Search Results

The ELSTAT case in Greece exposes the weak rule of law

Yes, the case against former head of ELSTAT Andreas Georgiou is still on-going in Greek courts. In spite of international concern for rule of law in Greece, Greek authorities continue the persecution of Georgiou, now in its 8th year. The latest turn beggars belief: the former vice president of ELSTAT, Nikos Logothetis was found to have hacked Georgiou’s emails for months in 2010 after which the Greek police confiscated two computers and a hard drive from Logothetis. Logothetis was charged with hacking but, on account of ‘technical reasons’ he was never tried! Now, following his recent request, Logothetis has been given back his previously confiscated assets, with Georgiou’s emails still in them. In the meantime, there is no mercy for the man who, together with his team at ELSTAT, oversaw the final corrections of Greek statistics and changed the working practice at ELSTAT in order to re-establish trust in Greek statistics.

As the Greek economy started to deteriorate in 2009, it was discovered that since before 2000, Greek national statistics concerning the economy had been falsified. During the winter of 2009 to 2010, work was done in order to find the correct data. Part of that process was hiring a new director of ELSTAT, the Greek national statistics office.

The new director was Andreas Georgiou, who had previously worked at the IMF in Washington. When Georgiou started in his new job at the beginning of August 2010, the relevant statistics had mostly been corrected. Georgiou and his team put the last corrections in place and introduced the necessary and recognised statistical methods, in order to safeguard the correct procedures and consequently the correct statistics.

Data does not falsify itself

Since data does not falsify itself, it would have been expected that Greek authorities would have opened an investigation into the falsification, which, as mentioned above, took place for over a decade.

But no, that was never done – no investigation, no stones turned.

Instead, only a year after Andreas Georgiou took over at ELSTAT, he and some from his team found themselves investigated and prosecuted, in several still on-going cases. Although parts have been thrown out repeatedly, the cases have been re-instated, again and again, in a process that shows clearly that Greek courts and Greek judicial authorities do not abide by the sort of justice principles considered the fundament of rule of law. Georgiou served his full term as director, from 2010 to 2015.

Kathimerini: the prosecutions of Georgiou equal witch hunt

Greek media, such as the newspaper Kathimerini, has earlier called the prosecutions against Georgiou a witch-hunt, and connected it to the dark forces around Kostas Karamanlis.

The latest turn in the ELSTAT saga – a worrying sign of the state of the Greek judicial system – is yet another unbelievable chain of events: Nikos Logothetis was found to have hacked and stolen emails from Georgiou from the time Georgiou became the director of ELSTAT and for the following months, until Logothetis was literally caught in the act when the Greek police paid him a visit at his home.

As a consequence of the hacking, Logothetis was dismissed as the vice president of ELSTAT and charged in 2011 with the hacking. However, although material from Georgiou was found on Logothetis’ computers, the charges were finally dropped in 2017 for “technical reasons.” Thus, Logothetis was charged but never tried for hacking Georgiou’s email.

The last turn in this story is this: Logothetis asked to have his two confiscated computers and a hard drive returned. His request was duly met: not only did he get his machinery back – it was not wiped clean but still contains Georgiou’s emails.

Slander case – yet another example of how dismissed cases pop up again

Further, On May 23, 2019 the Athens Appeals Court is slated to try Andreas Georgiou’s appeal of his October 2017 civil conviction for simple slander, for which he will have to pay monetary damages and make a ‘public apology’ by publishing parts of the decision to convict him in Kathimerini. In Greek law, “simple slander” means making statements that are not false but nevertheless damage the plaintiff’s reputation.

In this case, the plaintiff is Nickolas Stroblos, who was head of the National Accounts Division of the Greek statistics office from 2006 to 2010. In 2014, Stroblos objected to a 2014 press release by Georgiou where Georgiou defended the statistics produced during his time in office, noting they had always been validated by Eurostat contrary to earlier; yet, the period when fraudulent statistics, as deemed by Eurostat, were produced was not being investigated.

This fact, that Georgiou, who corrected the statistics is being investigated and not those who were responsible for the fraudulent statistics, has also been pointed out by the EU’s European Statistical Governance Board.

This is what Georgiou was stating in the 2014 press release where he was defending himself against baseless and slanderous public accusations, made inter alia by Stroblos. It should be noted in 2016, Georgiou was convicted of parallel criminal slander complaint, made by Stroblos, in criminal court but that conviction was annulled by the Greek Supreme Court on account of legal errors and irregularities in the convicting decision.

International concern, yet no change of heart in Greece

Both Eurostat and international associations of statisticians have voiced their concern. As Georgiou said when he addressed the Financial Assistance Working Group of the Economic and Monetary Affairs Committee at the European Parliament a year ago, the fact that these prosecutions have continued for seven years in Greece seriously undermines Greek and ultimately European statistics. This has long ceased to be only a Greek affair – it is a serious threat to European institutions.

In his talk Georgiou pointed out that the incentives created in Greece “are poisonous. Would the responsibility for allowing such incentives to arise burden only the Greek State or also EU institutions and other EU stakeholders that are willing to live for years with this situation, which gives rise to these incentives?”

Further, Georgiou underlined that Greece will not leave its troubles behind and prosper until “there is a firm commitment to credible official statistics. And this commitment will not be there—irrespective of anything that may be declared or signed—as long as the relentless prosecution of statisticians who followed European statistical law and statistical principles continues.”

Icelog has over the years on various occasions covered the ELSTAT case. See here a link to previous blogs on the case.

Follow me on Twitter for running updates.

EU is financing Greece – as the Greek government persecutes ex-head of ELSTAT

The horrifying political prosecutions by the Greek government against the former head of ELSTAT, ongoing for seven years, is no longer just a Greek affair. The European Union is undermining Greek and European statistics by not taking a stronger stance.

