Search Results

Capital controls abolished – offer to offshore króna holders

As Már Guðmundsson governor of the Icelandic Central Bank, CBI underlined at a press conference today ordinary Icelanders have not felt the capital controls for a long time. Today, the controls are lifted for not only individuals but also for companies and the pension funds. Earlier limits have been lifted – de facto the capital controls are coming to an end in Iceland, more than eight years after they were put in place end of November 2008.

What remains in place is the following, according to the CBI press release:

i) derivatives trading for purposes other than hedging; ii) foreign exchange transactions carried out between residents and non-residents without the intermediation of a financial undertaking; and iii) in certain instances, foreign-denominated lending by residents to non-residents. It is necessary to continue to restrict such transactions in order to prevent carry trade on the basis of investments not subject to special reserve requirements pursuant to Temporary Provision III of the Foreign Exchange Act and the Rules on Special Reserve Requirements on New Foreign Currency Inflows, no. 490/2016. Guidelines explaining the above-mentioned restrictions will be issued to accompany the Rules.

The measures announced today were mostly as could be expected. However, the unknown variable was what offshore króna holders would be offered. Last summer they were offered a rate of ISK190 a euro; the onshore rate was ca. ISK140 at the time. The four large funds holding most of the remaining offshore króna – Loomis Sayles, Autonomy, Eaton Vance and Discovery Capital Management – refused that offer and have since been locked into low interest rates with an uncertain date of exit.

Now the offer is quite a bit more attractive: ISK137.50 a euro; the onshore rate is today ISK115.41. Last year, the offshore króna holders were offering ISK160 a euro, quite a bit better had the government been willing to accept it last year.

The CBI has lowered its bar, presumably because getting rid of the offshore króna holdings is seen as a bonus for Iceland. The sums captured inside the capital controls now amount to ISK195bn, less than 10% of GDP. Settling this last important part of trapped offshore króna means that Iceland can now take a step out of the shadow of the 2008 banking collapse – a chapter is coming to an end.

Former prime minister and former leader of the Progressive party Sigmundur Davíð Gunnlaugsson, forced to resign because of his offshore holdings exposed in the Panama papers, wrote today on Facebook that now the vulture funds were being rewarded; the funds had known they could crush the Icelandic government and that’s what they have now done. Others will beg to differ.

According to governor Guðmundsson the amount of offshore króna exiting at the new offer is just under ISK90bn. As far as I’m aware three of the four large funds have agreed to the present offer, which remains in place for the coming two weeks. One fund is considering its options, which must include testing the legality of earlier measures, a route the funds had already embarked on.

In total the four funds hold ISK120bn, further ISK12bn are holdings in shares, which are not being sold (thus nothing volatile there) and ISK60bn are deposits owned by various investors (some of whom might well have forgotten about their holdings or who are for some reason unaware of being the lucky owners of some Icelandic króna).

This means that although ISK90bn is less than half of the remaining offshore króna it’s roughly 3/4 of the offshore króna that could potentially move (though the funds do indeed want to keep their Icelandic relatively high-interest króna assets but that’s another saga).

What now remains in place is hindrance on inflows – as I’ve said earlier some would call it another form of capital controls but I side with the CBI that already in 2012 announced the conditions after capital controls would not be like before November 2008. Iceland isn’t interested in being the destination of money flows looking for lucrative interest rates. Consequently, prudent measures are in place since last summer.

Benedikt Jóhannesson minister of finance called today “a day of gladness.” Given that the controls had already been eased it’s unlikely the Icelandic króna will move much tomorrow or the coming days. The pension funds have good reasons to be vary of moving abroad. Though foreign investments would be wise as means of hedging foreign markets of low interest rates and high asset prices are not inviting.

Iceland is booming – the economy grew by 7.2%(!) of GDP last year. No exaggeration that there are good times in Iceland but good times aren’t necessarily easy times in a small economy with its own currency. With capital controls out of the way Iceland there is one thing less to worry about, the rating agencies will see this as a favourable move that might soon be expressed in more favourable ratings, eventually meaning lower interest rates in Iceland – so as to end on an optimistic note.

PS Why was the government keen to act now re offshore króna holders? Well, first for the entirely obvious reasons that Iceland is doing very well with large foreign currency reserves (not entirely trivial to invest them sensibly) and consequently it’s difficult to claim that economic hardship bars solution. In addition, as the minister of finance mentioned today: the rating agencies have indicated that the rating might move up, with the benefits such as lower interest rates when the sovereign borrows, spilling over into lower interest rates in Iceland. Last, it seems that the International Monetary Fund, very patient so far, was starting to air its worries: Iceland couldn’t keep boxing in the offshore króna holders indefinitely.

From top prime minister Bjarni Benediktsson, minister of finance Benedikt Johannesson (the two ministers are closely related, both from one of the most prominent business families in Iceland) and Már Guðmundsson governor of the CBI. Screenshots from the press conference today – notice the painting behind the two ministers: by Jóhannes Kjarval (1882-1972) the most iconic Icelandic artist, whose favourite motive was Icelandic landscape, most notable the lava landscape like here.

Follow me on Twitter for running updates.

Will the last bit of capital controls soon be removed?

Now that ordinary Icelanders can invest ISK100m abroad a year and buy one property abroad, life is returning back to normal after capital controls or at least for the 0.01% of Icelanders that will be able to make use of this new normal. This new CBI regime was put in place on the last day of 2016.

For all others, capital controls have for a long time not been anything people sensed in everyday life. The controls really were on capital, in the sense that Icelanders could not invest abroad, but they could buy goods and services, i.e. ordered stuff online and, mostly relevant for companies, paid for foreign services.

The almost only tangible remains of the capital controls regard the four large funds – Eaton Vance, Autonomy, Loomis Sayles and Discovery Capital Management – still locked inside the controls with their offshore króna (by definition króna owned by foreigners, i.e. króna owned by foreigners who potentially want to exchange it to foreign currency).

