Archive for December, 2016

How is this possible, Greece?

The Greek ELSTAT saga has taken yet another turn, which should be a cause for grave concern in any European country: a unanimous acquittal by three judges of the Greek Appeals Court in the case of former head of ELSTAT Andreas Georgiou has been annulled. This was announced Sunday December 18 – the case was up in court December 6 – but no documents have been published so far, another worrying aspect.

The acquittal was the fourth attempt to acquit Gergiou – and this is now the fourth attempt to thwart the course of Greek justice and revive the unfounded charges against him. The intriguing thing to note here is that the acquittal was annulled by a prosecutor at the First Instance Court, who in September brought a whole new case regarding the debt and deficit statistics from 2010 and ELSTAT staff role here, this time not only accusing ELSTAT staff of wrongdoing but also staff from Eurostat and the IMF; a case still versing in the Greek justice system.

All of this rotates around the fact that ELSTAT, and now Eurostat and IMF staff, is being prosecuted for producing correct statistics after more than a decade of fraudulent reporting by Greek authorities.

It beggars belief that the justice system in Greece seems to be wholly under the power of political forces who try as best they can to avoid owning up to earlier misdeeds. In spite of acquittals, those who corrected the fraudulent statistics are being prosecuted relentlessly while nothing is done to explain what went on during the time of the fraudulent reporting. It should also be noted that in order to stop the ELSTAT prosecutions completely, four other cases related to this one, need to be stopped.

The ELSTAT staff is here reliving the horrors of the Lernaen Hydra in Greek mythology. Georgiou and his colleagues have had international support but that doesn’t deter Greek authorities from something that certainly looks like a total abuse of justice. How is it possible to time and again take up a case where those charged have already been acquitted?

Icelog has followed the ELSTAT saga, see here for earlier blogs, explaining the facts of this sad saga.

Follow me on Twitter for running updates.

Has Iceland learnt anything from the 2008 banking crash?

With its 2600 pages report into the banking collapse no nation has better study material to learn from than Iceland. However, with some recent sales in Landsbankinn and uncertainties regarding the sales of the new banks, Icelanders have good reasons to wonder what lessons have indeed been learnt from the 2008 banking collapse. If little or nothing has been learnt it’s worrying that two or three banks will soon be for sale in Iceland.

“During the election campaign I would have liked to hear the candidates form a clear and concise lessons from the 2008 banking collapse,” said one Icelandic voter to me recently. He’s right – there was little or no reference to the banking collapse during the election campaign in October.

The unwillingness to formulate lessons is worrying. So many who needed to learn lessons: bankers, lawyers, accountants, politicians and the media, in addition to every single Icelander.

Also, some recent events would not have happened had any lessons been learnt from this remarkable short time of fully privatised banking, from the beginning of 2003 to October 6 2008. There is a boom in Iceland, reminding many of the heady year 2007 but this time based inter alia tourism and not on casino banking. However, old lessons need to be remembered in order to navigate the good times.

Landsbankinn: six loss-making sales 2010-2016

Landsbankinn was taken over by the Icelandic state in 2011. The largest creditors, the deposit guarantee schemes in Britain and the Netherlands, were unwilling to be associated with the Landsbankinn estate, contrary to creditors in Kaupthing and Glitnir. Consequently, the Icelandic state came to own the new bank, Landsbankinn.

Over the years certain asset sales by Landsbankinn have attracted some attention but each and every time the bank has defended its action. In certain cases it has admitted mistakes but always with the refrain that now lessons have been learnt, time to move on.

Earlier this year, the Icelandic State Financial Investments (Bankasýsla), ISFI, published a report on one of these sales, the one causing the greatest concern – of Landsbanki’s share in a credit card issuer, Borgun. Landsbankinn had undervalued its Borgun share by billions of króna, creating a huge gain for the buyers.