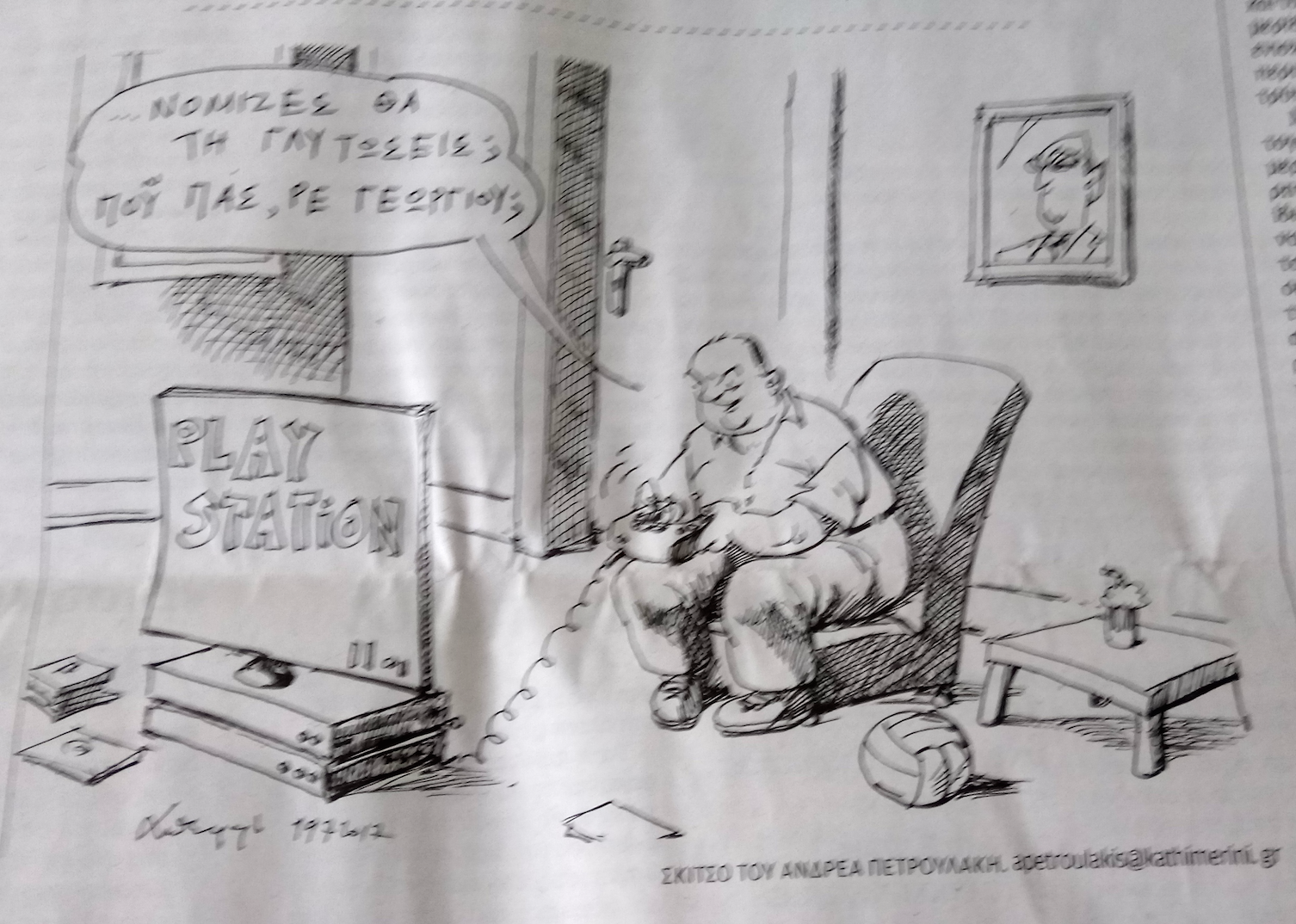

Even the Greek newspaper Kathimerini has called the relentless prosecutions of Andreas Georgiou former head of ELSTAT “witch hunt.” Last year, the paper published a cartoon showing Kostas Karamanlis playing a videogame of chasing Georgiou. Karamanlis, prime minister from 2004 to 2009, is widely seen as the driving force behind the political persecutions against Georgiou and other ELSTAT staff. Karamanlis’ party, New Democracy, is in opposition and Karamanlis long out of office. The cases against Georgiou, now running for seven years, indicate that Karamanlis is still a political force to be reckoned with, a sign of ill omen for Greece.

Andreas Georgiou had been working at the IMF in Washington when he applied for the position of head of ELSTAT. When he took over in August 2010, the systematic falsification of Greek statistics, ongoing since before 2000, had already been exposed. During his five year in office, Georgiou and his staff made the last correction, rebuilt ELSTAT, helped introduce the necessary legal framework and fully implemented the statistical principles in the European Statistics Code of Practice: professional independence, impartiality and objectivity, commitment to quality and other principles. All of this was vital in order to put Greece on a more virtuous economic path, fulfilling its duties as a member of the European Union.

But this was more than the dark forces around Karamanlis and those who had been in power during the years of falsified statistics could endure. Although Georgiou and his staff had only been doing their duty as public servants and statisticians, the first prosecution started already a year after Georgiou took over at ELSTAT.

In 2015, when his five year term ended, Georgiou left ELSTAT and has now moved back to Washington DC. However, the preposterous abuse of power continues, giving good reasons to worry about the state of justice in Greece. There are several court cases ongoing – Georgiou has been charged with damages to Greece of €171bn, violation of duty, felony and slander. Acquittals have systematically been annulled, cases re-opened and new charges brought – an utter travesty of justice.

Economists, statisticians and others in the international community have time and again expressed support for Georgiou’s case, condemning the Greek government’s behaviour and the abuse of the justice system. There is now an international fundraising to meet Georgiou’s legal costs (see here, please consider supporting it).

As Georgiou said on May 29 when addressing the Financial Assistance Working Group of the Economic and Monetary Affairs Committee at the European Parliament the fact that these prosecutions have continued for seven years in Greece seriously undermines Greek and ultimately European statistics. This has long ceased to be only a Greek affair – it is a serious threat to European institutions.

As Georgiou pointed out incentives created in Greece “are poisonous. Would the responsibility for allowing such incentives to arise burden only the Greek State or also EU institutions and other EU stakeholders that are willing to live for years with this situation, which gives rise to these incentives?”

Further, Georgiou stated he was “not happy to report all this. But Greece—which I love dearly—will leave its troubles behind and prosper only if there is a firm commitment to credible official statistics. And this commitment will not be there—irrespective of anything that may be declared or signed—as long as the relentless prosecution of statisticians who followed European statistical law and statistical principles continues.”

Allowing these prosecutions to continue within the borders of the European Union surely undermines not only European statistics everywhere and the governance of the Union, but also the fundamental principles of human rights and the rule of law that the European Union is supposed to uphold and champion in the world.

Icelog has covered the ELSTAT case extensively since I visited Greece in 2015. In “Greek statistics and poisonous politics, July 2015, I explained in some detail the whole saga of the falsified statistics, the corrections and then the processes Georgiou put in place. Here is an overview of later blogs on the ELSTAT case. – Here is the link to the crowdfunding page with a short overview of Georgiou’s case and links to international media coverage of his case. Again, please consider donating.

