Archive for 2010

The right to be wrong about Iceland (and any small country)

Now that Iceland has been more or less permanently in the eyes of the world for the last five years or so, acres of articles have been written about Iceland and radio and tv transmissions on Iceland could fill days and nights. Around and after the collapse of the banks the media interest was, for good reason, particularly intense. I read, listened and watched a good deal of all this. Almost without an exception there were factual errors and misunderstandings – yes, also in material from famous media and journalists. One of the more memorable ones was when one of the UK broadsheets quoted ‘the MP of Reykjavik,’ thereby transplanting the UK voting system to Iceland. There isn’t one MP for Reykjavik, there are several whereas each UK constituency has only one MP.

I can’t say that these mistakes irritated me much, plenty of erroribus around. Journalists are often in a hurry, deadlines have to be met and editors kept calm. It did however make me more alert to the fact that news reporting from small faraway places may quite often contain errors and misunderstandings. That’s the inequality of size and importance: the more important the country is in the eyes of the world the more likely it is that the news coverage of it abroad is more or less correct: there will more knowledge on it in the news rooms and also among the general audience and readers who will complain of mistakes and errors.

On the whole, these errors in the reporting of Iceland usually didn’t have much influence. But much worse than media mistakes are the errors and misunderstandings coming from ‘experts’ such as foreign economists who now and then take a look at Iceland, fit it into their grand scheme of thinking and then declare that the solution for Iceland is this or that or somehow advance their theories with often the wrong/misunderstood facts about Iceland. These ideas would often find their way into the Icelandic media and be hotly debated – even though they were based on wrong numbers and facts.

Earlier this week the Nobel Prize winner in economics Paul Krugman went to a conference in Luxembourg where he listened to an interesting lecture on Iceland, by two Icelandic social scientists, on the income distribution in Iceland: ‘The Income Inequality in a Bubble Economy.’ The academics, Stefan Olafsson and Arnaldur Solvi Kristjansson, have written on this issue for years. One of their more interesting findings is that the bubble years concentrated wealth with an even smaller segment of society than before. Wealth concentration is one of the things that most clearly divides Iceland from the other Nordic countries where income equality has been much greater than in Iceland.

This prompted Krugman to write a blog where he pointed out the conclusions of Olafsson and Kristjansson but saw a further twist in the tale: Iceland had, according to Krugman, massively devalued its currency and Krugman holds this up as an example to Eurozone countries going through misery and austerity. Here, Krugman gets it dismally wrong, Iceland didn’t devalue, the currency just dropped like a stone. And there’s further a whole string of other wrong conclusions on what Iceland might teach the rest of the world. The Icelandic economist Jon Danielsson, lecturer at the LSE, dissects Krugman on his blog today, concluding that Krugman couldn’t be assigned a higher grade for this piece of writing than an F.

The morale of this story isn’t that Icelandic economists, or Icelanders, are always right. It’s just that when it comes to small countries (or exotic topics) it seems permissible to express opinions without knowing very much – or even anything at all.

Follow me on Twitter for running updates.

Where are they now?

‘Iceland was bankrupted by twenty or thirty men.’ That’s how Vilhjalmur Bjarnason lecturer at the University of Iceland and a vocal commentator on finance and business put it a few months after the collapse of the banks in October 2008. At first, many felt that Bjarnason was overstating his case but time – and most clearly the report of the Althingi Investigative Commission – has shown that it did indeed only take ca thirty people (almost all male) to bankrupt Iceland.

Most Icelanders will be able to list these thirty odd names. These are the bank managers, the banks’ chairmen and the banks’ principal shareholders. The understanding is that the Office of the Special Prosecutor will in due course most likely bring criminal charges against these people. The banks’ resolution and winding-up committees are already bringing charges or planning charges against these people to claw back the money extracted from the banks by illegal means.

All these people were extremely prominent and visible in Iceland in the years up to October 2008. They sponsored art, culture, sport and charities and appeared frequently in the media. Some of them gave interviews in the weeks and months after the collapse but as more light was thrown on the operations of the banks and their shareholders they have become increasingly silent. After the report, little is heard from them – there isn’t much to say now that the report has spelled it out so clearly what went on, including verbatim sources such as emails. Some of this material contains phrases that everyone in Iceland now knows by heart such as ‘Thank you, more than enough:-)’ – the succinct answer from Magnus Gudmundsson director of Kaupthing Luxembourg when Kaupthing’s executive chairman informed him, in equally few words, that his bonus for 2007 would be €1m.

From being feted and admired these people are now generally despised in Iceland. There are stories of theatregoers unwilling to stand up to let them to their seats at the theatre, guests at restaurants driving them out, passengers accosting them as they waited for their luggage at Keflavik airport. There are even stories that they have been hit or spat on, on the streets. People threw snowballs at Jon Asgeir Johannesson when he left his wife’s hotel in Reykjavik during the winter following the collapse of the banks.

No wonder that many of them prefer to live abroad. There have been rumours lately that some of them might want to move to Luxembourg but sources close to a well known Luxembourg bank claim that some of the more famous names have already been turned down as clients. And in order to properly settle down in Luxembourg one has to register with the police. People then do have to declare if they have an earlier conviction or if they are under investigation – not a trivial question for some of the Icelanders who might be considering to move to Luxembourg.

For most of these people the yachts and private jets are gone. Some are bankrupt other still hold on to some assets though more might be lost later on. In Iceland, many speculate if and then how much these people have stacked away on in offshore save havens. But where are they now, the bankers and the Viking raiders?