Landsbankinn chose the buyers, nor bidding process etc., this was not a transparent sale. It so happens that some of the buyers happen to be closely related to Bjarni Benediktsson leader of the Independence party and minister of finance. No one is publicly accusing Benediktsson for having influenced the sale.

ISFI concluded that Landsbankinn should have known about the real value of the company and should only have sold via a transparent process, not by handpicking the buyers, some of whom are managers in Borgun. Part of the hidden value was Borgun’s share in Visa Europe, sold in November 2015 after the bank sold its Borgun share. Landsbankinn managers claim they were unaware of the potential windfall that could arise from such a sale.

Following the ISFI report the majority of the Landsbankinn board resigned but not the bank’s CEO, Steinþór Pálsson.

Landsbankinn’s close connections with the Icelandic Enterprise Investment Fund

Now in November the Icelandic National Audit Office, at the behest of the Parliament, investigated six sales by Landsbankinn, conducted in the years 2010 to 2016. It identified six sales, one of them being the Borgun sale, where it concluded that the state’s rules of ownership and asset sale had been broken as well as the bank’s own rules.

The report also points out that some of Landsbankinn’s own staff would have been aware of the potential windfall in Borgun. In a similar sale in another card issuer, Valitor, the sales agreement included a clause giving the bank share in similar gains after the sale.

Landsbankinn CEO Pálsson said he saw no reason to resign since lessons from these sales had already been learnt. However, nine days after the publication of this report Landsbankinn announced that Pálsson would step down with immediate effect.

Interestingly, four of the less-than-rigorous sales involved the Iceland Enterprise Investment Fund (Framtakssjóður), IEIF, set up in 2010 by several Icelandic pension funds. In the first questionable Landsbankinn sale, in 2011, the bank sold a portfolio of assets directly to the IEIF without seeking other buyers. The portfolio was later shown to have been sold at an unreasonably low price.

In relation to the sale Landsbankinn became the IEIF’s biggest owner. The Financial Surveillance Authority, FME, later stipulated that the bank could not hold a IEIF stake above 20%. In 2014 the bank then sold part of its share in the IEIF to the Fund itself, again at an unreasonably low price. In two sales, 2011 and 2014, Landsbankinn sold shares in Promens, producer of plastic containers for the fishing industry, again to the Fund.

As the Audit Office points out all the questionable sales have had two characteristics: a remarkably low price and Landsbankinn has not searched for the highest bidder but conducted a closed sale to a buyer chosen by the bank.

No one is accused of wrongdoing but it smacks of closed circuits of cosy relationships, a chronic disease in the Icelandic business community.

Landsbankinn and the blemished reputation

Landsbankinn claims it has in total sold around 6.000 assets via a transparent process. That may be true but the Audit Office report indicates that the bank chooses at times to be less than transparent, especially when it’s been dealing with the IEIF.

The bank’s management has time and again stated the importance of improving the bank’s reputation – after all, the 2008 collapse utterly bereft Icelandic banking of its reputation. This strife is the topic of statements and stipulations but so far, deeds have not followed words. The Audit Office concludes that inspite of its attempts the bank’s reputation has been blemished by the questionable sales.

How the banks were owned before the collapse

During the years of privatisation of the Icelandic banks, from 1998 to end of 2002, it quickly became clear that wealthy individuals were vying to be large shareholders in the banks. There was some talk of a spread ownership but in the end the thrust was towards having few individuals as main shareholders in the three banks.

Landsbankinn was bought by father and son, Björgólfur Guðmundsson and Björgólfur Thor Björgólfsson who during the 1990s got wealthy in the Soviet Union. A fact that gave rise to articles in the magazine Euromoney in 2002, before the Landsbankinn deal was concluded.

Kaupthing’s largest owners were, intriguingly, businessmen who got wealthy through deals largely funded by Kaupthing. The largest shareholder, Exista, was owned by two brothers, Ágúst og Lýður Guðmundsson and the second largest was Ólafur Ólafsson. The brothers own one of Britain’s largest producers of chilled ready-made food, Bakkavör. Ágúst got a suspended sentence in a collapsed-related criminal case. Ólafsson, together with Kaupthing managers, was sentenced to 4 ½ years in prison in the so-called al Thani case.