UPDATE: the case of Andreas Georgiou has now taken a turn for the worse. The Greek Supreme Court has rendered “final and irreversible his conviction for not submitting the 2009 deficit and debt statistics to approval by a vote (this was judged to be a violation of duty, despite the fact that the European Statistics Code of Practice is very clear that statistics are not voted upon). This conviction makes final Andreas’ conviction to 2 years in prison, which is suspended for two years unless he gets another conviction in the meantime. Moreover, there is no further recourse in the Greek justice system for this case. The next step would be to take the case to the European Court of Human Rights.” See here, please consider supporting the crowd-funding for Georgiou’s legal defence. – Following the news, around 80 chief statisticians and heads of statistical associations from all over the world have published a statement, declaring their support for the cause of Georgiou, see their statement and names here.

Follow me on Twitter for running updates.

No end to the Greek government’s relentless persecution of ELSTAT staff

In spite of earlier promises to the Eurogroup the Greek government continues to persecute former head of ELSTAT Andreas Georgiou and two of his former senior staff. As long as the never-ending prosecutions continue the Greek government cannot claim it is seriously committed to turn the country around. By continuing these persecutions the Greek government is clinging to the story that the fraudulent statistics from around 2000 to 2009 are the correct ones, thereby in effect presenting the 2010 revisions as criminal misreporting. Thus, the Eurogroup and other international partners should refuse to cooperate with the Greek government as long as these trials continue.

In spite of earlier acquittals time and again, Greek authorities keep finding new ways to prosecute the former head of ELSTAT. The latest development happened last week, July 18 and 19. As at the trial in May, there was a shouting and insulting mob of around thirty people present in court at the trial on July 18 when Georgiou was being tried for alleged violation of duty. The mob was clearly cheering on the accusation witnesses in a disturbing way; again, something that would be unthinkable in any civilised country.

On July 19, the Chief Prosecutor of the Greek Supreme Court proposed yet again to annul the acquittal of Georgiou and two senior ELSTAT staff for allegedly intentionally inflating the 2009 government deficit and causing Greece a damage of €171bn.

Mob trial

After being unanimously found innocent of charges of violation of duty in December last year by a panel of three judges, as the trial prosecutor had recommended, this acquittal was annulled by another prosecutor. This is how this farce and mockery of justice has been kept going: acquittals are annulled and on goes the persecution.

This trial will now continue on 31 July when judgement is also expected – and it can be fully expected that Georgiou will be found guilty.

This report from Pastras Times gives an idea of the atmosphere at the trial: The professor [Z. Georganda] argued that from the data she has at her disposal, she considers that the 2009 government deficit was around 4 to 5% [of GDP] – a statement, which ignited the reaction of the audience that began applauding and shouting: “Traitors” “Hang them on Syntagma square”… The witness continued her point arguing that Greece had one of the lowest deficits “but we could and we were paying our debts because there was economic activity. Georgiou led the country to prolonged recession.” Ms. Georganda said characteristically, causing the audience to explode anew.

A pattern over six years: acquittals followed by repeated prosecution

As everyone who knows the story of the discoveries made in 2009 and 2010 of the Greek state statistics Georganda’s arguments are a total travesty of the facts, a story earlier recounted on Icelog (here the long story of the fraudulent stats and the revisions in 2010; here some blogs on the course of this horrendous saga).

July 19 was the deadline for the Chief Prosecutor of the Supreme Court, Xeni Demetriou to make a proposal for annulment of the decision of the Appeals Court Council to acquit Georgiou and two former senior ELSTAT staff of the charge of making false statements about the 2009 government deficit and causing Greece a damage of €171bn. Demitrou opted to propose to annul the acquittal decision.

The Criminal Section of the Supreme Court will now consider her proposal for the annulment of the acquittal. If the latter agrees with the proposal of the Chief Prosecutor of Greece, the case will be re-examined by the Appeals Court Council. If the Appeals Court Council, under a new composition, then decides to not acquit Georgiou and his colleagues, the three will be subjected to full a trial by the Appeals Court. If convicted they face a sentence of up to life in prison.

This would then be yet another round of the same case: in September 2015, the same Prosecutor of the Supreme Court, then a Deputy Prosecutor, proposed the annulment of the then existing acquittal decision of the Appeals Court Council. In August 2016, the Criminal Section of the Supreme Court agreed to this proposal, which is why the Appeals Court Council re-considered the case.

And so it goes in circles, seemingly until the legal process gets to the “right result” – trial and conviction.

Can the three ELSTAT staff get a fair trial?

Given the fact that the same case goes in circles – with one part of the system agreeing to acquittals, which then are thrown out, in the same case – it can only be concluded that Andreas Georgiou and his two ELSTAT colleagues are indeed being persecuted for fulfilling the standard of EU law, as of course required by Eurostat and other international organisations.

As this saga has been on-going for six years it seems that the three simply cannot get a fair hearing in Greece. This raises serious questions about the rule of law in Greece and the state of human rights there.

At the same time the last chapter in this six-year saga took place now in July, €7.7bn of EU taxpayer funds, a tranche of EU and IMF funds for Greece, was paid out. This, inter alia on the basis of the statistics revised in 2010, for which the Greek state keeps prosecuting the ELSTAT statisticians thereby de facto claiming these statistics were the product of criminal misreporting.

Tsakalotos breaks his promise

As reported earlier on Icelog the Eurogroup has clearly noticed the ELSTAT case: at the Eurogroup meeting of 22 May ECB governor Mario Draghi raised the matter, saying that as agreed earlier, priority should be given to implementing “actions on ELSTAT that have been agreed in the context of the programme. Current and former ELSTAT presidents should be indemnified against all costs arising from legal actions against them and their staff.”

Greek minister of finance Euclid Tsakalotos announced that “On ELSTAT, we are happy for this to become a key deliverable before July.”

In an apparent attempt to appease the Eurogroup, it was announced this week that ELSTAT will pay legal costs for the former ELSTAT employees facing trial. However, the legal provision proposed by the government is wholly inadequate and may actually do more harm than good to Georgiou and his colleagues.

For example, it says that these official statisticians will have to return any funds they get if they are convicted. This is legislating perverse incentives. It is like saying: Convict them otherwise we will have to pay them.

The proposed legislation also puts a very low limit on the amounts that would be covered. In addition, it would not cover costs of legal counsel, costs of interpretation of foreign witnesses, nor would it cover the cost of travel and accommodation of these witnesses when they come to Greece abroad to be defence witnesses for Georgiou. There also seems to be a labyrinthine process for accessing the funds making it unlikely the accused will ever see any reimbursement of cost.