Kaupthing

When Sigurdur Einarsson ex-executive chairman of Kaupthing was summoned to Iceland in May to be interviewed by the OSP in Iceland he refused to go to Iceland since he didn’t want to risk following three Kaupthing ex-top executives into custody. He probably didn’t expect that he would end up on Interpol’s wanted list – but that’s where he’s now. Einarsson isn’t known to have been involved in any business after the collapse of the bank and has been living in London since 2005. According to the AIC report Kaupthing lent Einarsson the £10m needed to buy his house in Chelsea – and then Einarsson rented his house to the bank so he could live in the house, apparently an exceedingly smart way of living for free as the rent paid or didn’t pay off the mortgage.

Kaupthing’s CEO Hreidar Mar Sigurdsson moved to Luxembourg last year to run Consolium, a consultancy staffed by several ex-Kaupthing managers. Sigurdsson was held in custody for ten days in May as the OSP picked through his testimony and some of his colleagues’. Sigurdsson is now back in Luxembourg.

Magnus Gudmundsson was the director of Kaupthing Luxembourg where some think that Kaupthing’s darkest secrets, if there are any, were kept. When David and Jonathan Rowland, father and son, took over Kaupthing Luxembourg last year and turned the good bank into Banque Havilland and put the bad assets into Pillar Securitisation that Havilland administrates, they retained Gudmundsson as a director, much to the surprise of those who thought that the new owners wanted to start with a clean slate and a new business. When however the OSP put Gudmundsson into custody the Rowlands dropped him like a hot potato. Consolium had business ties with Havilland and Pillar and according to my sources these ties are still in place.

Olafur Olafsson has a longer business record than most of the other high-flying Icelandic bankers and businessmen since he’s older than most of them. He grew up when political ties were essential and his fortune was tied to the Progressive Party and the co-op movement, part of the Progressive sphere of influence. From Kaupthing’s first ventures during the late 90s he was close to them, underlining that bank’s connection to this party.

The softly spoken cultivated Olafsson wasn’t much seen in Iceland during the noughties but he had and still has a charity there. He used to have an office in Knightsbridge and lived close by. Last year he moved to Lausanne. According to a Swiss source he lives modestly. The SIC report is full of juicy stories of Olafsson – there’s his connection to the Qatari investor al Thani who seemed to have the greatest trust and belief in Olafsson’s two main undertakings in Iceland, Alfesca and Kaupthing. But according to the report there was less trust and more loans from Kaupthing. Through Kjalar Olafsson owned 10% in Kauphting but still holds on to companies in Iceland, most notably the shipping company Samskip. The Kaupthing loan overview from end of September 2008 indicates that Olafsson’s personal loans from Kaupthing Luxembourg were €49m.

Until shortly before the collapse of Kaupthing brothers Lydur and Agust Gudmundsson, the bank’s biggest shareholders, were seen as being of a different breed from Viking raiders such as Jon Asgeir Johannesson and Thor Bjorgulfsson. The brothers started in fish manufacturing during the 90s, seemed to have built their wealth up out of concrete things and not only financial acrobatics. But the report throws a different light on their activities, their close if not incestuous connections with Kaupthing and equally close ties to many of the bulging Icelandic pension funds. Robert Tchenguiz sat on the board of Exista.

Lydur owns a beautiful house in Reykjvik where he hasn’t been much seen lately and a grand house on Cadogan Place that Pillar now wants to take over due to unpaid mortage of £12,8m. It seems that Agust might suffer the same fate – Pillar isn’t showing any mercy and according to the loan overview Agust had a mortage of €9m with Kaupthing Luxembourg. As Olafsson the brothers still hold on to companies in Iceland, most notably the investment company Exista and the food company Bakkvor UK – but the final outcome is still unclear.

Landsbanki

Father and son, Bjorgolfur Gudmundsson and Thor Bjorgolfsson, shot to fame in Iceland when they managed to set up a brewery in St Petersburg in the 90s. The story of that venture is most fully told in a front-page article in Euromoney November 2002, ‘Is this man fit to be at the helm (of Landsbanki)?’ and in documents on Wikileaks: the short version is that father and son were working for two investors running a bottling plant in St Petersburg in the early 90s. One day in 1995 the investors found out they no longer owned the bottling plant though they couldn’t remember ever having sold the plant father and son and their co-worker Magnus Thorsteinsson. The venture took off and the St Petersburg power elite, i.a. Vladimir Putin, was friendly. Deutsche Bank started financing other Bjorgolfsson’s ventures in Easter Europe in the late 90s. When the trio sold the brewery to Heineken in 2002 they had the money to buy 40% of Landsbanki, then already partly privatised.

The distinguished-looking Gudmundsson is now bankrupt, having not only lost his share of Landsbanki but also his ultimate trophy asset West Ham and lives in Iceland. His son, with the body of a body builder and the square jaws to go with it, still lives in Holland Park though there might be fewer vintage cars in the garage now. It’s not clear if he still owns his country house in Oxfordshire but he is holding on to Novator, his investment company with ties to Luxembourg, the Cayman, Cyprus and other offshore havens. The fate of his biggest asset, Actavis, depends on what Deutsche Bank intends to do about the loan against Actavis, said to the single biggest loan on DB’s loanbook. The question is if DB turns the debt into equity, practically taking Actavis over, or if Bjorgolfsson manages to turn things to his benefit. Thorsteinsson was declared bankrupt in Iceland last year, used to have a large country estate in the UK but is now said to live where it all started, St Petersburg.

