Entangling the Jon Asgeir Johannesson’s sphere

The charges brought against Jon Asgeir Johannesson, formerly of Baugur Fame, and his closest business allies in Reykjavik and New York and the international freezing order from a London court all relate to an empire so complicated that it’s staggering that any one person could have commanded over it all. It kept an army of lawyers and accountants busy. Now it’s quite a task for the administrators of Baugur in Iceland and the UK, of other Johannesson related companies and for the resolution committees of the three Icelandic banks, as well as foreign creditors, to entangle the web, trying to understand how money and assets were moved around. In an interview some years ago the UK retail tycoon Sir Philip Green, whom Johannesson was no doubt trying to eclipse, said he had never seen anything as complicated as the companies related to Johannesson.

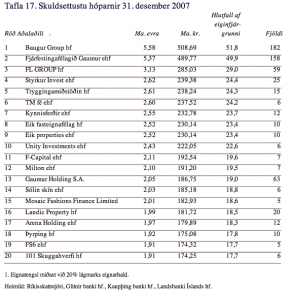

A table in the report of the Althingi Investigative Commission tells a striking story of the complicated web of companies. This table shows the most heavily indebted company groups at the end of 2007:

Out of these 20 companies 18 (!) are closely related to Johannesson:

Baugur, Fjárfestingafélagið Gaumur, FL Group, Styrkur Invest, Tryggingamiðstöðin, TM fé, Eik fasteignafélag, Eik properties, Unity Investments, F-Capital, Milton, Gaumur Holding, Sólkin skín, Mosaic Fashion, Landic Property, Arena Holding, Þyrping, 101 Skuggahverfi. Quite a number of accounts to sort out.

However, the column farthest to the right is interesting as it throws light on the structure of the groups in the Johannesson business sphere. It shows the number of companies related to these groups: 607 (!) companies are related to the 18 companies in the Johannesson sphere.

These loans, at the end of 2007, are not the whole loan saga since this covers only loans from the Icelandic banks. Foreign debt related to Johannesson’s companies isn’t included.* Add to that the fact that at the end of 2007 debt related to Johannesson personally was €1,5bn.

It’s clear that from early on Kaupthing was heavily and intimately involved in financing Johannesson’s companies. Landsbanki was also a diligent lender, not only to the companies but also to Johannesson’s private consumption, i.a. the flat at Gramercy Park where no collaterals were asked against a loan of $25m. Until lately, he seems to have had this flat for his personal use. And then towards the end it was Glitnir that was, according to the charges brought in New York, practically raided by Johannesson, ‘a convicted white collar criminal’ and ‘a cabal of businessmen’, his closest business partners.

The lingering question is how it was possible for one man to borrow all this money – it’s important to note that the loans were issued against a myriad of companies that by all means didn’t all do well but were continuously bought, sold, sliced and diced, sold and resold.

The continuum of quicksilver movements was one of the means to keep the merry roundabout going attracting ever more loans – and it’s now one of the reasons why it’s so time-consuming and complicated to entangle the web to figure out where the assets are and what the real status of Johannesson is. A lawyer close to one of the debtors told me that figuring out where his personal assets are is proving to be quite a task; it would be more simple if he were personally bankrupt but that’s not the case. Not yet, at least.

The sad thing is that all this money has mostly evaporated, not only because falling asset prices but also because the investments were simply not very clever. Johannesson didn’t turn out to be quite the business wizard made out to be: those who know him say he has an uncanny eye for retail – but he reached far beyond retail. The staggering trail of debt tells the story of lost opportunities and hubris. In an interview yesterday on Icelandic radio with Olafur Hauksson from the Office of the Special Prosecutor in Iceland Hauksson indicated the Johannesson’s affairs are now being investigated. Again, that is quite a task as the table above indicates.

*Earlier today, I had added the debt of the companies in the Johannesson sphere together. However, that doesn’t give a correct overview of the loan status since the loans do, in some cases, overlap.

Follow me on Twitter for running updates.

This actually answered my drawback, thank you!

golden goose

23 Oct 23 at 11:20 pm