It is thus quite clear from events this week that not only has Tsakalotos broken the promise he gave to Draghi and the Eurogroup in May – he clearly has no intention of keeping it. The question is how long the Eurogroup will tolerate broken promises and the fact that by prosecuting the ELSTAT staff the Greek government does indeed keep portraying the revised statistics as criminal misreporting.

According the Kathimerini‘s cartoonist, the ELSTAT saga is a simple one: New Democracy PM 2004 to 2009 Kostas Karamanlis is unwilling to let go of the persecution – “You thought you would get away? Where do you think you are going, eh Georgiou?”

According the Kathimerini‘s cartoonist, the ELSTAT saga is a simple one: New Democracy PM 2004 to 2009 Kostas Karamanlis is unwilling to let go of the persecution – “You thought you would get away? Where do you think you are going, eh Georgiou?”

Follow me on Twitter for running updates.

Greece – still failing the ELSTAT test

Greek authorities have not yet dropped the wholly unfounded criminal cases against former head of ELSTAT Andreas Georgiou. As expressed earlier on Icelog, the ELSTAT saga is a test if Greece is beholden to a corrupt past or trying to amend its ways. So far, no amendment. And interestingly, Greece is again stalling in terms of improving the economy and disbursement of €7bn from the Eurozone are being withheld.

The case of Georgiou and two ELSTAT colleagues was again up in court in Athens on Friday, Again acquitted but in this saga, where everything goes in circles and nothing is brought to an end, it is far from certain if this really is the end. There is, yet again the distinct possibility that the Chief Prosecutor of the Supreme Court will again reverse the acquittal, as in September 2015.

Another part of this case – for some reason it has been split up and the two cases are tried separately – came up this Monday, 29 May.

Also a new criminal investigation about exactly the same issue, ordered last September by the same Chief Prosecutor, could theoretically continue and keep the case going for years to come.

Leaked minutes from the Eurogroup meeting 22 May shows that ECB governor Mario Draghi brought the ELSTAT case up right at the beginning of the meeting, asking that, as agreed earlier, priority should be given to implementing “actions on ELSTAT that have been agreed in the context of the programme. Current and former ELSTAT presidents should be indemnified against all costs arising from legal actions against them and their staff.”

Greek minister of finance Euclid Tsakalotos said that “On ELSTAT, we are happy for this to become a key deliverable before July.”

The Eurogroup has clearly noticed the ELSTAT case. It remains to be seen if Tsakalotos does indeed deliver before July. I’m told that there is a real opposition in some quarters to give earlier ELSTAT president indemnity against cost. Unless he and his staff is included this action does not have the intended effect. Hopefully, Draghi and others in the Eurogroup will not lose sight of this issue.

Sir, As you reported on May 22 (FT.com), the eurogroup failed to complete the review of the economic programme with Greece and enable the disbursement of €7bn of Eurozone member taxpayer money to Greece. Negotiations are continuing. Meanwhile, on May 29, Andreas Georgiou again went on trial for violation of duty while he was president of the Hellenic Statistical Authority (Elstat) from August 2010 to August 2015 (The Big Read, December 30, 2016).

These two strands should be linked, but to date have not been. The eurogroup and associated European organizations (the European Stability Mechanism, the European Commission and the European Central Bank) have not established the appropriate linkage.

Mr Georgiou and senior colleagues of his at Elstat are being prosecuted for doing their job in producing honest statistics about Greece’s fiscal condition for 2009, before the start of the first Greek programme, and during the first five years of programmes. Their work is central to the Greek economic reform efforts. It was based on European standards for statistical data quality. Successive Greek governments have committed to comply with those standards and to defend the professional independence of Elstat. The current government and several previous governments have failed to live up to these commitments.

We the undersigned call on the European authorities not to complete the programme review with Greece until and unless the Greek government declares publicly in writing that the statistics compiled by Mr Georgiou and his colleagues at Elstat were accurate and that they were produced and disseminated using appropriate processes and procedures based on European standards.

Michel Camdessus Paris, France; José Manuel Campa Madrid, Spain; Edwin M. Truman Washington, DC, US; Gertrude Trumpel-Gugerell Vienna, Austria; Nicolas Véron Washington, DC, US and Paris, France; Geoffrey Woglom Amherst, MA, US; Edmond Alphandéry Paris, France; Paul Armington Washington, DC, US; Ruthanne Deutsch Washington, DC, US; Robert D Kyle Washington, DC, US; Barry D Nussbaum Annandale, VA, US; Christopher Smart Boston, MA, US; Peter H. Sturm Washington, DC, US; Stephanie Tsantes Lewes, DE, US; Ronald L. Wasserstein Springfield, VA, US; Charles Wyplosz Geneva, Switzerland; Jeromin Zettlemeyer Washington, DC, US

Follow me on Twitter for running updates.

The ELSTAT saga: the latest

Former head of ELSTAT, the Greek statistical authority, Andreas Georgiou has been acquitted in the case where he was charged with misdemeanour. Three foreign statisticians came to Athens to bear witness in the case, testifying to Georgiou’s positive work on rectifying the problems of earlier false statistics.

The irony is that the Greek government is silently accepting that civil servants who fixed the problem of a decade or fraudulent statistics are being prosecuted, not those who committed the fraud for years.

But as lister earlier on Icelog this is only one of four cases Georgiou is fighting in Greece. The other cases against Georgiou are still lingering in Greek courts. In the largest case against himm where he is charged with treason for in fact correctly reporting correct statistics, the examining judge has now proposed that the case be dismissed. Stunningly, this is the fourth time a judge proposes to have the case dropped but so far it’s always risen again in a new guise.

Here is Kathimerini report on the latest trial and its outcome.

Follow me on Twitter for running updates.

The ELSTAT saga: ongoing vendetta against civil servants who saved Greek statistics

There is no end in sight of the ELSTAT saga of political vendetta against the ex ELSTAT director Andreas Georgiou who oversaw the correction of Greek statistics 2010 to 2015. Yes, the Prosecutor of the Appeals Court has recommended to throw the case of Georgiou and his colleagues out, not once but three times, only to resurface again. In addition, the case has transformed into several case all migrating through the Greek judicial system. I’ve earlier claimed that the ELSTAT case is a test of Greek political willingness to own up to the past and move on. The steadfast will to prosecute civil servants for doing their job exposes the damaging corrupt political forces still at large in Greece, a very worrying signal for the European Union and the International Monetary Fund – but most of all worrying for Greece.