Landsbanki had two CEOs, Sigurjon Arnason and Halldor Kristjansson. Kristjansson was a civil servant before becoming the CEO of Landsbanki as it was being privatised. Arnason was the CEO of Bunadarbanki but when Kaupthing bought the bank he and a whole team from Bunadarbanki defected over to Landsbanki. Kristjansson kept the quiet demeanour of a civil servant, Arnason was the aggressive banker known to empty bowls of chocolate is within his reach. It’s interesting to note that Kristjansson kept his post after the privatisation, possibly underlining that the change wasn’t as fundamental as one might have thought – the political ties were still important. Kristjansson now lives in Canada, working for a financial company. Arnason lives in Iceland and is, as far as is known, not involved in any business.

Glitnir

While Landsbanki and Kaupthing were involved with high-flyers abroad Islandsbanki, later Glitnir, seemed more down-to-earth expanding in Norway. Bjarni Armannsson ran the bank with experience from the investment bank FBA in the late 90s. The AIC report shows that Armannsson was very deft at trading for his own companies along running the bank leading the report to advice clearer regulation of CEO’s personal dealings. Armannsson left the bank when Jon Asgeir Johannesson and the FL Group gang became the bank’s largest shareholder in early 2007. He moved to Norway for a while but has recently returned to Iceland and runs his own business there.

Earlier on, two brothers were among Glitnir’s major shareholder, Karl and Steingrimur Wernersson. Their father was a wealthy pharmacist and they, mainly Karl, built on that wealth which mushroomed into companies at home and abroad under their investment fund Milestone. Milestone bought into the Swedish financial sector, bought a bank in Macedonia and an Icelandic insurance company, Sjova, in Iceland. The crudeness and excesses of it all, i.a. a villa in Italy and a vinyard in Macedonia, have been masterly documented by the daily DV in Iceland. Milestone is bankrupt and the brothers are no longer on speaking terms as Steingrimur, who now lives in North London, has accused his brother of bullying him into business ventures. Karl lives in Iceland and spends most of his time on his farm in Southern Iceland where he tames and breeds horses.

The group that came to power and ownership in Glitnir was headed by Jon Asgeir Johannesson, famous his UK retail partners such as Sir Philip Green, Tom Hunter, Kevin Stanford and Don McCarthy. Johannesson started his business ventures by opening a supermarket with his father Johannes Jonsson who now lives in Akureyri. Jonsson is still involved in business though there a now more debts than assets to care for.

Johannesson has for years invested together with a small group of Icelandic businessmen, most notably Palmi Haraldsson, Magnus Armann and his wife Ingibjorg Palmadottir, herself the daughter of the man who built up the biggest retail empire until Johannesson arrived on the scene, bought the empire and later got the princess as well. These shareholders brought in a new CEO, Larus Welding who ran the bank for just over a year. Welding now lives in Northern London and doesn’t seem to be involved in banking anymore. Johannesson still owns the biggest private media company in Iceland. His ownership is the source of some speculation in Iceland since Baugur, also Baugur UK, and so many other investments of his have failed.

On the sideline in this group but for a while extremely powerful was Hannes Smarason, much admired as the McKinsey man who turned biotech to gold at deCode and later built up the investment fund FL Group that outshone everyone in excesses and, in the end, losses. Smarason lives in Notthing Hill, London and documents at Companies House show a string of failed business ventures of his.

The connection between Johannesson, Armann and Haraldsson goes roughly a decade back and though his Icelandic partners were less famous than some of his UK partners they stayed with him. Now they all and Palmadottir are charged by the Glitnir Winding Up Committee that wants $2bn dollars back. Haraldsson has two major investment companies, one is bankrupt the other is in operation and he still owns Iceland Express. Haraldsson has been living in Iceland but has a flat in Chelsea, London.

Johannesson allegedly lives with his wife in Surrey on the same road as Armann, yet again underlining not only the closeness of these two but also the Icelandic tendency to stay with one’s own countrymen. A clan mentality that also characterised the now failed Icelandic banks and businesses.

Follow me on Twitter for running updates.

Icelandic Tory ties: Rowland, Spencer and Yerolemou

David Rowland, the owner of Blackfish Capital UK, has been named the treasurer of the Conservative party. Through their ownership of Banque Havilland Luxembourg David and his son Jonathan are almost household names in Iceland. But there are other intriguing Tory connections to the Icelandic banks, notably Kaupthing.

David and Jonathan Rowland, or rather their investment company Blackfish Capital, took over the Kaupthing operation in Luxembourg last year and turned it into Banque Havilland. Havilland draws its name from the family’s Guernsey address, the splendid Havilland Hall. Father and son firmly deny any connections to the owners of Kaupthing but they held onto Magnus Gudmundsson until he was taken into custody due to the Kaupthing investigation in Iceland. The Rowlands have stressed that house searches at the former Kaupthing premises in Luxembourg earlier this year were unrelated to Banque Havilland. It is of interest that Martyn Konig, a well merited banker who had worked for Blackfish, resigned as a chairman of Havilland almost as soon as it opened.

Earlier, the Rowlands weren’t bothered neither over the Kaupthing investigation in Iceland nor in the UK – and yet, it’s been clear for a long time that the Kaupthing Luxembourg operation was central in all the deals and connection that are being investigated, be it the al Thani case or loans to UK business men such as Kevin Stanford and Robert Tchenguiz. It’s interesting to notice that al Thani is of the Qatari ruling family. Recently, a court case in London showed that a Qatari company bowed to pressure from Prince Charles. Christian Candy who won that case was also one of Kaupthing’s clients and a partner in joint ventures with the bank.