I’ve written extensively on this issue earlier, recently with a focus on the utterly misplaced ads regarding the policy of the Icelandic government (the policy can certainly be disputed but absolutely not in the way the ads chose to portray it; see here and here; more generally here). From over 40% of GDP end of November 2008, when the controls were put in place, the offshore króna amounted to ca. 10% of GDP towards the end of 2016 (see the CBI: Economy of Iceland 2016, p. 75-81.) The latest CBI data is from 13 January this year, showing the amount of offshore króna at ISK191bn, below 10% of GDP.

It now seems there have been high-level talks and as far as I can understand there is great willingness on both sides to find an agreement, which would most likely involve an exit rate somewhat less favourable than the present rate (meaning there would be some haircut for the funds, i.e. some loss) and also that they would exit over some period of time (they have earlier indicated that they are in no hurry to leave).

As before, the greatest risk here is political: will the opposition or parts of it, try to use this case to portray the government as dancing to the tune of greedy foreigners? Icelanders have had a share of the populism so prevalent in other parts of the world but Icelandic politics is by no means engulfed by it.

Arguments in this direction can’t be ruled out but the argument for solving the issue is that Iceland should be moving out of the long shadows of the 2008 collapse, the Central Bank has been buying up foreign currency in order to fetter the ever-stronger króna and this is a problem easier to solve now with the economy booming rather than at some point later in a more uncertain future.

Obs.: on 4 June 2016 the CBI announced a new instrument to “temper and affect the composition of capital inflows.” Some people call this a new form of capital controls. I don’t agree and see these measures, as does the CBI, as a set of prudence rules, announced as a possible course of action already in 2012. Over the last decades other countries have taken a similar course to prevent the inflow of capital that could in theory leave quickly.

Follow me on Twitter for running updates.

Liberalising capital controls on Icelanders – who don’t really notice

The Ministry of finance has now introduced the third and last significant step towards lifting capital controls. After lifting controls on the estates of the failed banks last year and the disputed action earlier this year to solve, or box in, offshore króna holders, it’s now as promised since the elections in 2013 time to lift controls on Icelanders, both individuals and companies, just in time for the coming election on October 29. All but the very wealthiest Icelanders will now be outside controls. And Icelanders? They don’t pay much attention to this latest step.

Ordinary Icelanders have not much felt the capital controls in their daily lives since the capital controls only cover investment but now those wealthy enough to want to buy property abroad or invest in foreign companies etc. can do so. The main points are the following, according to the Ministry of finance press release:

- That outward foreign direct investment be unrestricted but subject to confirmation by the Central Bank of Iceland.

- That investment in financial instruments issued in foreign currency, other monetary claims in foreign currency, and prepayment and full payment (retirement) of foreign-denominated loans be permissible up to a given amount, upon satisfaction of specified conditions.

- That individuals be authorised to purchase one piece of real estate abroad per calendar year, irrespective of the purchase price and the reason for the purchase.

- That requirements that residents repatriate foreign currency be eased and that they be lifted entirely in connection with loans taken abroad by individuals for real estate or motor vehicle purchases abroad, or for investment abroad.

- That various special restrictions be eased or lifted entirely, including individuals’ authorisation to purchase foreign currency for travel.

- That the Central Bank of Iceland’s authorisations to gather information be expanded so that the Bank can promote price stability and financial stability more effectively.

As of 1 January 2017, the following are to take effect:

- The ceiling on investment in financial instruments issued in foreign currency, other monetary claims in foreign currency, and prepayment and full payment (retirement) of foreign-denominated loans will be raised.

- Transfers of deposit balances will be permissible for amounts below a certain ceiling. The requirement for domestic custody of foreign securities investments will be revoked. This will enable residents and non-residents to transfer deposits and securities to and from Iceland and to trade in securities abroad within the limits specified in the bill.

- Individuals’ authorisation to purchase foreign currency in cash will be expanded significantly.

Capital controls lifted in a record boom

All of this is made easier since Iceland is enjoying a record boom with tourism flourishing and more foreign reserves compared to more or less any time in the country’s recent history. As I’ve mentioned earlier, Icelandic authorities don’t regard it as a problem that the largest offshore króna holders are preparing to test in court(s) the earlier decisions regarding the offshore króna, i.e. either a haircut in an auction or a lock-in with 0.5% interest rates, effectively negative in Icelandic context and no expiry date. Nor does the comparison with Argentina seem to cause worries in Iceland.

Easing out of the capital controls is obviously a hugely important step for Iceland. Yet, it has mostly gone unnoticed in the media. The reason is that people normally haven’t noticed the controls except in minor things like having to bring a flight ticket in order to buy travel currency. For those running companies it’s been a different story, the controls have both been annoying and harmful. Measuring losses due to capital controls isn’t easy but in 2014 The Icelandic Chamber of Commerce estimated it to be ISK80bn annually. As the CBI and others have frequently pointed out the longer controls remain in place the greater the harm.

The CBI has put in place safety measures re foreign inflows. Some claim this means that controls are still in place but that’s certainly not how I see it. By 2012 the CBI had already announced in a report, Prudential Rules Following Capital Controls, that as well as lifting capital controls the bank would also develop financial stability rules in order to temper foreign inflows if needed, much like other countries with have done such as Asian countries under similar circumstances.

Collapse measures out, political distrust in

Alors, after almost eight years with capital controls Iceland has now almost entirely graduated from that part of the banking collapse, certainly a significant step towards normality. The question is still if the second measure, i.e. re offshore króna holders, will come back to haunt the country.

Though the emergency measures from 2008 have disappeared over the years politically the collapse still looms large in Icelandic politics. It’s not that the collapse itself is frequently discussed, not at all, but it shapes the hues and colours of the political debate. Quite specifically, the collapse has inter alia stoked distrust in politicians both in general and in certain politicians, due to their stories, still looms large. Icelanders are willing to throw their trust on new parties, next to be tested in the coming election.