Glitnir had a less clear-cut owner profile to begin with. The family of Bjarni Benediktsson were large shareholders in the bank (then called Íslandsbanki, as the new bank is now called) but as the SIC report recounts the Landsbankinn father and son had built up a large stake in the bank. The FME kept pestering the father and son about these shares, the authority claimed the two were not authorised to own, later sold to the Benediktsson’s family and others.

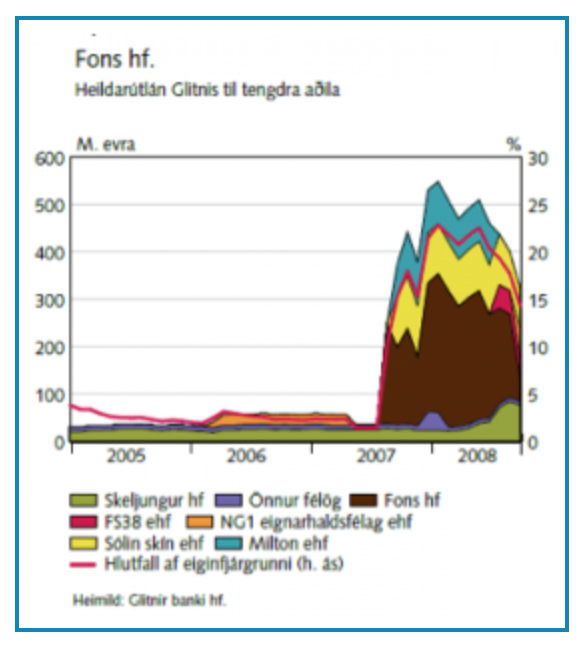

In spring of 2007 Jón Ásgeir Jóhannesson, who had insistently but unsuccessfully tried to buy a bank in 1998, gathered a group to buy around 40% in Glitnir. Involved were Baugur and FL Group, both owned or largely owned by Jóhannesson. One of his partners was Pálmi Haraldsson, a long-time co-investor with Jóhannesson. This graph (from the SIC report) shows Glitnir’s lending to Fons and other Haraldsson’s related companies: the cliff of debt rises after these businessmen bought Glitnir. It could also be called Icelandic banking in a nutshell:

Biggest shareholders = biggest borrowers

The graph above is Icelandic banking a nutshell. It characterises what the word “ownership” meant for the largest shareholders: they were also the banks’ largest borrowers, as well as borrowing in the other two banks. The shareholding of the largest groups in each of the banks was around and above 40% during most of the short run – the six years – of privatised banks.

Here some excerpts from the SIC report about the borrowing of the largest shareholders:

The largest owners of all the big banks had abnormally easy access to credit at the banks they owned, apparently in their capacity as owners. The examination conducted by the SIC of the largest exposures at Glitnir, Kaupthing Bank, Landsbankinn and Straumur-Burðarás revealed that in all of the banks, their principal owners were among the largest borrowers.

At Glitnir Bank hf. the largest borrowers were Baugur Group hf. and companies affiliated to Baugur. The accelerated pace of Glitnir’s growth in lending to this group just after mid-year 2007 is of particular interest. At that time, a new Board of Directors had been elected for Glitnir since parties affiliated with Baugur and FL Group had significantly increased their stake in the bank. When the bank collapsed, its outstanding loans to Baugur and affiliated companies amounted to over ISK 250 billion (a little less than EUR 2 billion). This amount was equal to 70% of the bank’s equity base.

The largest shareholder of Kaupthing Bank, Exista hf., was also the bank’s second largest debtor. The largest debtor was Robert Tchenguiz, a shareholder and board member of Exista. When the bank collapsed, Exista’s outstanding debt to Kaupthing Bank amounted to well over ISK 200 billion.