A source close to the Havilland informed me earlier this year that the Rowlands were interested in private banking and had been looking for a bank to buy for some time. When the Libyian Investment Authority’s offer for restructuring Kaupthing was turned down by the bank’s creditors and JC Flower’s rumoured interest didn’t materialise the Rowlands stepped in to buy the bank. The good assets were put into Havilland and Pillar Securitisation took over the bad assets, administrated by Havilland.

Unexpectedly, the Rowlands and Blackfish are also a well-known name in Latvia. When the renowned newspaper Diena was sold last year it seemed at first that Latvian businessmen with previous ties to the paper were buying it. Then it turned out they didn’t really have that kind of money and in the end the real owners came forth: Blackfish and the Rowlands. Why they suddenly wanted to own a newspaper in Latvia seemed hard to explain – and hasn’t really been explained except the Rowlands say they won’t interfere with the editorial line. That didn’t satisfy the Diena journalist: most of them left the paper and have now founded a new paper.

David Rowland moved from Guernsey to England in 2009 to be able to donate money to the conservatives. He has donated £3m, is now the party’s major donor – and that qualifies him to be the next party treasurer when Michael Spencer steps down in autumn. Now that the Conservatives are in government Spencer isn’t quite the kind of name they want to be linked to. Spencer has long had a reputation for being rather unsquemish when it comes to ways to make money. Last December, Spencer’s company Icap made $25m settlement with the US Securities & Exchange Commission, following a four years investigation, to escape charges for using fake trades to encourage customers to trade.

But Spencer’s company Icap was also a broker in the UK and did business with the Icelandic banks. Butlers, Icap’s financial consultancy, advised its customers, i.a. many of the UK councils, to keep their funds with the Icelandic banks even though the rating agencies, unbelievably late, downgraded the banks. Consequently, the councils that used the advice of Butlers lost badly and lost more than those who had other or no advisors. A possible conflict of interest has been alleged but strongly denied by Icap and Spencer. But the owner of a company that used fake trades would certainly have found a common ground with the Icelandic banks that are now being investigated i.a. for market manipulation.

Interestingly, the incoming and the present treasurer of the Conservative party aren’t the only conservative high-fliers with Icelandic connections. Tony Yerolemou is one of the Tories important donors and has been over the years. The Cypriot food producer was one of the owners of Katsouris Food, sold to Bakkavor in 2001. He got very close with the Bakkavor owners Lydur and Agust Gudmundsson who eventually became Kaupthing’s biggest shareholders. – And mentioning the Rowlands: as administrator Pillar is claiming back a Kaupthing Luxembourg loan to Lydur who might lose his £12.8m house on Cadogan Place if he can’t refinance his loan.

The Rowlands might also have to pick over their fellow conservative Yerolemou who not only sat on the Kaupthing board but had huge loans with the bank through Luxembourg. When the bank collapsed Yerolemou was one of the bank’s biggest debtors, his loans through Luxembourg amounting to €365 (whereof £203m were unused). The report of the Althingi Investigative Commission concludes that because of the loans and because his companies were firmly in red Yerolemou hadn’t been fit and proper to be on the bank’s board. Together with Skuli Thorvaldsson Yerolemou was involved in companies organised by Kaupthing and partly financed by Deutsche Bank to influence Kaupthing’s CDS spread. Yerolemou has been the chairman for Conservatives for Cyprus – and interestingly, the Conservative party had pledged before the election to give Cyprus priority when the party would be in power. Yerolemou has donated money to the campaigns of various MPs, i.a. Theresa Villiers now minister of State for transport and who also very much has the interest of Cyprus at heart.

Apart from ongoing investigations in Iceland the Serious Fraud Office is conducting an investigation into Kaupthing. With the conservatives in power and the particular ties that some conservatives have had with Kaupthing it will be of great interest to see what happens with the SFO investigation. It’s also interesting to see if authorities in Luxembourg make a move to look more closely at the Kaupthing operation in Luxembourg.

Who would have guessed there were so many Icelandic ties to the Conservative party? There are many stories to follow here.

Follow me on Twitter for running updates.

Jon Asgeir Johannesson seeks release from freezing order

Jon Asgeir Johannesson is seeking a release from Glitnir’s freezing order. In May the Glitnir winding-up committee got an international freezing order at court in London. According to sources close to the case Johannesson in now trying to have the order thrown out. It’s not known yet when the case will come up.

Freezing orders are what lawyers call a ‘nuclear option’ and are, consequently, hard to get. The freezing order was made around the time when the GWC brought out charges against Johannesson, his wife, Palmi Haraldsson and other business partners and ex-Glitnir bankers in New York, demanding back some $2bn. It was also around that time that the GWC passed on material to the Office of the Special Prosecutor in Iceland relating to alleged fraud committed by Johannesson and others before the collapse of Glitnir in October 2008.

A freezing order is only effective if it’s passed without the knowledge of the person hit by it. With a freezing order assets can neither be sold nor made use of in another way. The defendant only gets access to a limit amount of his money to meet everyday expenses.

If a defendant is able to get a release from a freezing order the claimant can be liable for damages done. That means that should Johannesson be successful in getting a release the GWC might be liable to paying damages to Johannesson. This is however part of the equation before demanding a freezing order. No doubt, Glitnir’s legal team has taken this risk into account.