One obviously prudent measure not introduced in Iceland is the separation of retail and investment banking. Three governments have ignored doing this, meaning that there is probably a silent political will to sell Landsbanki and Íslandsbanki without this safety measure. Hugely indicative of the influence of powerful private interests, quite worrying for the public interest.

Now, mostly free of restraining controls the Icelandic króna, the currency of the world’s smallest independent economy with own currency, will again be free (with the safety jacket of financial stability rules) to float in the large ocean of international finance. Trying times await booming Iceland, testing if the right lessons were learnt in 2008.

*Here is an earlier blog on the offshore króna problem and potential litigation; here is the latest one on offshore króna holders and their US political contacts.

Fitch has downgraded “Iceland’s Long-Term Local Currency (LTLC) IDR to ‘BBB+’ from ‘A-‘. The Outlook is Stable.” – The downgrade results not from Icelandic conditions but are due to changes Fitch has introduced to reflect regulatory changes, see here.

Follow me on Twitter for running updates.

Capital controls and legal risks: major concern last year, ignored now

In the months leading up to the June 2015 plan on moving the three banking estates out of capital controls minister of finance Bjarni Benediktsson was adamant about avoiding legal risk. Indeed, that plan was only announced once the creditors had agreed to a haircut on the estates’ króna assets. The new Act on the offshore króna raises some legal issues as two of the four funds holding the lion share of these assets have pointed out in a letter to Alþingi. Intriguingly and contrary to last year, Benediktsson and the Central Bank of Iceland now seem to be intensely relaxed about legal risk though this time, contrary to last year, it really is the state that is the counterparty.

There has been little debate in Iceland regarding the offshore ISK and measures to lift controls on its owners. Certainly, the numbers are fundamentally different from when these offshore ISK, i.e. owned by foreigners (individuals or entities registered abroad; can in theory be Icelandic and are in some cases) caused the introduction of capital controls in November 2008. At the time these assets amounted to 44% of Icelandic GDP; now they amount to 14% of GDP or ISK319bn.

The largest part of the offshore ISK is owned by a few large institutional investors, two of them being Autonomy Capital and Eaton Vance. The underlying assets are Icelandic sovereign bonds and T-bills, meaning that the counterparty here is the Icelandic state.

As with creditors last year there have been meetings between the large offshore ISK owners and Icelandic representatives of the ministry of finance and the CBI. Contrary to last year, when nothing was done until it had been negotiated with the creditors of the estates, no agreement was reached before the new Act was passed in parliament this weekend.

Officials met with representatives of offshore ISK holders yesterday in New York to inform them of the new measures.

The state sure will pay its debt or… maybe not

Last year, creditors to the estates agreed to roughly a 75% haircut on the estates’ ISK assets. This outcome came as no surprise but had been more or less foreseen for the last several years, based on the Icelandic current account: this is what Iceland could manage without upsetting financial stability.

Hawkes among Icelandic officials have been adamant that offshore ISK owners should endure a similar fate. That however goes against the rule that a state pays its debt in full. At a hearing in the parliament’s economy and trade committee a CBI official underlined this fact: the sovereign will pay its debt.

This is clearly what the funds owning the offshore ISK have literally been banking on: the state is its counterparty and a state pays its debt.

Two options: ISK220 for a euro or deposit at negative rate

The new Act (English translation of the Bill) stipulates that offshore ISK holders can participate in an auction where the reference exchange rate will be ISK220 for the euro, more than a third higher than the present onshore rate of ISK140.

There was a meeting in New York yesterday, where the measures were explained. Clearly, a higher participation in the auction would lead to a better price (creating a version of “prisoner’s dilemma”…) but the funds might also calculate that they were better off heading to court.

If an auction doesn’t tempt them the assets will be turned into a “Central Bank of Iceland certificates of deposit: Debt instruments issued by the Central Bank of Iceland to deposit money banks that hold offshore króna assets in accounts subject to special restrictions.” This debt instrument has no maturity, interest rates are set at 0.5% but will be reviewed annually. Needless to say, 0.5% in Iceland is negative interest rates, well below inflation.

Effectively, the offer is either a haircut of more than a third of the assets or a lock-in at negative interest rates for unspecified time.

If the haircut was meant as a carrot compared to the lock-in stick, offshore ISK owners might well keep in mind the CBI official’s words that the sovereign was of course going to pay its debt in full – and simply head for the courts.

Property rights and human rights

Over the weekend, Eaton Vance and Autonomy sent a clarification of their stance to parliament (here, in Icelandic). The funds protest the Bill defines all offshore ISK as being “potentially more volatile than other króna-denominated assets, as the latter are subject to a home bias.” This does not at all apply to the funds, they claim since they have already shown a preference to being long-term investors in Iceland, i.e. they are willing to buy Icelandic bonds and T-bills.

In addition, they point out that considering growth and good state of the Icelandic economy, the present offer can’t be justified by hardship, as emergency measures following the banking collapse in October 2008.

Furthermore, the funds see their position as being strong since a partial payment would amount to a credit event, thus putting the state into default, with all the unpleasant consequences involved – a potentially expensive experience for Iceland, both the state, public institutions and companies.

There is a “Provisions of the Constitution and the European Human Rights Convention” in the Bill, stating that the “recommendations in the bill of legislation have been drafted with the aim of maintaining compliance with the Constitution and the European Human Rights Convention, particularly as regards protection of ownership rights and prohibition of discrimination.” – The funds clearly disagree and consider these provisions to be inadequate.

A legal risk but so what…

One view heard from one of those involved on the Icelandic side is that the measures are clearly close to the margin of the possible and postulate a clear legal risk. However, there was no need for Icelandic authorities to pay any special attention to problems the offshore ISK holders might identify, according to this source. Yes, the offshore ISK owners could now decide to challenge the Act but perhaps they had already had enough of wrangling with Icelandic authorities and might just be ready to call it a day. And anyway, an Icelandic court is unlikely to rule against the parliament, states the source.