When Landsbankinn collapsed, Björgólfur Thor Björgólfsson and companies affiliated to him were the bank’s largest debtors. Björgólfur Guðmundsson was the bank’s third largest debtor. In total, their obligations to the bank amounted to well over ISK 200 billion. This amount was higher than Landsbankinn Group’s equity.

Mr. Thor Björgólfsson was also the largest shareholder of Straumur-Burðarás and chairman of the Board of Directors of that bank. Mr. Björgólfur Thor Björgólfsson and Mr. Björgólfur Guðmundsson were both, along with affiliated parties, among the largest debtors of the bank and together they constituted the bank’s largest group of borrowers.

The owners of the banks received substantial facilities through the banks’ subsidiaries that operated money market funds. An investigation into the investments of money market funds under the aegis of the management companies of the big banks revealed that the funds invested a great deal in securities connected to the owners of the banks. It is difficult to see how chance alone could have been the reason behind those investment decisions.

During a hearing, an owner of one of the banks (Björgólfur Guðmundsson), who also had been a board member of the bank, said he believed that the bank “had been very happy to have [him] as a borrower”. Generally speaking, bank employees are not in a good position to assess objectively whether the bank’s owner is a good borrower or not.

De facto, the Icelandic banks were “lenders of last resort” for their largest shareholders: when foreign banks called in their loans in 2007 and 2008 the Icelandic banks to a large extent bailed their largest shareholders out with massive loans.

Needless to say, systemically important banks in most European countries are owned by funds and investors, not few large shareholders who are also the banks’ most ardent borrowers. Icelandic banks will hopefully never return to this kind of lending again.

Separating investment banking and retail banking

As very clearly laid out in the SIC report the banks did not only turn their largest shareholders into their largest debtors but the banks’ own investments were usually heavily tied to the interests of their largest shareholders. Therefor, it’s staggering that now eight years after the collapse and three governments later a Bill separating investment banking and retail banking has not yet been passed in the Icelandic Parliament.

This means that most likely the new banks – Landsbankinn, Arion and Íslandsbanki – will be sold without any such limitation on their banking operations.

It is indeed difficult to see that there could be a market in Iceland for three banks. There is speculation that there will be foreign buyers but sadly, the history of foreign investment in Iceland is not a glorious one. Iceland is not an easy country to operate in as heavily biased as it is towards cosy relationships so as not to say cronyism.

Another way to attract foreign buyers is to offer shares for sale at foreign stock exchanges; Norway has been mentioned. Clearly a good option but I’ll believe it when I see it.

Judging from the short span of privatised banks in Iceland it’s also a worrying thought that the banks will again be owned by large shareholders, holding 30-50%.

The fact that state-owned Landsbankinn could over six years conduct six questionable sales with no consequence until much later, raises questions about lessons learnt. And the fact that this potentially simple risk-limiting exercise of splitting up investment and retail banking hasn’t yet been carried out by the Icelandic Parliament makes one again wonder about the lessons learnt. And yet, Iceland has the most thorough report in recent times in the world to learn from.

Follow me on Twitter for running updates.

The ELSTAT saga: the latest

Former head of ELSTAT, the Greek statistical authority, Andreas Georgiou has been acquitted in the case where he was charged with misdemeanour. Three foreign statisticians came to Athens to bear witness in the case, testifying to Georgiou’s positive work on rectifying the problems of earlier false statistics.

The irony is that the Greek government is silently accepting that civil servants who fixed the problem of a decade or fraudulent statistics are being prosecuted, not those who committed the fraud for years.

But as lister earlier on Icelog this is only one of four cases Georgiou is fighting in Greece. The other cases against Georgiou are still lingering in Greek courts. In the largest case against himm where he is charged with treason for in fact correctly reporting correct statistics, the examining judge has now proposed that the case be dismissed. Stunningly, this is the fourth time a judge proposes to have the case dropped but so far it’s always risen again in a new guise.