If anyone thought that the long-running saga of prosecutions against ex head of ELSTAT Andreas Georgiou was over, just because so little is now heard of it, then pay attention: the case is still ongoing, there is an upcoming decision in the Appeals Court that could potentially send Georgiou to trial with the possibility of a life sentence for him. In addition, there are side stories here, other ongoing investigations and prosecutions.

The ELSTAT saga started after Georgiou had only been in office for just over year. It really is a saga (here my earlier reports and detailed account of it) of upside down criminal justice but it’s so much taken for granted in Greece that little or no attention is paid to the fundamental issue:

How is it possible that the man who as Head of ELSTAT from August 2010 until August 2015, putting in place procedures for correct reporting of statistics following the exposure of fraudulent statistics for around a decade, is being prosecuted and not the people who for years provided false and fraudulent statistics to Greece, European authorities and the world?

This case of a Hydra with many heads is rearing one of these heads next on 6 December when Georgiou is to face charges of violation of duty in producing the correct 2009 government deficit statistics. On important aspect is this: the charges imply that the Greek government isn’t accepting the correct figures on which the current bailout program and debt relief is based on.

European and international organisations have supported Georgiou’s point of view, the last being a letter from the International Association for Research in Income and Wealth (IARIW), to prime minister Alexis Tsipras now in November. However, the support from abroad does not seem to have had any effect on the prosecutions against Georgiou in Greece. As can be seen from the overview below of how the cases have sprawled in various directions there really is no end in sight. A worrying trend in a European democracy, the country that calls itself the cradle of Western democracy.

To Icelog, Georgiou says: “The numerous prosecutions and investigations against me and others that have been going on for years – as well as the persistence of political attacks and the absence of support by consecutive governments – have created disincentives for official statisticians in Greece to produce credible statistics. As a result, we cannot rule out the prospect that the problem with Greece’s European statistics will re-emerge. The damage already caused concerns not only official statistics in Greece, but more widely in the EU and around the world, and will take time and effort to reverse.”

Charges three times thrown out resurface in wider charges

The original criminal case concerned criminally inflating the 2009 deficit causing damages to Greece in the order of €171bn or €210bn (depending on how it was calculated on different occasions by his detractors). For three consecutive years – in 2013, 2014 and 2015 – investigating judges and prosecutors proposed to drop the case only to see the charges resurfacing again each and every time. In 2016, the Prosecutor of the Appeals Court assigned to the case yet again proposed that the case be dropped. A decision is pending at the Council of the Appeals Court.

The same issue of the 2009 deficit did indeed resurface in the form a separate, brand new case on 1 September this year, now not only alleging criminal actions by Georgiou and ELSTAT staff but by the EU Commission and the IMF. A separate criminal investigation has begun and is running parallel to the over five year old case above. On the losing end here are not only the individuals hit by these charges but also public statistics, Greece, EU and international partners.

A worrying disincentive to service truthful information

Now, on 6 December, Georgiou is facing a trial for violation of duty, exactly the violations that various prosecutors and investigating judges had, in 2013, 2014 and 2015, proposed to drop. However, the Appeals Court decided in 2015 to refer the case to an open trial. In Greece, this trial is being presented as doing justice for Greece, implying that earlier cases may have been dropped due to European pressure.

Again, this clearly shows that there are political forces in Greece refusing to shoulder any responsibility for fraudulent statistics and a huge cover up of the dismal governance in Greece up to the surfacing crisis in 2009.

If convicted for violation of duty, Georgiou faces a possible conviction of two years in prison. Greek statistics face an uncertain future: a trial against the people who fixed the problem of Greek statistics is hardly a great incentive to Greek civil servants to service truthful information instead of untruthful politicians.

Twelve months for “criminal slander”: told the truth but should have kept quiet

In June, Georgiou was tried for criminal slander for defending the 2009 deficit statistics, the very numbers ELSTAT produced as required by the European Statistics Code of Practice. The Court Prosecutor recommended to the Court that the case be dropped and that Georgiou be acquitted. But the Court ruled in the end that although it believed Georgiou to have told the truth he should still not have said the things he said and sentenced him to twelve months in prison.

The appeal of this conviction was due to be heard in October in the Appeals Court. However, the plaintiff – actually the former director of national accounts at the National Statistics Office (later ELSTAT) in 2006 to 2010, i.e. during the fraudulent reporting – succeeded in having the appeal trial postponed. It’s now due in 16 January 2017, possibly a tactical move to influence two other ongoing cases involving Georgiou, the above-mentioned criminal case and a civil case.

The civil case is related to the criminal slander case. Decision is due in the coming weeks and could land Georgiou with a crippling fine of tens of thousands of euro.

Protecting the perpetrator of a crime, not the victim

As reported last summer in my detailed article of the ELSTAT saga, ELSTAT’s former vice president Nikos Logothetis was found by the police to have repeatedly hacked into Georgiou’s ELSTAT email account. This started already on Georgiou’s first day as president of ELSTAT, in August 2010, before he had even started to look at the thorny issue of the 2009 deficit, and continued until the hacking was exposed late October 2010.

Police investigations showed who was responsible for the criminal action of hacking Georgiou’s account – Logothetis was actually logged into the account as the police came unannounced to his home.

Georgiou was informed that Logothetis would be prosecuted for this and that following the criminal case he could then bring a civil case against Logothetis. However, in early July this year Logothetis was acquitted of violating Georgiou’s email account in a felony case. The Court also decided Logothetis could not be retried for the felony charge due to the time passed since the hacking.

According to the ruling it was not disputed that Logothetis had indeed accessed Georgiou’s account. However, the action was deemed not to have been carried out because of monetary gains or to hurt Georgiou but only because Logothetis “wanted to understand Georgiou’s illegal actions and to legally defend the legitimate interests of ELSTAT and consequently of the Greek state.”

Quite remarkably, the felony case was allowed to wait for five years before it was considered by the Appeals Court, thus triggering the statute of limitations. In addition, somehow Georgiou received no notice of the decision of the Appeals Court on the Logothetis felony case acquittal and thus had no chance to take legal action to potentially reverse the ruling within the allowed one month period.

Furthermore, the Court hadn’t taken any note of the fact that Logothetis actually hacked the account before Georgiou even looked at the 2009 deficit numbers nor did it figure in the case that Logothetis had continuously slandered and attacked Georgiou during his five years in office, even calling for the hanging of Georgiou in a published interview.

Another case against Logothetis, also for the hacking but as a misdemeanor and not a felony, was due to go to trial now in November but has been postponed in accordance with Logothetis’ wishes. It’s now been set for February 2017.