That is certainly one way of seeing the situation. What I find difficult to explain is why the minister of finance and other officials were so adamant last year about avoiding all possible legal risks, by beforehand securing the creditors’ support to the plan to lift controls for the estates – but are now apparently intensely relaxed about possible legal risks and the pretty obvious invitation to a legal challenge.

All the more surprising since the creditors to the estates had known for a long time that they would only get part of their ISK assets whereas the offshore ISK owners are certainly counting on the state paying back and in full.

Could the Act be only a stick (as was the “stability tax” last year), are talks still going on? That’s one version and an Act of law can certainly be changed. That said, I still find the Act looking surprisingly like a final act if the intention is to explore further avenues with offshore ISK holders.

Reputation risk and “those in the cage”

At a public meeting on the offshore ISK in 2013, some of those present argued that the solution to the Icelandic current account problem was just to cage in the foreign-owned assets so capital controls could be lifted on the domestic part of the economy. Present at the meeting was CBI governor Már Guðmundsson who pointed that when new investors would then arrive in Iceland they would see the cage and ask who was in it. “The investors who invested in Iceland last time around.”

This doesn’t seem to be the most alluring introduction to Iceland but that is none the less what seems about to happen: offshore ISK holders are being offered a cage, unless they prefer fleecing.

Icelandic officials will clearly have Icelandic interests at heart. Last year, it seemed that these interests were best safeguarded by negotiating an outcome with creditors so as to secure a full harmony in the outcome and execution. With the offshore ISK the same officials seem to act in the certain belief that the state can dictate an outcome it wishes, with no need to pay any special attention to those who lent money to the state and who are also willing to continue lending. It will take some time before it’s clear if this is a sound judgement and what the possible reputation risk will be.

Update: here is further information from Ministry of finance on the new Act.

Follow me on Twitter for running updates.

Plan to lift capital controls: crunching the numbers… again

In the case of Glitnir there was a retrade – the numbers have been renegotiated since the June plan. The government has talked effusively about clarity and transparency in liberalising capital controls but the process of introducing such a plan has been characterised by obfuscation and opacity. The plan seems sensible but earlier promises by the prime minister’s party, the Progressives, of gigantic windfall seem to have pushed the government to play a game of make-believe, smoke and mirrors. Selling the banks will prepare for the coming years: drumming up the fear of foreign investors masks the fact that the greatest danger is the mind-set of the boom years.

The press conference October 28, to introduce the assessment made by the Central Bank of Iceland, CBI of the draft proposals from Glitnir, Kaupthing and LBI, was a very low-key event held at Hannesarholt, a small culture house in the centre of 101 Reykjavík – nothing like the hugely publicised and carefully staged June event at Harpan, the glass palace by the harbour.

In June, when the plan to lift capital controls was formally introduced, the emphasis was on the large funds, altogether ISK850bn or 42.5% of Icelandic GDP, which could be recovered by the planned stability tax. There was albeit to be some deduction, the number was closer to ISK660bn but yet, the tax was the thing and the numbers astronomical.

Already then, it was heard from all directions that in spite of the tax rhetoric, minister of finance Bjarni Benediktsson was not keen on the stability tax. He preferred a negotiated stability contribution, seeing it as best compatible with his goal of the least legal risk and taking the shortest time, as the International Monetary Fund, IMF, also recommended.

Lo and behold, the CBI now recommends stability contribution, as governor Már Guðmundsson presented last week (full version in Icelandic; a short one in English) firmly supported by Benediktsson at last week’s press conference. The stability contribution mentioned is ISK379bn but plenty of numerical froth was whirled up, as so-called counter-active measures, pumped up to a sum of ISK856bn, no doubt meant to trump the tax of ISK850.

With the booming Icelandic economy luckily there are strong indications that the economy can well cope with the measures planned; getting rid of the controls will be a big leap forward for Iceland. What leaves a lingering irritation is the illusion and mis-information used, no doubt to make the Progressive party’s election campaign promises look less outrageous now that the plan goes in an entirely different direction compared to its earlier promises.

A bank or two

Due to the toxic legacy of Icesave, the Left government (2009-2013) was forced to take over the new Landsbankinn. What now came as a surprise was to see the government accepting to take over Íslandsbanki as part of the Glitnir solution.

Clearly, Glitnir with its large share of ISK assets was always going to be a tricky situation to solve but well, this turn of event was a surprise.

Until the announcement, Glitnir’s winding-up board, WuB, had bravely tried to convert its largest Icelandic asset, Íslandsbanki, into foreign currency by selling it to foreigners paying in foreign currency. Time and again there was news about an imminent sale, to outlandish elements – Arabic and Chinese investors were mentioned.

Cough cough, getting such investors accepted as fit and proper by Icelandic authorities was never going to be trivial though getting the Icelandic political class agreeing to foreign owners was a no less daunting task. After all, Iceland is the only European Economic Area, EEA, country where the banks are entirely under domestic ownership.

It is still unclear what the price tag on Íslandsbanki is. At first I understood that the bank would be acquired for a fraction of its book price of ISK185bn, of which Glitnir owns 95%, ie. ISK176bn. Now I’m less sure; apparently the price might be as much as ISK164bn.

Glitnir number crunching

According to previously published information, the stability contribution amounted in total to ISK334bn. The recent changes to the Glitnir contribution are not entirely easy to decipher.

As I pointed out earlier the new Glitnir agreement was indeed a retrade since Íslandsbanki was unable to honour previous plans. With the new plan Glitnir gives up 40% of the planned FX sale of Íslandsbanki, valued in ISK at ISK47bn as well as Íslandsbanki dividend of ISK16bn, meant to be paid in FX, in total ISK63bn. In return creditors are allowed to exchange more ISK into FX than earlier planned.