Here is Kathimerini report on the latest trial and its outcome.

Follow me on Twitter for running updates.

Offshore króna owners allowed to seek independent estimates – inflows have stopped

An application with the Reykjavík District Court for independent assessment of the Icelandic economy, launched by two of the funds holding the majority of the Icelandic offshore króna, has been met by the Court. Originally, the funds had eleven requests; the Court granted three of them according the Icelandic daily DV.

The two funds claim the measures taken against the offshore króna holders this summer – effectively forcing them out at a great discount or freezing the funds at below-inflation interest rates – are harmful measures, utterly unnecessary in the booming Icelandic economy. They now want an independent assessment of the economy, in order to show that the Icelandic government could well afford more generous terms.

According to a recent decision by the EFTA Surveillance Authority the offhore króna measures were within the remit of the Icelandic government and did not break any EEA rules.

The measures no doubt had a sobering effect on foreign visitors but it the use of a new tool to temper inflows, announced in June this year that has had an effect: according to new figures released by the Central Bank, inflows into Icelandic sovereign bonds have completely stopped since June when the measures were put in place.

There had been some concern that the large inflows might jeopardise Icelandic financial stability as indeed it did in 2008 when capital controls were put in place exactly because of these inflows. Governor of Central Bank Már Guðmundsson said earlier this year that the renewed inflows, which the Bank would monitor, were a sign of trust in the Icelandic economy. Well, no worries – the measures in June stopped the inflows.

For earlier Icelog on the offshore króna issues please search the website.

Update: this piece has been updated as the earlier report re the effect on inflows was incorrect.

Follow me on Twitter for running updates.

The ELSTAT saga: ongoing vendetta against civil servants who saved Greek statistics

There is no end in sight of the ELSTAT saga of political vendetta against the ex ELSTAT director Andreas Georgiou who oversaw the correction of Greek statistics 2010 to 2015. Yes, the Prosecutor of the Appeals Court has recommended to throw the case of Georgiou and his colleagues out, not once but three times, only to resurface again. In addition, the case has transformed into several case all migrating through the Greek judicial system. I’ve earlier claimed that the ELSTAT case is a test of Greek political willingness to own up to the past and move on. The steadfast will to prosecute civil servants for doing their job exposes the damaging corrupt political forces still at large in Greece, a very worrying signal for the European Union and the International Monetary Fund – but most of all worrying for Greece.

If anyone thought that the long-running saga of prosecutions against ex head of ELSTAT Andreas Georgiou was over, just because so little is now heard of it, then pay attention: the case is still ongoing, there is an upcoming decision in the Appeals Court that could potentially send Georgiou to trial with the possibility of a life sentence for him. In addition, there are side stories here, other ongoing investigations and prosecutions.

The ELSTAT saga started after Georgiou had only been in office for just over year. It really is a saga (here my earlier reports and detailed account of it) of upside down criminal justice but it’s so much taken for granted in Greece that little or no attention is paid to the fundamental issue:

How is it possible that the man who as Head of ELSTAT from August 2010 until August 2015, putting in place procedures for correct reporting of statistics following the exposure of fraudulent statistics for around a decade, is being prosecuted and not the people who for years provided false and fraudulent statistics to Greece, European authorities and the world?

This case of a Hydra with many heads is rearing one of these heads next on 6 December when Georgiou is to face charges of violation of duty in producing the correct 2009 government deficit statistics. On important aspect is this: the charges imply that the Greek government isn’t accepting the correct figures on which the current bailout program and debt relief is based on.

European and international organisations have supported Georgiou’s point of view, the last being a letter from the International Association for Research in Income and Wealth (IARIW), to prime minister Alexis Tsipras now in November. However, the support from abroad does not seem to have had any effect on the prosecutions against Georgiou in Greece. As can be seen from the overview below of how the cases have sprawled in various directions there really is no end in sight. A worrying trend in a European democracy, the country that calls itself the cradle of Western democracy.