An international freezing order is often issued when the person in question has assets abroad and offshore – certainly the case with Johannesson whose web of companies is both intricate and complicated. In considering if the defendant should escape the freezing order the judge will i.a. consider earlier behaviour of the defendant, i.e. if he has shown the will to co-operate.

One of the companies no doubt hit by the freezing order is JMS Partners, registered in the UK. The owners are Baugur’s ex-CEO Gunnar Sigurdsson and House of Fraser chairman Don McCarthy, who has been close to Johannesson’s UK ventures. The third founder was Piano Holding, a company registered in the Cayman Islands, earlier the holding company for the yacht that Johannesson bought in 2007 with a loan from Kaupthing Luxembourg. Since earlier this year Johannesson figures as the third owner of this company. The freezing order will most likely hit this asset.

Following the freezing order Johannesson was obliged to hand over to the GWC a list of his assets. He’s done that but the list is a very closely guarded secret. The myriad of companies related to company groups in the Johannesson’s sphere indicates that searching for his assets might prove a time-consuming process. Luckily, the experts at Kroll, working for Glitnir, are involved in it – and tracing and recovering assets will be part of their expertise.

Follow me on Twitter for running updates.

Entangling the Jon Asgeir Johannesson’s sphere

The charges brought against Jon Asgeir Johannesson, formerly of Baugur Fame, and his closest business allies in Reykjavik and New York and the international freezing order from a London court all relate to an empire so complicated that it’s staggering that any one person could have commanded over it all. It kept an army of lawyers and accountants busy. Now it’s quite a task for the administrators of Baugur in Iceland and the UK, of other Johannesson related companies and for the resolution committees of the three Icelandic banks, as well as foreign creditors, to entangle the web, trying to understand how money and assets were moved around. In an interview some years ago the UK retail tycoon Sir Philip Green, whom Johannesson was no doubt trying to eclipse, said he had never seen anything as complicated as the companies related to Johannesson.

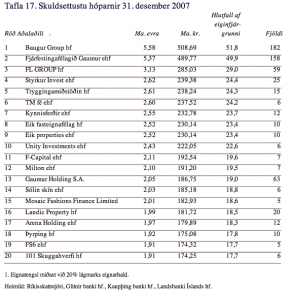

A table in the report of the Althingi Investigative Commission tells a striking story of the complicated web of companies. This table shows the most heavily indebted company groups at the end of 2007:

Out of these 20 companies 18 (!) are closely related to Johannesson:

Baugur, Fjárfestingafélagið Gaumur, FL Group, Styrkur Invest, Tryggingamiðstöðin, TM fé, Eik fasteignafélag, Eik properties, Unity Investments, F-Capital, Milton, Gaumur Holding, Sólkin skín, Mosaic Fashion, Landic Property, Arena Holding, Þyrping, 101 Skuggahverfi. Quite a number of accounts to sort out.

However, the column farthest to the right is interesting as it throws light on the structure of the groups in the Johannesson business sphere. It shows the number of companies related to these groups: 607 (!) companies are related to the 18 companies in the Johannesson sphere.

These loans, at the end of 2007, are not the whole loan saga since this covers only loans from the Icelandic banks. Foreign debt related to Johannesson’s companies isn’t included.* Add to that the fact that at the end of 2007 debt related to Johannesson personally was €1,5bn.

It’s clear that from early on Kaupthing was heavily and intimately involved in financing Johannesson’s companies. Landsbanki was also a diligent lender, not only to the companies but also to Johannesson’s private consumption, i.a. the flat at Gramercy Park where no collaterals were asked against a loan of $25m. Until lately, he seems to have had this flat for his personal use. And then towards the end it was Glitnir that was, according to the charges brought in New York, practically raided by Johannesson, ‘a convicted white collar criminal’ and ‘a cabal of businessmen’, his closest business partners.

The lingering question is how it was possible for one man to borrow all this money – it’s important to note that the loans were issued against a myriad of companies that by all means didn’t all do well but were continuously bought, sold, sliced and diced, sold and resold.

The continuum of quicksilver movements was one of the means to keep the merry roundabout going attracting ever more loans – and it’s now one of the reasons why it’s so time-consuming and complicated to entangle the web to figure out where the assets are and what the real status of Johannesson is. A lawyer close to one of the debtors told me that figuring out where his personal assets are is proving to be quite a task; it would be more simple if he were personally bankrupt but that’s not the case. Not yet, at least.

The sad thing is that all this money has mostly evaporated, not only because falling asset prices but also because the investments were simply not very clever. Johannesson didn’t turn out to be quite the business wizard made out to be: those who know him say he has an uncanny eye for retail – but he reached far beyond retail. The staggering trail of debt tells the story of lost opportunities and hubris. In an interview yesterday on Icelandic radio with Olafur Hauksson from the Office of the Special Prosecutor in Iceland Hauksson indicated the Johannesson’s affairs are now being investigated. Again, that is quite a task as the table above indicates.

*Earlier today, I had added the debt of the companies in the Johannesson sphere together. However, that doesn’t give a correct overview of the loan status since the loans do, in some cases, overlap.

Follow me on Twitter for running updates.

Cameron reminds Icelanders of the unpaid Icesave bill

Icelanders have to pay the Icesave bill. In a statement yesterday to Parliament on the meeting last week of the European Council PM David Cameron stressed that ‘this country should be a good friend to Iceland and a strong supporter of continued EU enlargement. But Iceland does owe the United Kingdom £2.3 billion…We will use the application process to make sure that Iceland meets its obligations because we want that money back.’