This seems to rhyme with the Ministry of finance press release: “According to the above-described proposal, the transfer of liquid assets, cash, and cash equivalents will be reduced by 16 b.kr. because of the proposed foreign-denominated dividend to Glitnir, which will not be paid, and 36 b.kr. due to other changes provided for in the amended proposal from the Glitnir creditors.”

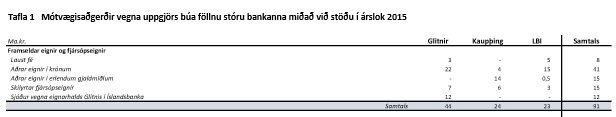

(From the Oct. 28 Icelandic CBI report; counter-active measures related to the estates of the three big banks, at end of 2015; 1. line Cash; 2. Other ISK assets; 3. Other assets in FX; 4. Cash-sweep assets)

The interesting thing is that the CBI report seems to indicate that this has negative impact on the CBI currency reserve, by ISK51bn

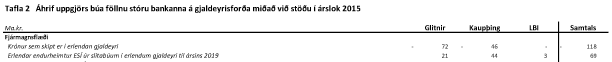

(From the Oct. 28 Icelandic CBI report; counter-active measures related to the estates of the three big banks, at end of 2015; 1. ISK converted into FX; 2. FX recovery by ESÍ, Assets held by CBI, from the estates, in FX until 2019)

Smoke and mirrors

It has been my firm opinion that since the estates, because of capital controls, can’t be resolved as a private company normally would, i.e. without a state interference, the outcome should be negotiated. This has now happened, a welcome and wise approach.

The smoke-and-mirrors events that the government has chosen in introducing the latest step towards lifting the controls is however neither wise nor welcome. Considering the emphasis in June on the stability tax the step taken now towards stability contribution can’t be said to be a logical step on from the June plan though an entirely sensible plan. Indeed, the June emphasis on the tax was a deviation from what Benediktsson seems to have intended for quite some while, i.e. a negotiated contribution and not a one-sided tax.

Value of Íslandsbanki v Arion

With news that investors are seeking to buy Arion it seems that the p/b in question is 0.6-0.8, where the lower estimate may turn out to be the more realistic one.

However, this is in stark contrast to the p/b that the state seems to be paying for Íslandsbanki, i.e. 0.93. Considering the banking sector in Iceland – probably still too big and still miraculously gaining from one-off legacy windfall – this price for Íslandsbanki would be nothing less than staggering and could well be seen as a total failure on part of those negotiating for the government.

Arctica Finance and Virðing – ties to politics and the past

It comes as no surprise that the pension funds are buyers in spe of the Icelandic banks. According to news in Iceland, it seems there are two finance firms – Virðing and Arctica Finance – vying for buying Arion. As could be expected, both have ties to politics and the past.

Virðing is run by ex-Kaupthing bankers i.a. Kaupthing Singer & Friedlander manager Ármann Þorvaldsson, owned by investors with various ties to the boom times and very active during the last few years. Arctica Finance was set up by bankers mostly from old Landsbanki, i.a. Bjarni Þórður Bjarnason, seen to be strongly connected to the Independence Party, Benediktson’s party. Unsurprisingly, both firma are courting the pension funds, the source of the greatest financial power in Iceland.

The really worrying aspect here is that the pension funds have all clung religiously to their mantra of being non-interfering non-active owners. During the boom years the pension funds were closely aligned with the banks and in the end lost heavily because of these ties and their unquestioning and uncritical attitude to the banks. There were clear indications of clustering: certain pension funds seemed particularly close to certain banks and certain large shareholders.

The billionaire-makers of Iceland: the pension funds

In most countries such ties exist to a certain degree but in Lilliputian Iceland these ties of friendship, kinship and political ties, border on the incestuous.

If we are now seeing these old ties revived among owners of one or more banks Iceland is set for round two of running the banks as during the boom years: with a chosen group of what I have called “preferred clients” and their fellow-travellers, i.e. clients who got collateral-light or no-collateral loans, who got bullet loans that were continuously rolled on, never classified as non-performing – and then all other clients who just got the professional scrutiny any normal person can expect from a bank.

Indeed, the pension funds are not only king-makers in the new Iceland but billionaire-makers. This has to a certain degree started, though on a minor scale so far: the pension funds are already investing with groups of investors who are doing very well from these ties. Clearly, investors chosen as the funds’ co-investors are pre-destined to do exceedingly well.

Indeed, the pension funds are not only king-makers but billionaire-makers.

The fight against foreign ownership – to control Iceland

This possible danger of the pension funds repeating past mistakes is compounded in an Icelandic-owned banking system with no foreign competition and no foreign ownership, a wholly exceptional situation in Europe.

Seen from this point of view it is utterly fascinating to notice that many in power in Iceland, both in politics and business, have for decades fought with all their might against foreign ownership of banks or any sort of important businesses in Iceland – and still do.

From the point of view of these old bastions of power Iceland needs to be connected to the outer world but only to the degree that Icelandic entities can make use of connections abroad, not the other way around, i.e. no foreign ownership in Iceland. Needless to say, these powers fiercely oppose closer connection to the European Union – nothing more than the EEA, thanks!

The fight to link with the pension funds and to buy banks is the latest apparition of interest politics in Iceland: it is a battle of the soul of Iceland and the weapons are fear of foreigners and foreign ownership though the real danger is entirely domestic: the danger of the same mind-set that ruled the banks during the boom years and eventually pushed them off a cliff in October 2008.

Follow me on Twitter for running updates.

Capital controls and political rumblings

With the June plan on lifting capital controls the Icelandic government had finally managed to agree on a way out of controls or rather, the two government leaders had. But the implementation still left a room for disagreement. A recent letter to the governor of the Central Bank from the In Defence group, active during the Icesave debate and close to prime minister Sigmundur Davíð Gunnlaugsson showed unease among a certain faction of Icelandic politics. A delay in publishing the CBI’s Financial Stability report, scheduled for October 6, including a summary of the so called “stability contribution” indicates that something has been brewing. – The question is how deep this disagreement runs and if there still are political obstacles to be overcome.