The ELSTAT case in the European Parliament:

On 22 November the ongoing political pressure on Greek statistics and Georgiou and his colleagues was taken up in a hearing at the Committee on Economic and Financial Affairs of the European Parliament. Both Georgiou and Walter Rademacher president of Eurostat participated, presented their views and were questioned by MEPs.

Rademacher gave an overview of the problems with Greek statistics and emphasised the need to close with the past, stop going after ELSTAT staff and to recognise what had been wrong (see video; Rademacher at 2:20-12:15). Rademacher paid tribute to Georgiou and the ELSTAT staff in modernising the organisations, bringing the governance to the proper standard and thus re-establishing trust in Greek statistics, a much needed contribution.

Rademacher pointed out that the serious misreporting didn’t cause the crisis in 2009 but was a “blatant symptom of very serious flaws” within the Greek statistics administration “at that time.” He also underlined the immense effort taken by various organisations to aid and support ELSTAT in improving its work, inter alia hundred Eurostat missions since 2010 to the present day, around one a month, to ELSTAT as well as to Eurostat in-house assistance, to the cost of around €1m in addition to technical assistance from the IMF and other EU National Statistical Institutes – no other country has needed anything like this.

In his presentation, Georgiou (12:26-20:12) emphasised the enormous disincentive for official statistics in Greece his case has been.

“These and other cases and investigations send a strong signal to today’s guardians of honest, transparent statistics in Greece: you do so at your own risk. The point cannot be lost on them that compiling reliable statistics according to EU law and statistical principles can endanger their personal well-being.”

The ELSTAT case: a scary disincentive for Greek civil servants

Georgiou had only been in office for around thirteen months when political forces in Greece openly started questioning in parliament his professional integrity. That was also the time when allegation emerged of him committing treason in reporting the correct figures.

Now, more than five years later, the case is still going on in various ways. Quite remarkably, Georgiou has not had any support from the Tsipras government. Given how the ELSTAT case has progressed, there are clearly forces both in the government and in the main opposition party who have a personal and political interest in hiding the truth on how the fraudulent reporting was kept going for around a decade, until 2009 and who find a convenient scapegoat in Georgiou and his staff.

Given the strong Greek political forces at large here the only way to stop the scapegoating seems to be that the donor countries and institutions show Greece that it can’t be helped until it helps itself. Until it helps itself by putting an end to prosecuting civil servants who fixed a serious problem that severely undermined the trust in the Greek government. As it stands, there is no incentive for Greek civil servants to withstand political pressure for corrupt action.

Follow me on Twitter for running updates.

The ELSTAT case takes a new turn – IMF and Eurostat staff implicated

Anyone who has followed the Greek crisis will be familiar with stories of insane corruption and absurd clientilismo. As the criminal prosecution of the former head of ELSTAT, Andreas Georgiou, shows the Tsipras government prefers scapegoats rather than facing painful truths about the past. Now, also foreigners working for the IMF and Eurostat are being implicated in a new criminal case against Georgiou and his colleagues.

Before the January 2015 elections, which brought Alex Tsipras and his Syriza party to power, Tsipras had been adamant on the need to tackle corruption. Once in power this discourse ebbed out. Now Tsipras and his government is watching a so-called independent judiciary persecuting the former head of ELSTAT, the Greek statistical bureau, Andreas Georgiou, who demonstrably turned ELSTAT and statistics around after a decade of falsified statistics.

The latest and most remarkable turn in the ELSTAT saga is a new criminal investigation, not only focusing on Georgiou and two of his colleagues, whose cases have all been dismissed more than once (see my detailed ELSTAT saga, written after I visited Athens in June 2015) but also on the IMF and Eurostat staff.

As I have earlier pointed out the ELSTAT prosecutions are a test of the new Greece trying to be born after the crisis: as long as ELSTAT staff and now foreigners striving to bring clarity to statistics, one of the absolute pillars of any modern country, are being prosecuted Greece is failing to free itself of political corruption. The fact that the Greek state is yet again trying to prosecute civil servants who did their jobs admirably is a sign of something seriously wrong in this country.

To Icelog Georgiou says: “The prosecutions within the borders of the European Union of official statisticians, whose work has been thoroughly checked and fully validated by the competent European Union institutions for six years in a row, should be a cause of great concern given their important precedential significance at a European Union level and an international level as well.”

A new criminal investigation of ELSTAT directors – as well as IMF and Eurostat staff

The latest move was brought on by the chief prosecutor of the Greek Supreme Court, Xeni Demetriou. As a deputy prosecutor of the Supreme Court until June 2016, Demetriou had been responsible for proposing in September 2015 to annul the last acquittal decision regarding Andreas Georgiou and his two colleagues. In the event, the Supreme Court published a decision in August 2016 accepting that annulment proposal and referring the case back to the lower court so that the latter reconsider its decision.

Amazingly, in this latest move, Demetriou as chief prosecutor, initiates an additional, brand new criminal investigation. The case was brought following a publication of two articles in the Greek newspaper Dimokratia at the end of August; the articles were introduced with photos of Andreas Georgiou, as well as of Eurostat and IMF officials.

Apparently based on emails and other sources, Dimokratia focuses on the 2009 deficit calculation. The newspaper’s coverage doesn’t seem to add anything but clamours statements such as “The Mafia of the Deficit,” to what was earlier investigated and then dismissed in previous attempts to bring Georgiou and his colleagues to court. The magazine reported inter alia of burglaries to allegedly make the case against the ELSTAT directors go away, postulating that they incriminate Georgiou and his colleagues.

This new prosecution does not only involve ELSTAT directors but goes further, involving IMF and Eurostat staff. Dimokratia claims that Eurostat’s Director General Walter Radermacher forced Greece to use statistical methods not used in any other country, directly causing the high deficit. The grand scheme was to force Greece to pay foreign banks, or as stated by the magazine: “the dirty plan of the destruction of Greece was planned and executed with distorted data so that the foreign banks can be repaid completely.”

One of the Dimokratia sources is Nikos Stroblos, a former director of the national accounts division of Greece’s statistics office during the years of fraudulent reporting. As so often pointed out on Icelog: quite extraordinarily, Georgiou and ELSTAT directors who brought the reporting of statistics to international standards, are being hounded in Greece but nothing has been done to investigate what went on during the years of false reporting.