There have been some speculation in Iceland that the Tories might have a different view on Icesave than Labour and the, for Icelanders, mean Gordon Brown. Some months ago I heard from a leading Conservative that his party shared Labour’s stance on Icesave so I wasn’t surprised to hear Cameron’s words. What some Icelanders fail to understand is that there are no UK political interests aligned with the Icelandic interests on not paying. In the UK, Icesave is an unpaid bill, not a cause that the voters are worried about or interested in. Neither are the politicians except they want their money back.

Cameron’s words haven’t gone unnoticed in Iceland. Some even think this was a diplomatic blunder of great dimensions that will only strengthen the opposition in Iceland to EU membership. That’s a rather crude view since Icesave is an issue that needs to be resolved while a EU membership is about very long-term interests, not about paying or not paying for Icesave.

The fact is that Iceland owes £2.3 billion to the U.K. and €1.3 billion to the Netherlands as compensation for depositors who lost money in the collapse of Internet bank Icesave. The Icesave saga is turning into a long one – no wonder that the UK government wants to use all possible means to solve the issue. What would Icelanders do if they were owed money by a nation that had gone back and forth on its words on paying?

Follow me on Twitter for running updates.

Hubris and the demise of the ‘currency-basket loans’

A major factor in the Icelandic expansion of banks and businesses abroad was the belief held by these expanding forces that they had important qualities and ways of doing business that outdid foreigners. Time and again, Icelandic bankers and business leaders said that their way of doing business was something others could learn from. Olafur Ragnar Grimsson president of Iceland was a diligent propagator of this thesis of the Icelandic business Übermench. Grimsson eventually formed a theory of thirteen key characteristics that made Icelandic banks and businesses so good at conquering the world, most eloquently explained in a speech in May 2005. The collapse of the three Icelandic banks, a large part of the Icelandic financial sector and many of those businessmen who formed part of the Icelandic financial elite has seriously undermined the validity of this theory. Interpreting this belief through the Icelandic sagas ‘hubris’ is a better explanation – after hubris comes the fall.

The recent ruling of the Icelandic High Court on the so-called ‘currency-basket loans’ is another chapter in the story of the Icelandic hubris. Instead of doing something to properly strenghten the economy and fight inflation the created a byway, linking loans to low interest rates abroad by issuing loans to individuals and companys that were set up as loans in foreign currencies but were actually in Icelandic kronur. This has now been ruled an illegal form of loans by the Icelandic High Court: it’s illegal to tie interest rates to foreign currencies when the loans aren’t really in foreign currencies.

A source familiar with the situation pointed out to me that the ruling is yet another ‘thumbs down’ for the Icelandic banks. These loans could easily have been set up so that they would have complied to Icelandic law. It was just a matter of wording the loan contracts more precisely. If the legal departments of the banks had done their job properly and the managers of the banks had been alert to the importance of working out the details, acknowledging that the devil is in the details, and leaving no issue unexplored this wouldn’t have happened. Not only did the banks mess up things abroad. They didn’t do a brilliant job at home either.

There were from the beginning critical voices regarding the currency loans – but the banks seemed to have ignored them, probably thinking it was good enough to function. Rather like the BP employee who wrote in an email when BP cut corners drilling the now so infamous well in the Gulf of Mexico: “Who cares, it’s done, end of story, will probably be fine.” – Relying on the ‘probable’ can be a damaging and dangerous strategy.

Follow me on Twitter for running updates.

EU membership: The striking lack of Icelandic enthusiasm

Today, the EU leaders didn’t only agree on a new pan-European bank levy. The Council of Ministers also agreed that the membership negotiations with Iceland could now begin. No Icelandic minister was present in Brussels today. June 17 is the Icelandic national day, the tradition is that the prime minister addresses the people on that day. That’s what PM Johanna Sigurdardottir did today instead of going to Brussels like the Norwegian PM Jens Stoltenberg who media-wise made the most out of his visit. But the national day doesn’t explain why the Icelandic minister of foreign affairs couldn’t be in Brussels today.

The Council also expressed hope that the Icesave dispute would be resolved. It’s clear that without an agreement on Icesave a EU membership is impossible. It’s still over a year until an agreement will be crucial but it’s a timely reminder that at one point or another the matter has to be resolved. In an interview with the daily Morgunbladid president Olafur Ragnar Grimsson said that his stopping the Icesave bill in Althingi, the Icelandic parliament, had been the wise thing to do and had strengthened the Icelandic position in Icesave. Others will beg to differ – as long as there’s no agreement in place it’s unclear if Iceland really has gained from the delay.

Now that the EU membership negotiations can start the lack of political leadership on the issue is striking. The opinion polls show a dwindling support for an Icelandic EU membership – according to the latest polls 58% are against membership – reflecting that there isn’t any political enthusiasm at all for membership. Last summer, Althingi agreed to formally apply for a membership indicating there was an interest – but that interest has since evaporated.

Having followed the debate on EU membership in Norway, Sweden and Finland in 1994 when Norway, for the second time, turned down membership and Finland and Sweden joined, I can only say that there was, at the time, a huge momentum around EU in these countries. In Iceland there is nothing, simply nothing. And when voices are heard they are usually negative. Those who preach that Iceland will lose its national characteristics can be heard loud and clearly. Those who think Iceland belongs in Europe because it’s already part of the European Economic Area and should be a fully paid up member of the union either don’t speak up or wait and see.