Although strongly denied all along that there was any difference of opinion, the comments on lifting the capital controls from prime minister Sigmundur Davíð Gunnlaugsson and minister of finance Bjarni Benediktsson pointed in different directions. Benediktsson stressed solutions that would take the shortest time and steer clear of legal risks whereas Gunnlaugsson emphasised the funds the state would acquire. The difference was ironed out in June when a plan to lift capital controls was presented.

At the presentation all the emphasis was put into presenting the “stability tax” – and later a law on that tax was passed. However, following talks with creditors of the failed banks an agreement on “stability contribution” was what the creditors wished for, as did those who wanted to avoid legal wrangling and a stalled process to lift the capital controls.

In a recent letter, the In Defence group (set up by individuals opposing the attempt by the left green government to reach an agreement with the British and Dutch government) indicated that the stability tax would be better solution than a stability contribution. The letter was addressed to Már Guðmundsson governor of the CBI, who has already answered the group, clarifying the bank’s position.

October 6, the CBI Financial Stability report was due to be presented (including a summary of the stability measures and the plan for lifting the capital controls; only a summary of known facts, nothing new as far as I understand) but at the last moment the publication was postponed.

The CBI explanation was that there had not been enough time to present the stability contribution as expected, i.a. to the Alþingi economics and trade commission. According to the CBI there had been a last minute addition to the report, which still needed to be presented to the minister of finance. Interestingly, there is no date as to when this could happen.

Creditors of the estates of the three largest failed banks have recently agreed to what they are due to pay in stability contribution: Glitnir ISK200bn, Kaupthing ISK120bn and Landsbanki ISK14bn, in total ISK334bn. The tax would probably be just between ISK600 and 700bn.

In terms of practicality the difference is i.a. that the contribution is already agreed on whereas the tax is not and would most likely be disputed, causing further delays for Icelanders in escaping the capital controls. When the plan was presented in June it sounded as if there were two equally viable routes: a high tax or a lower contribution.

This was rather unfortunate since the debate in Iceland is now evolving in the direction of “why accepting a lower contribution when a higher tax can be harvested?” – A very misleading question, originating in the June presentation, again an attempt to paper over what seems to have been an unsolved disagreement all along.

As the Icelandic economy has been doing well, there were viable solutions to lifting the controls and these were put forth in the capital controls plan. As Benediktsson has stressed, the plan would provide the final solution to the problems keeping the controls in place. The wobbles now will test Benediktsson’s grip of things.

The question is if the In Defence letter is a sign that the group’s earlier close ally, the prime minister, is having doubts about the agreement with creditors. His party has a strikingly low following in polls, ca. 11% compared to 24% in the 2013 elections. It has been clear for a long while that now the economy is doing well the greatest risk regarding Iceland is political risk – and it still is.

Follow me on Twitter for running updates.

Iceland and capital controls: … and then there was a plan

The waiting for Godot turned into a theatrically staged presentation at Harpa by the prime minister and minister of finance, assisted by their two main Icelandic experts. The grand plan to lift capital controls has now seen the light of day. If realised as planned the future looks bright for Iceland. But there are still political risks until the planned good deeds are indeed done.

Here are the main points of the new plan: the size of the problem is ISK1200bn, $9bn, ca. 60% of Icelandic GDP where ISK300bn, $2.2bn, is the original overhang from October 2008 (mostly carry trade funds, which flowed to Iceland in the years before the collapse) and then ISK900bn, $6.7bn, in the estates of the failed banks: ISK500bn, $3.7bn, is pure ISK assets, ISK400bn, $3bn, is debt paid in FX by Icelandic entities.

According to the new plan, there are “non-negotiable stability conditions” the estates of the three failed banks have to meet. These conditions are defined in the plan, but not spelled out in króna. On the basis of these conditions the estates have to pay a “stability contribution,” as part of the composition agreement; again, the amount of the contribution is not stated.

The composition agreement has to be in place by the end of the year. If not, the estates will be forced into bankruptcy and will then have to pay a 39% “stability tax,” a one-off tax, of ISK850bn, $6.3bn, due on 15 April 2016. However, there is a deduction to the tax, meaning it will be, according to the presentation, ISK680bn, $6.3bn.

This is all stated in the plan – but in interviews afterwards Bjarni Benediktsson minister of finance the contribution, which he aims at and not the tax, will be ISK500bn.

The rhetoric used implied that the state could, on the basis of emergency and imminent danger, overrule private property rights, i.e. of the creditors. This sounded somewhat bombastic given that Iceland is a thriving country and well capable of solving the problems related to the foreign-owned ISK. Also, there was emphasis on solving the problems for the “real economy” – all of this was interesting, clearly used to create a sense of the danger the government is averting with its plan. This is the rhetoric in the world of staged politics and the Icelandic government is no exception here (except that its spin is always rather visible, i.e. not very professional as good spin should be invisible).

According to the presentation “For seven years there were no realistic proposals from the estates” – given the fact that Glitnir and Kaupthing presented their composition draft in 2012 and 2013 and have waited for answers and clear guidelines this is again part of the rhetoric. The government’s tactic has so far been like inviting the creditors to a game of dart without telling them where the dartboard was.

The numbers

As already explained, I doubt the size of the problem as related to the estates: I estimate it being ISK500bn, not ISK900bn. The higher number is, as far as I can see, again to underline the danger and justify the means. But again, this is part of the staged performance; the numbers were flashed up again and again.

Will the stability contribution be ISK500bn? From calculations I have seen the likely contribution is in the range of ISK300bn to ISK420bn, $3.1bn, – reaching ISK500bn does not seem likely. The contribution will be paid over time, most likely two to three years. It depends on values of assets etc that change over time, therefore the uncertainty. Further insight into the numbers can be gauged from the letters received from the three estates, see here. Whatever the estates agree to 60% of creditors have to vote for it.