International support for Georgiou and his ELSTAT colleagues

Eurostat and the European commission have earlier voiced concern over the turn of events in Greece. On August 24 Commissioner for Employment, Social Affairs, Skills and Labour Mobility, as well as European statistics, Marianne Thyssen was adamant that the independence of ELSTAT and the quality of its statistics were essential, adding that from the point of view of the Commission and Eurostat “it is absolutely clear that data on Greek Government debt during 2010-2015 have been fully reliable and accurately reported to Eurostat.” The Commission called “upon the Greek authorities to actively and publicly challenge the false impression that data were manipulated during 2010-2015 and to protect ELSTAT and its staff from such unfounded claims.”

The International Statistical Institute, ISI, has earlier voiced great concern for the course of events in Greece and has recently, yet again, called upon “the Greek authorities to actively and publicly challenge the false impression that data were manipulated during 2010-2015 and to protect ELSTAT and its staff from such unfounded claims.”

Further, ISI, “is extremely concerned about the persecution/prosecutions of Mr. Andreas Georgiou, Ms. Athanasia Xenaki and Mr. Kostas Melfetas for doing their work with the highest professionalism, integrity and adherence to international standards and the UN Principles, regardless of political pressure. It is inconceivable that such work, independently verified and approved in line with international standards, could lead to prosecution, and even successful prosecution of those responsible. Instead, such work should be praised!”

Persecution due to correct statistics shows the Tsipras government’s ties to the past

So far, none of this has had the slightest effect on the Tsipras government.

As pointed out recently on Icelog, the case against Georgiou and his colleagues, and now also involving IMF and Eurostat staff, is a test of the Greek government’s commitment to change and to acknowledge fraudulent behaviour in the past.

As pointed out by Tony Barber in the Financial Times on September 12, Tsipras is “yet again testing his EU partners’ patience. He is not only dragging his heels on economic reform, but is letting a criminal prosecution go ahead in a blatantly politicised case against Andreas Georgiou, a former head of the national statistics agency.”

In his review of “Game Over,” ex minister of finance George Papaconstantinou’s book on his six years in politics, Peter Spiegel notes the significance of the ELSTAT case and the Greek tendency to find scapegoats: “… it is Greece’s abiding myth that somehow the day of reckoning was avoidable. Papaconstantinou’s highly readable book makes that falsehood clear. No doubt Mr Georgiou’s trial will do the same.”

As long as Alexis Tsipras and his government continue to persecute the ELSTAT directors it is clear that the old bad ways and corrupt powers are untouched and still ruling.

Follow me on Twitter for running updates.

Old and new powers in Greece – and the ELSTAT case

The re-awoken charges against ex-ELSTAT head Andreas Georgiou and two of his colleagues are attracting attention in the international media. Last, the Financial Times takes the case up on its front page today. According to recent report on EurActiv it also seems that powers in Brussel are rightly getting increasingly worried about the procedures in Greece against Georgiou.

After a trip to Athens last year I wrote about the case in detail on Icelog. When the case resurfaced now in summer I pointed out that Greek authorities were punishing the messenger instead of those who really falsified Greek statistics for roughly a decade.

The reason I find the ELSTAT case so interesting and important is that in my view it’s a test case for the willingness of the Greek political class to face the misdeeds of the past, the corruption and all the things that hinder prosperity in Greece. In addition, a country without reliable statistics can’t really claim to be a modern and accountable country.

As it is now, Greece is heading towards a political trial where those who fixed the fraud are being hounded and punished, not the perpetrators. As long as the charges against Georgiou and his colleagues are upheld it is clear that the forces who want to keep Greece as it was – weakened by corruption and unhealthy politics – are still ruling. That isn’t only worrying for Greece but for Europe as a whole.

Follow me on Twitter for running updates.

Andreas Georgiou and the eternal wait for justice in Greece

The case of Andreas Georgiou has again surfaced in the Greek media – a case that’s still unresolved, leaving Georgiou living with the same uncertainty as in the last decade, and potentially facing severe cost. His case is also a sad example of political corruption in Greece, the politically convenient disregard by EU institutions and the unwillingness of other EU politicians to express view on actions taken in other countries than their own – being too polite, as Mario Monti once said. Georgiou’s case also shows that civil servants, who are not whistleblowers, have little or no protection against corrupt politicians.

In autumn 2009, Greek authorities were found one more time to have falsified national statistics regarding the government deficit; this time the falsified accounts led to a massive debt crisis in Greece and the EU. In the following months, the statistics were corrected in several steps. The last bit was corrected in late 2010, by the then new head of ELSTAT, Andreas Georgiou, who had been headhunted from the IMF to oversee necessary changes at the Greek statistics office. That has turned into a legal nightmare for Georgiou, exposing political corruption in Greece and unwillingness to acknowledge what went on at the time before the Greek statistics were finally fully corrected. Georgiou has been persecuted but it beggars belief that the falsification of the statistics – who organised it and why – has never been investigated.

Over the years, Georgiou has faced a flurry of legal cases. Some of these cases have evaporated over the eleven years since investigations against him first began in September 2011. There are however still two ongoing cases against Georgiou: criminal conviction for violation of duty, now being tried at the European Court of Human Rights, ECHR, and a civil case for slander.

Recent coverage of Georgiou’s case in Greek media shows that the cases are not forgotten but yet, there is never any attention paid to the original sin in this case: the falsification of the Greek statistics that played its part in pushing Greece and the EU into financial crisis.

Waiting for the ECHR

In 2011, a criminal investigation for violation of duty was opened against Georgiou. This happened only a year after he was trusted to take office in order to put into practice European rules and regulations regarding public finance statistics. In 2013, he faced criminal charges for violation of duty. He was acquitted at the First Instance Court, but inexplicably that acquittal was annulled a few days later. In 2017, two years after he left office, Georgiou was convicted at the Appeals Court and sentenced to two years in prison, suspended unless there would be a second conviction.

The conviction related to not putting the revised statistics of the government deficit, from November 2010, to vote at the then board of the Greek national statistics office. By not doing it, Georgiou followed European rules: the statistics are the sole responsibility of the head of the national statistics office in any EU member state.

After the Greek Supreme Court dismissed Georgiou’s appeal case, Georgiou took the case to the ECHR on account of violations of his human rights by Greek courts in the process of convicting him for violation of duty. ECHR accepted to consider the case in late 2021. The Greek government was given the opportunity to voluntarily acknowledge that Georgiou’s human rights had been breached in this case.

So far, the government has not only not taken that opportunity, but it has submitted arguments to ECHR in May 2022 that there was no such violation and, effectively, that the Greek courts rightly convicted Georgiou. Greece now risks a condemnation by the ECHR as the latter adjudicates the case of Georgiou vs Greece. If Georgiou wins at the ECHR, then, according to Greek law, he would be entitled to be retried in Greece. While that might be a long process, it would give Georgiou – at least in theory – a path to exoneration in his birth country.