Now, just as so long as I can remember, there are those who claim that Iceland is so special that it can only follow its own rules. These are usually those who think it’s fine that Iceland profits from international fora but shouldn’t be tied or obliged or committed in any way. Iceland tried to run its bank in a particularly Icelandic free-style. It didn’t end well. The emphasis on Icelandic superiority rings both false and hollow to my ears but it’s an underlying current in much of the political debate in Iceland – a very strong and prominent current found in some corners of all the political parties.

The Social democrats, now leading the government, are in principle pro-EU and have driven the EU agenda but without much conviction. The Independence Party is split on the issue – and since that party was in power during the 90s and well into this decade this party is largely responsible for preventing the European co-operation ever to become an issue for the best part of the last twenty years. As the other Nordic countries voted on the issue the IP decided that the EEA was good enough for Iceland. The Progressive Party has been split on the issue and consequently fairly silent on Europe. The Left-Green, in coalition with the social democrats, are against but have bowed to going through the process of applying, ultimately resigned to a referendum on the issue.

In 1997 I interviewed the historian and diplomat Sergio Romano. He said that nothing would change in Italy until there were enough Italians in power who had been abroad and learned that there are other ways of doing things than just the Italian way. There are plenty of Icelanders who have lived abroad but it seems that as soon as they move back they are more than happy to do things the Icelandic way.

Follow me on Twitter for running updates.

The Icelandic High Court: ‘currency-basket loans’ are illegal

One of the reasons so many Icelanders have been badly hit by the collapse of the Icelandic banks and the simultaneous collapse of the Icelandic krona is that for years a big share of mortgages and car loans were linked to foreign currencies instead of the krona. Today, the Icelandic High Court ruled that tying loans to the value of foreign currencies was illegal. Loans in Iceland can only be linked to the domestic currency, the krona. The two cases related to car loans issued by two financial companies specialising in these loans but the same principle is thought to apply equally to ‘currency-basket mortgages,’ another popular form of currency loans. According to figures from the Icelandic Central Bank ISK125bn, £660m, in car loans and ISK225bn, £1,3bn, worth of mortgages are currency loans.

The loans were usually a selection, or a basket, of different currencies, hence the name ‘currency basket loans’ – often a combination of yen, euros and dollars. This flight to foreign currencies was a move by the banks as the Icelandic interest rates steadily got higher and higher, to combat the rising inflation.

Interestingly, the ever-higher interest rates didn’t take the pressure off the system and the inflation steadily crept upwards – also because so much of the lending was done outside the realm of the krona and the Icelandic interest rates. Consequently, interest rates close to 20% didn’t punch the inflation down but had the adverse effect of luring foreign capital into Iceland making the krona ever stronger.

In principle, it’s a huge risk to take out loans in a currency that’s unrelated to your source of income. For example a teacher in Iceland with all his or her income in krona and no exposure to other currencies shouldn’t really take out a loan in euro yen and dollars to buy a new car. With more than 10% difference in interest rates and the loans indexed (i.e. moving with the inflation) many people thought this was a risk they could live with: even if the krona lost some value it wouldn’t hurt except in the case of a massive and highly unlikely devaluation. With a krona steadily gaining strength from 2003, when these loans started to crop up, by 2005 it seemed that the krona couldn’t be anything but strong and the loans really took off.

As the banks collapsed in October 2008 so did the krona. Repayments of currency loans doubled or even more. Even prudent borrowers woke up to sky-high debts, in some cases higher than the value of the assets they had borrowed against. This has often been most noticeable in terms of cars: people might have borrowed five million krona to buy a car that now is worth only 3 millions and the loan is at 10 millions – clearly not a good situation to be in.

While the going was good, the krona strong and the interest rates low on the currency loans they seemed a good deal and no one complained. As the collapse in 2008 changed all that there were voices claiming that actually it was against Icelandic law to tie interest rates to a foreign currency. Even more so since those who took out the loan took it out in krona, i.e. no currency changed hands. The currency rate was only a point of reference but the loan wasn’t actually in any currency but the Icelandic krona.

Today, the High Court confirmed what many suspected: loans in Iceland can only be connected to the domestic currency. However, the High Court didn’t rule on the interest rates nor what should substitute the currency link. The banks claim they are already well on their way in solving this issue and that they already have a firm grip on it. The government says the same: that it had already had planned for this eventuality. There are however some financial companies that have mainly operated on currency loans and they might now go bankrupt. The two cases that the High Court ruled on today were related to loans taken out with two such companies.

The government now has two problems to solve: firstly, how to calculate the currency loans now that the currency link isn’t valid anymore; secondly, how to hinder a bias against those with indexed loans in Icelandic krona. Since it’s been known for a while that the High Court ruling was imminent and that this outcome was likely (an earlier ruling had indicated what could be expected) the government has had time to prepare. Having already had to refinance the banking sector it remains to be seen if the loan companies will need to be bailed out and if they really should be bailed out. Many debtors with currency loans will see the ruling today as a vindication of their struggle to meet repayments – anything that smacks of the government robbing people of their victory will most likely be met with great anger.

Follow me on Twitter for running updates.