A tax of ISK682bn, $5bn, as stated in the press release, is also, as far as I understand too high a number; ISK620bn, $4.6bn, would be more likely.

The old overhang will be resolved by the CBI in the classic way of auctioning and offering long-term bonds, no surprise there as this plan is already on-going.

Tax (= stick) or contribution (= carrot)?

What does the government want, a tax or contribution? Interestingly, the tax was the main focus of the presentation and little time and attention given to the contribution. The same in the press release, where composition and contribution is merely mentioned en passant whereas the tax is spelled out in great detail.

This however seems to have been part of the show. I understand that the advisers are wholly on the side of composition and contribution, as are the creditors. The emphasis on the tax would then be wielding the stick to make sure the creditors go for the carrot (another matter if a stick was needed).

While emphasising tax and bankruptcy, the refrain was that the capital controls liberalisation is NOT a money-making scheme for the treasury but to lift the controls and nothing else.

The government’s chief negotiator Lee Buchheit also stressed this aim to the Icelandic media but he did put a number on the outcome. His number was ISK650bn, $4.8bn, (see here, at 9:55 min; the number comes up at 15:49) in spe for the government. As far as I can see, an unrealistically high number, closer to the tax, which no one officially wants, than the desired contribution.

Buchheit had earlier mentioned another thing: that lifting the controls would take a short time, only about six years. This may not be what most people understand as “a short time” but it is a realistic time frame: it will take some time to carry out this plan.

In spite of the emphasis on giving priority to the “real economy” easing of controls for people, businesses and pension funds will only come later. On this, the presentation gave no dates. According to my sources, new Bills in parliament coming autumn or winter will clarify this issue.

Moral hazard and political risk

In spite of the government rhetoric of big funds to come, the debate in Iceland has mostly been characterised by relief: at last a plan, which seems realistic. The opposition has embraced it, pointing out that this is very much what had always been the plan.

There have been some voices asking why Greece and Argentina are struggling with their creditors while Iceland has so effortlessly negotiated with its creditors. The answer is of course that creditors in Iceland are not creditors to the state, contrary to Greece and Argentina, where the problem is sovereign debt; not the case in Iceland.

As stated earlier it is clear that the government aims at composition and contribution, not tax and bankruptcy. There is however always a political risk and the possibility of panic politics. The Progressive party has fallen from 25% of votes in the election in 2013 to 9% in the opinion polls in spite of successfully carrying out the promised “debt correction.”

The party very much got elected on the basis of its promises to fight the “vulture funds,” mentioning ISK800bn days before the election after talking about “only” ISK300bn to ISK400bn. And this was a promise of funds right into the state coffers, not to pay down sovereign debt as is now the plan; a plan that might annually free up ISK30bn, $200m to ISK40bn, $300m, otherwise used on interest payments.

The government had been adamant about not negotiating with creditors. Since talks have been going on over the last months the government has now defined these as “conversations,” not negotiations. No matter the word used it is clear that the largest creditors agree to the plan – and what they agree to is the outlined composition. Tax is a different matter.

For some reason, the old Roman saying “Pacta sunt servanda” has never quite reached Iceland. Icelanders and Icelandic governments over decades have repeatedly understood agreement made as being only valid until they have a different idea as to what they want. This will now again be tested.

Could the composition fail if an agreement on composition is not in place by the agreed deadline at end of the year? My understanding is that this is not likely: if needed, the deadline will be extended but that would of course only happen if things are moving in a realistic way.

Having had their patience tested over the last few years, creditors and the winding-up boards are no doubt both eager and well-prepared for the coming negotiations. Unless there will be a political itch to pick a fight, serving either political interests and/or special interest groups, things could look really bright in Iceland by the end of the year, otherwise the darkest time in Iceland.

Follow me on Twitter for running updates.

Lifting capital controls – in a hurry

There were negotiations and changes until last minute. So much, that the various press releases published after the presentation of the plan to lift capital controls do not have the same numbers as to the percentage of a possible tax.

The tax percentages agreed on, as far as I understand, in negotiations with representatives of creditors is the one published in the press releases referring to Kaupthing, Glitnir and LBI:

The Task Force’s preliminary analysis suggested that to achieve the goal of neutralizing a threat to the balance of payments, this Stability Tax would be set at a rate of 37% of the total assets of each estate (measured as of end-June 2015), with an automatic exemption of ISK 45bn for each estate, which would bring the effective tax rate down to about 35%.

Tax of 37%, de facto 35% after exemption, on the assets as they are at the end of June this year – was then changed and the automatic exemption was removed. The changes were the tax as it was presented at the press conference and in a general press release following the presentation:

A new bill of legislation on a stability tax imposes a one-off 39% tax on the total assets of the failed commercial or savings banks in accordance with their assessed value as of 31 December 2015.

This indicates that the tax was in the end higher than had been negotiated with representatives of the creditors, who were not amused, or so I hear, when they saw the changes.

*I am writing this ca. 8 hours after the press releases have been published but this has not yet been corrected.

Follow me on Twitter for running updates.

Easing capital controls: Non-negotiable terms and national interests

In a heavily staged appearance, prime minister Sigmundur Davíð Gunnlaugsson told Icelanders that ISK850bn, ca 45% of Icelandic GDP would fall into the state coffers, used to reduce the public debt, not for pet projects as earlier announced. With

The size of the problem to solve amounts to ISK1200bn, i.e. this is the sum of ISK, in the estates of the banks and Glacier bonds etc., that cannot be converted to FX and therefore cannot be paid out to creditors right now. What amounts to ISK850bn, or 39% of the assets of the estates at the end of this year will have to be paid off in a stability “contribution” if composition is negotiated and then this amount will be reduced – or tax and bankruptcy if no composition, to fulfil what the government calls “stability conditions.”

Glacier bond-holders and others will either be able to take part in auctions in autumn or buy long-term bonds. All of this is done under the auspice of a phrase repeated over and over again: “National interests takes precedence over interests of private parties.” Here is the English press release, carefully worded and not very clear.

