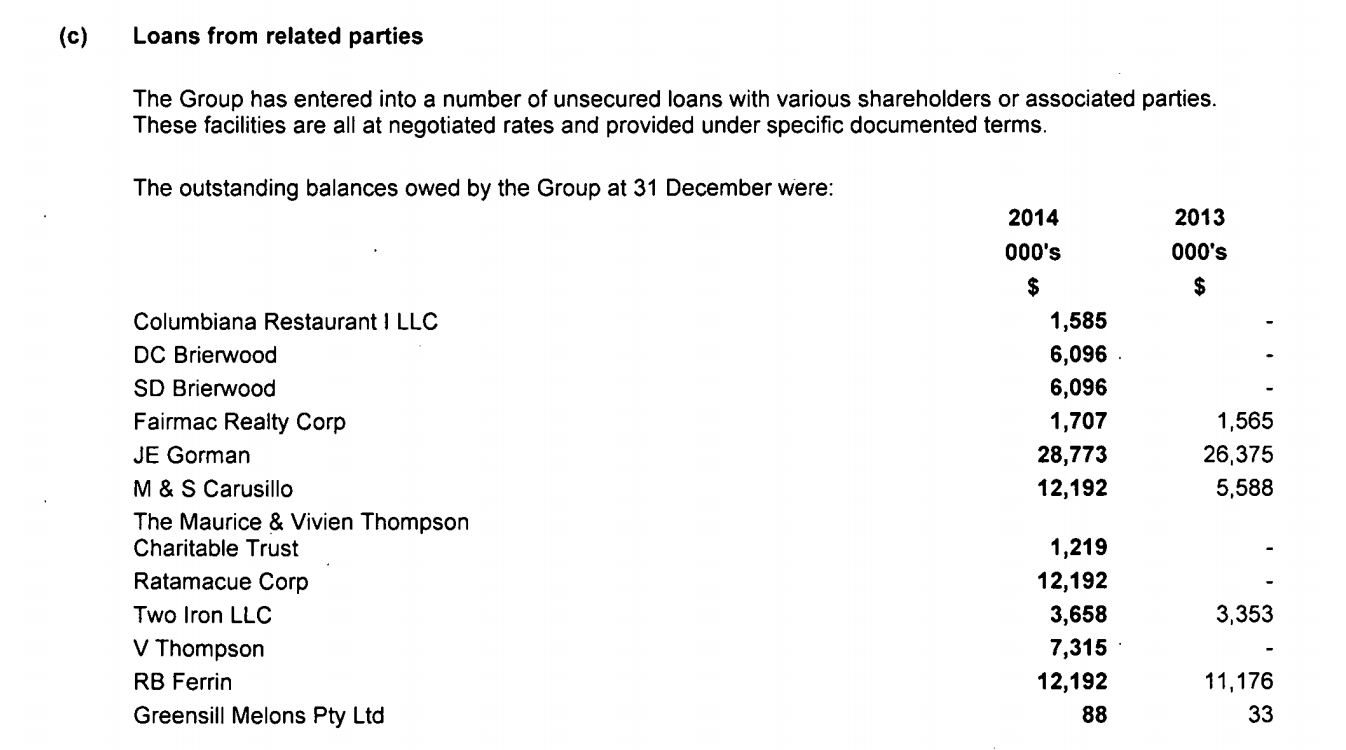

The 2014 accounts tell various interesting stories. One of them, from the accounts for the Australian mother company shows loans to related parties, in total almost AU$100m, quite a bit at the time when Greensill’s UK profit was AU$1,6m. Also, the loans started in 2013.

Like Lex Greensill, David Brierwood is a former Morgan Stanley banker. He was a director of the UK Greensill Capital from January 1 2015 until January 22 2018, according to Company House. Brierwood fits into Greensill’s political newworking, which could have been hugely important for his business. Brierwood was a Crown Representative at the Cabinet Office from October 2014 to June 2018, according to his LinkedIn profile, as The Guardian has pointed out.

In 2014, Brierwood had profited from a private loan from Greensill’s Australian company. It seems safe to conclude that SD Brierwood might be a close relative of Brierwood.

It is interesting to note that the Brierwoods combined loan is AU$12,192,000 – the same amount that two other companies got. Maurice Thompson is another Greensill director, who was with Greensill from September 25 2015 until he resigned on the same day as Brierwood. V Thompson might be Vivien Thompson.

Columbiana Restaurant 1 LLC has been (as documented in 2001) owned by John E Gorman, an American entrepreneur, who was a Greensill director until February this year. By far the highest loan, in addition to the Columbiana loan, seems to have been for Gorman.

Fairmac Realty Corp is a Delaware company, apparently a subsidiary of CBI Industries, a holding company for oil and gas, forestry, waste water and real estate, with no visible connection to Greensill. Who M & S Carusillo are is unclear.

There is a Las Vegas asset management company, called Ratamacue Corp, among shareholders in the Australian Greensill company. The man behind the Las Vegas company is David Solo, an elusive player in international finance, who apparently in 2015 introduced Lex Greensill to GAM, where Solo had worked. The GAM connection was a massive boost for Greensill massively but less profitable for GAM, another intriguing chapter in the Greensill saga. Given the Greensill rise, this connection to Solo is quite intriguing.

There are more than one US companies with the name of Two Iron LLC; not quite clear which company it is and what the connection is to Greensill. RB Ferrin I couldn’t relate to anything. Greensill Melons Pty is a company related to his farming family, from whose financial interests he has been distancing himself from lately.

PS There are many ways to look at the Greensill demise – one way, is to see it as yet another chapter in the SoftBank Vision Fund saga…

Follow me on Twitter for running updates.