To Icelog, Georgiou says: “The numerous prosecutions and investigations against me and others that have been going on for years – as well as the persistence of political attacks and the absence of support by consecutive governments – have created disincentives for official statisticians in Greece to produce credible statistics. As a result, we cannot rule out the prospect that the problem with Greece’s European statistics will re-emerge. The damage already caused concerns not only official statistics in Greece, but more widely in the EU and around the world, and will take time and effort to reverse.”

Charges three times thrown out resurface in wider charges

The original criminal case concerned criminally inflating the 2009 deficit causing damages to Greece in the order of €171bn or €210bn (depending on how it was calculated on different occasions by his detractors). For three consecutive years – in 2013, 2014 and 2015 – investigating judges and prosecutors proposed to drop the case only to see the charges resurfacing again each and every time. In 2016, the Prosecutor of the Appeals Court assigned to the case yet again proposed that the case be dropped. A decision is pending at the Council of the Appeals Court.

The same issue of the 2009 deficit did indeed resurface in the form a separate, brand new case on 1 September this year, now not only alleging criminal actions by Georgiou and ELSTAT staff but by the EU Commission and the IMF. A separate criminal investigation has begun and is running parallel to the over five year old case above. On the losing end here are not only the individuals hit by these charges but also public statistics, Greece, EU and international partners.

A worrying disincentive to service truthful information

Now, on 6 December, Georgiou is facing a trial for violation of duty, exactly the violations that various prosecutors and investigating judges had, in 2013, 2014 and 2015, proposed to drop. However, the Appeals Court decided in 2015 to refer the case to an open trial. In Greece, this trial is being presented as doing justice for Greece, implying that earlier cases may have been dropped due to European pressure.

Again, this clearly shows that there are political forces in Greece refusing to shoulder any responsibility for fraudulent statistics and a huge cover up of the dismal governance in Greece up to the surfacing crisis in 2009.

If convicted for violation of duty, Georgiou faces a possible conviction of two years in prison. Greek statistics face an uncertain future: a trial against the people who fixed the problem of Greek statistics is hardly a great incentive to Greek civil servants to service truthful information instead of untruthful politicians.

Twelve months for “criminal slander”: told the truth but should have kept quiet

In June, Georgiou was tried for criminal slander for defending the 2009 deficit statistics, the very numbers ELSTAT produced as required by the European Statistics Code of Practice. The Court Prosecutor recommended to the Court that the case be dropped and that Georgiou be acquitted. But the Court ruled in the end that although it believed Georgiou to have told the truth he should still not have said the things he said and sentenced him to twelve months in prison.

The appeal of this conviction was due to be heard in October in the Appeals Court. However, the plaintiff – actually the former director of national accounts at the National Statistics Office (later ELSTAT) in 2006 to 2010, i.e. during the fraudulent reporting – succeeded in having the appeal trial postponed. It’s now due in 16 January 2017, possibly a tactical move to influence two other ongoing cases involving Georgiou, the above-mentioned criminal case and a civil case.

The civil case is related to the criminal slander case. Decision is due in the coming weeks and could land Georgiou with a crippling fine of tens of thousands of euro.

Protecting the perpetrator of a crime, not the victim

As reported last summer in my detailed article of the ELSTAT saga, ELSTAT’s former vice president Nikos Logothetis was found by the police to have repeatedly hacked into Georgiou’s ELSTAT email account. This started already on Georgiou’s first day as president of ELSTAT, in August 2010, before he had even started to look at the thorny issue of the 2009 deficit, and continued until the hacking was exposed late October 2010.

Police investigations showed who was responsible for the criminal action of hacking Georgiou’s account – Logothetis was actually logged into the account as the police came unannounced to his home.