After dealing with this amount, pension funds and ordinary Icelanders will have greater movement. Some quick thoughts on some of the topics du jour:

Size of the problem:

It is clear that the ISK300bn (actually ISK290bn) of the remains of the old overhang (see my last blog before this one on the barest essentials) cannot be paid out in FX – so this amount is clearly a part of the problem. But this is already being dealt with and that action will now continue: the CBI will hold auctions in autumn and those ISK-owners can also buy long-term bonds to come, either in ISK of FX.

That leaves ISK900bn – and this is a more questionable size: ISK500bn (ISK507bn exactly) is the number I have been posting earlier as the size of the problem because these are ISK assets. The remaining ISK400bn are FX assets in Iceland, i.e. assets in Iceland paid off in FX, which I would think was a more debatable size but this is how the government defines the size of the problem.

Stability “conditions” – contributions and tax:

So the problem that needs to be solved amounts to ISK1200 – and by reducing it by 39% the rest can be paid out. Or that seems to be the calculation.

The conditions, i.e. the numbers, are non-negotiable, as was repeated again and again. If the estates negotiate a composition by the end of the year they do not pay a tax but a “contribution”: in fact the same numbers, i.e. 39% or ISK850 but – as far as I understand this will be some reduction so the amount will be ISK500-600bn.

If they do not negotiate a composition the estates go into bankruptcy and pay the full amount: 39%.

This leaves some angles since the ISK850 is well above the ISK500bn but not quite the ISK900bn and well, the ISK300bn is outside of this equation. How these numbers were found I do not know but well, this is how the non-negotiable numbers look like.

The non-mentioned dates

Apart from foreign creditors smarting from controls there are the Icelanders: here, pension funds will be able to invest for ISK10bn a year, more or less what they have asked for, until 2020, unclear from when. And ordinary people will at some non-mentioned date be able to feel liberalisation on certain transactions.

What will creditors do?

Some creditors have already been negotiating with representatives of the government so the plan is indeed not quite out of the blue. According to a Glitnir announcement today, 25% of their creditors agree to this.

Kaupthing’s situation is different, less ISK assets, which might mean that Kaupthing creditors will be less happy to pay. However, no chance to tell until there is an announcement. Everyone might be happy to see an end to this and possible payout in sight.

Either this will all go well, composition beckon and much good will. Or not and the future is legal wrangling in multiple jurisdictions for a decade, like in Argentina. Today, the Icelandic government has taken the country on a journey along a very narrow road above a precipice. If all goes well, everyone reaches the final destination on the other side and there will be much rejoice.

Follow me on Twitter for running updates.

Capital controls: the essentials

There are many misconceptions floating around regarding Iceland and capital controls. Here are the barest essentials:

Iceland introduced capital controls on November 29, seven weeks after the official collapse date October 2008. The reason was not money flowing out of banks, as in Cyprus but because foreigners, mostly those who had invested in Icelandic bonds, so called “Glacier bonds”, were converting their Icelandic funds into foreign currency, rapidly draining the none-too large currency reserves. At the time, these holdings amounted to 44% of GDP.

Over time, this original overhang of 44% of GDP has been reduced and now amounts to 16%. This is a process overseen by the Central Bank of Iceland, CBI, which has held auctions to match in- and outflows. The original overhang is further being worked on; the Central Bank of Iceland recently announced measures and more will come as part of a plan to lift capital controls.

The controls are on CAPITAL, meaning that capital, i.a. for investment can not be moved in our out of the country. This means that Iceland no longer adheres to the four freedoms of European Economic Area, EEA, i.e. freedom on goods, services, people and capital.

However, the controls are NOT on goods and services, meaning that money to pay for goods and services can move freely.

With time however another reserve of foreign-owned ISK has formed, i.e. ISK in the estates of the three failed banks. Since foreign creditors hold ca. 95% of the claims to these three estates the ISK assets of the estates are another pool of foreign-owned ISK, now ca. 25% of GDP. FX assets of Glitnir amount to 63% but the FX ratio in Kaupthing is 72%.**

These two pools of foreign-owned ISK holds the controls in place, which is why a plan needs to tackle both of them. As said earlier, the old overhang is already part of a process. What now needs to be tackled is the ISK pool within the estates of the three banks.

The simple and classic way to solve this kind of a problem (Iceland certainly is not the first country to face this problem) would be to negotiate with creditors on a haircut of the ISK assets in the estates. This is what the creditors have been hoping for and this is what the Icelandic government has not been willing to do.

The government’s reasoning has been that engaging with creditors was none of their business and could expose the government to legal risk. After all, the estates are of private companies, no relation to the state. However, the estates cannot be resolved unless it is clear how to deal with their ISK assets and since they cannot be taken out of the country the creditors cannot be paid out, i.e. the estates cannot be resolved. Which means that really, the government holds the threads, i.e. because it has put legislation in place regarding the estates and so, the government is already part of this equation.

Now it seems that the creditors will get some sort of an offer – maybe with a scope to negotiate, maybe only a take-it-or-leave-it offer. Remains to be seen until all the government’s cards are on the table, probably Monday afternoon.

What complicates matters is that the government seems to want not only to get a cut of the ISK assets but of the foreign assets as well. There is no balance-of-payment reason for taking foreign funds though the government refers to “stability tax.”

Further, the Icelandic capital controls are NOT a sovereign debt problem, such as lie at the core of the Argentinian dispute with creditors nor is it parallel to the Greek situation, another sovereign debt problem. And the Icelandic capital controls are not comparable to the Cypriot controls, which were put in place to keep money in the banks and prevent them from collapsing as funds flowed out.

*For data regarding the estates and capital controls see the latest CBI Financial Stability report.

**UPDATE: sorry, I wrote earlier that this was the ISK ratio – it is of course the FX ratio!

Follow me on Twitter for running updates.