The dark stain of Kreppa

By guest contributor Michael Schulz. A social scientist who has worked for 30 years as a humanitarian manager in development, natural disasters and conflict on missions for the Red Cross in Africa, Asia, the Middle East, Russia and Trans-Caucasus and was i.a. based in Ramallah for two years. The last 5 years Michael was a diplomat with a Red Cross delegation in New York, accredited to the UN. – His Icelandic connection is through his partner who gives Michael an ‘Icelandicness’ and the authority to speak of Iceland though seen through his European eyes. Michael takes a keen interest in all aspects of the ‘Kreppa’ (Icelandic for ‘crisis’) in a philosophical, historical, political, socio-economic and cultural context.

Isn’t it amazing: the Icelandic elites are being pilloried. Former large shareholders and CEO’s of banks, so called banksters, amongst them many who also owned large chunks of the Icelandic economy and media, politicians, members of parliament, “political” ministers, governors of the Central Bank, et al are being critically targeted by the special prosecutors, social media and the general public, not least the voters in elections.

At long last the big players and not merely the bystanders seem to be held accountable. Their criminal acts, corruption, un-ethical and immoral deeds have finally rendered them “vulnerable” to justice, both legally and politically.

Of course, the vast majority of the vulnerable are all those who had fallen victim to manipulation (some might call it marketing) by banks that had for example talked them into high risk, outright toxic credits, indexed or foreign currency loans, to buy property they couldn’t afford or luxury cars they didn’t need. The property prices were based on virtual not real value; the limousines and sports cars were unnecessary as there are no real highways to drive them in Iceland.

These are the people who did not so much lose illegitimate fortunes but ill-aspired affluence transcending Icelanders general prosperity. True, all could have been sceptical and questioned the origins and legitimacy of all those unexpected riches. Instead they indulged in a frenzy of consumerism, with luxury brands topping the lists.

But, it has to be said, being excluded from the elite’s exclusive circles it was near impossible to see through the bubble or net that had been cast over the entire society. Economists, the experts, for example, didn’t see that the bubble was about to burst – did they? Regulatory authorities did not provide oversight – did they? Besides, the ideological climate and a policy of laissez-faire was such that the excesses ruled over balanced supply and demand.

All in all up to 35% of Icelandic households are seriously hit by debt. Some will manage thanks to remainders of their former prosperity. Icelanders are a resilient people. But others will become the newly poor as opposed to the nouveaux riche.

Then there are the vulnerable, the people who did not lose ill-aspired affluence but lost a livelihood as they were on the fringe of relative prosperity and social security. They are poor.

The poor they are not one iota concerned whether their poverty is measured in relative or absolute terms. Their poverty is not only one of socio-economic terms as they lost employment or are a single parent or are elderly or old. For many poor their status is aggravated by personal, physical and/or mental adversities. And their social status is such that they are deprived of coping mechanisms.

Nowadays food security is an issue for many Icelanders. The charity Fjölskylduhjálpin alone (there are also a number of other charity organizations) provides between 400-500 families, roughly 1200 individuals, with weekly food rations. That’s about triple the number compared to before the crisis. The charity is still not able to serve all those who apply for assistance.

It is difficult to assess the number of families and individuals in need of immediate humanitarian assistance. Understandable albeit false shame and pride prevent many to register as there is social stigma attached. But, be it seems a reasonable estimate that 10000 families, 27000 individuals, now live in dire straits in Iceland.

Funding and donations in kind do not cover needs. Without volunteers recruited from amongst the beneficiaries the charity couldn’t function. The premises from which Fjölskylduhjálpin operates – ironically the historical location where the now bankrupted supermarket chain Hagkaup was started – have to be rented from Reykjavik City for annually ISK 1.2 mill. – almost half the annual amount (ISK 2.5 mill.) the City grants the organization.

To date, just over one and a half years into the crisis, it seems depressions or suicide rates are not on the increase. But in Iceland, with a population of just over 300 000, eventual trends might start on a miniscule scale, detectable and readable only over time. By contrast, psychiatry and psychology practitioners today report a significantly increased “pressure”, as more people seek help because of i.a. anxieties, fear, stress and anger.

Iceland is a small nation. Perhaps its national pride or misguided chauvinism when one hears there are needy and poor but(!) they are only very few and official welfare helps!

One wonders: Does it make a difference if the poor are only few? What about the proportionality of figures or are about 27000 individuals or almost 10% of a population of roughly 300 000 enough?

Welfare helps? Of course it does. It better does. But is it a generous gift from society or authorities? Isn’t it a “natural” entitlement, indeed a human right!?

Quantifiably, today’s monthly welfare support stands at about 125 000 ISK (leaving aside inflation, tax increases, etc.). Quantifiably, it has also been established that in today’s Icelandic society one requires monthly ISK 180.000 – ISK 220.000, say, rounded up and down, ISK 200.000 to make a living.

ISK 200.000 minus ISK 125.000 thus leaves a balance of ISK 75.000.

ISK 75.000? Yes, this amount marks the dark stain on the downside of Kreppa!

The authorities have argued social security can’t be increased because there was no money in spite of and because of millions being spent to repair a criminally wrecked financial sector and turning around the economy. How much do only the negotiations around the Icesave case cost in – say – salaries, legal fees, travel costs, mounting interest rates, etc.?

Besides, if the poor are the few, isn’t ISK 75.000 only a low sum per individual per month – compared to spending billions elsewhere?

There is no upside to the downside of Kreppa – except perhaps the return to social values, family, friendships and knitting. But there are the poor and that dark stain. The authorities should recall the ethical and moral failings of the past. They should understand that any society is only as strong as its weakest member and they should seek to wipe away that stain.

Follow me on Twitter for running updates.