Georgiou was informed that Logothetis would be prosecuted for this and that following the criminal case he could then bring a civil case against Logothetis. However, in early July this year Logothetis was acquitted of violating Georgiou’s email account in a felony case. The Court also decided Logothetis could not be retried for the felony charge due to the time passed since the hacking.

According to the ruling it was not disputed that Logothetis had indeed accessed Georgiou’s account. However, the action was deemed not to have been carried out because of monetary gains or to hurt Georgiou but only because Logothetis “wanted to understand Georgiou’s illegal actions and to legally defend the legitimate interests of ELSTAT and consequently of the Greek state.”

Quite remarkably, the felony case was allowed to wait for five years before it was considered by the Appeals Court, thus triggering the statute of limitations. In addition, somehow Georgiou received no notice of the decision of the Appeals Court on the Logothetis felony case acquittal and thus had no chance to take legal action to potentially reverse the ruling within the allowed one month period.

Furthermore, the Court hadn’t taken any note of the fact that Logothetis actually hacked the account before Georgiou even looked at the 2009 deficit numbers nor did it figure in the case that Logothetis had continuously slandered and attacked Georgiou during his five years in office, even calling for the hanging of Georgiou in a published interview.

Another case against Logothetis, also for the hacking but as a misdemeanor and not a felony, was due to go to trial now in November but has been postponed in accordance with Logothetis’ wishes. It’s now been set for February 2017.

The ELSTAT case in the European Parliament:

On 22 November the ongoing political pressure on Greek statistics and Georgiou and his colleagues was taken up in a hearing at the Committee on Economic and Financial Affairs of the European Parliament. Both Georgiou and Walter Rademacher president of Eurostat participated, presented their views and were questioned by MEPs.

Rademacher gave an overview of the problems with Greek statistics and emphasised the need to close with the past, stop going after ELSTAT staff and to recognise what had been wrong (see video; Rademacher at 2:20-12:15). Rademacher paid tribute to Georgiou and the ELSTAT staff in modernising the organisations, bringing the governance to the proper standard and thus re-establishing trust in Greek statistics, a much needed contribution.

Rademacher pointed out that the serious misreporting didn’t cause the crisis in 2009 but was a “blatant symptom of very serious flaws” within the Greek statistics administration “at that time.” He also underlined the immense effort taken by various organisations to aid and support ELSTAT in improving its work, inter alia hundred Eurostat missions since 2010 to the present day, around one a month, to ELSTAT as well as to Eurostat in-house assistance, to the cost of around €1m in addition to technical assistance from the IMF and other EU National Statistical Institutes – no other country has needed anything like this.

In his presentation, Georgiou (12:26-20:12) emphasised the enormous disincentive for official statistics in Greece his case has been.

“These and other cases and investigations send a strong signal to today’s guardians of honest, transparent statistics in Greece: you do so at your own risk. The point cannot be lost on them that compiling reliable statistics according to EU law and statistical principles can endanger their personal well-being.”

The ELSTAT case: a scary disincentive for Greek civil servants

Georgiou had only been in office for around thirteen months when political forces in Greece openly started questioning in parliament his professional integrity. That was also the time when allegation emerged of him committing treason in reporting the correct figures.

Now, more than five years later, the case is still going on in various ways. Quite remarkably, Georgiou has not had any support from the Tsipras government. Given how the ELSTAT case has progressed, there are clearly forces both in the government and in the main opposition party who have a personal and political interest in hiding the truth on how the fraudulent reporting was kept going for around a decade, until 2009 and who find a convenient scapegoat in Georgiou and his staff.

Given the strong Greek political forces at large here the only way to stop the scapegoating seems to be that the donor countries and institutions show Greece that it can’t be helped until it helps itself. Until it helps itself by putting an end to prosecuting civil servants who fixed a serious problem that severely undermined the trust in the Greek government. As it stands, there is no incentive for Greek civil servants to withstand political pressure for corrupt action.

Follow me on Twitter for running updates.