“The simple slander” – where statements found to be true can still be used against defendant

In the civil case Georgiou still faces, the plaintiff is Nikos Stroblos, former director of Greek national accounts statistics from 2006 to 2010 and notably still working at ELSTAT. The case refers to a press release Georgiou issued in 2014, when he was already finding himself subjected to criminal prosecutions, alleging that he inflated the government deficit figures so that Greece would incur extraordinary damages and be subjected to the EU supported economic adjustment programs.

Stroblos claimed that when Georgiou defended the revised Greek government deficit and debt data for 2006 to 2009 – a revision validated multiple times by Eurostat – it was damaging for Stroblos’ reputation. In 2017, a Greek First Instance Court found Georgiou liable for something called “simple slander:” that is, the Court ruled Georgiou had told the truth but by telling the truth he damaged Stroblos’ reputation. Georgiou appealed to the Appeals Court but lost.

Following the Appeals Court ruling, Georgiou was to pay Stroblos a compensation of EUR10,000 plus interest since 2014, in addition to paying Stroblos’ legal expenses and publishing large part of the court decision in the Greek newspaper Kathimerini, as a ‘public apology.’ A delay in publishing the apology would result in a fine of EUR200 a day.

In autumn last year, there was a court injunction against Stroblos enforcing the ruling. This case is now set to come up in the Greek Supreme Court in January 2023. The positive outcome for Georgiou would be to get the ruling annulled as the case would then have to be retried by the Appeals Court, possibly in 2024 or later.

The injunction means that Stroblos can’t, for the moment, seize assets Georgiou has in Greece, including the home of Georgiou’s mother, which is in Georgiou’s name. Consequently, not only is Georgiou facing serious financial threats by Stroblos but also his wider family. Although a retrial would be a positive outcome, since it gives Georgiou the possibility of exoneration in his country and – importantl – not losing his family’s home, it also means a continued legal fight for years to come, with no end in sight for the uncertainty for him and his family.

On whose side is the Greek government?

Greek politicians have often claimed – usually to foreign media – that they have nothing to do with Georgiou’s cases. The Greek court system is independent, they claim, as it should be in any democratic state.

That there has been no political interference can definitely be disputed – and as pointed out before: there has never been any political will to investigate the saga of the falsified statistics, which happened before Georgiou took office.

One indication of where the Greek government’s allegiance is in the case of the civil suit by Stroblos is that he has had financial support from the government for pursuing Georgiou in court. As previously reported on Icelog, the Syriza government, then in office, funded a significant part of Stroblos’ legal fees, which seems an abuse of the law under which the funds were provided.

The 2017 law was supposed to assist “current and former ELSTAT presidents” against legal actions arising against them. Instead, the Greek government perverted this intent and funded the misguided efforts of an individual, challenging the very statistics the ECB and Eurogroup sought to defend. A stunning perversion of the intended purpose of these funds, underscoring that the Greek government has funded, at least in part, an effort to continue the persecution of Georgiou.

In 2017, in the midst of Georgiou’s political persecution, the European Central Bank, ECB, and the Eurozone Finance Ministers had pressed the Greek government to provide funding to assist Georgiou in defending his statistics against the legal actions in Greece. As previously reported on Icelog, leaked minutes from the Eurogroup meeting 22 May 2017 show that ECB governor Mario Draghi had brought the ELSTAT case up at the beginning of the meeting, asking that, as agreed earlier, priority should be given to implementing “actions on ELSTAT that have been agreed in the context of the programme. Current and former ELSTAT presidents should be indemnified against all costs arising from legal actions against them and their staff.”

The answer from the Greek minister of finance Euclid Tsakalotos was that “On ELSTAT, we are happy for this to become a key deliverable before July (2017).” – Needless to say, the Greek government has not taken the action promised. Sadly, EU institutions have not pursued the matter.

On a visit to Washington DC this past May, Greek prime minister Kyriakos Mitsotakis of the now ruling New Democracy party was asked about Georgiou’s case. The question came up as the US State Department has pointed out Georgiou’s case (see here, under section E. Denial of Fair Public Trial) in its latest report on human rights. Mitsotakis said it wasn’t appropriate for him to comment on an ongoing legal case, but he would like to see it finished. Further, he claimed the Greek justice system had a structural and systemic problem; cases took far too long but his government was working on solving that problem (see here, 21:28-22:59).

It is worth noting that Mitsotakis made his comment just before his government submitted arguments against Georgiou in ECHR.

Although Mitsotakis is right about the slow workings of the Greek courts, that is not the main problem facing Georgiou. His case shows how the justice system has indeed been weaponised for political motives in order to persecute a civil servant who did his job.

International attention – recent coverage

It is rare that a public servant is prosecuted for doing his job. Georgiou’s case has over the years attracted international attention and been decried by professional organisations such as the American Statistical Association, the International Statistical Institute, the Royal Statistical Society, the International Science Council and others (see here, here and here for recent public statements and letters) .

At the same time, however, there has been deafening silence for a couple of years now from the side of the European Commission regarding the above two instances of obviously politically motivated legal proceedings against Georgiou. These cases used to be monitored and publicly commented on by the Commission in its quarterly reports (that were part of the post-program surveillance of Greece) until the end of 2019. However, starting in 2020, all mention of the persecution has been expunged from subsequent post-program surveillance Commission reports, for what can only be seen as political convenience. By doing this, the European Commission is planting the seeds for further problems for European statistics.

The case of Andreas Georgiou also draws attention to the fact that in many countries, also at a European level, regulation connected to whistle-blowers has been strengthened. However, persecuting civil servants for doing their job is rare. Subsequently, little attention has been paid to that danger in European countries or at EU level. Georgiou’s case shows that when this is the case, also at European level, there is little or no protection to be had.

*See here for earlier Icelog blogs on Georgiou’s case.

Follow me on Twitter for running updates.

The Georgiou case: from bad to worse, also for Greece

Parts of Greece are consumed by horrifying wildfires but in the Greek legal system there is a slow-burning fire exposing Greek corruption, linked to the Greek financial crisis of more than a decade ago. The relentless persecution of Andreas Georgiou is not only a personal matter but is part of a saga of political corruption and European weaknesses.

In autumn 2009, when the financial crisis in Greece was coming to the surface, Greece was found out, for the second time, of having falsified its national accounts, i.e. the statistics of national debt, deficit and GDP. When a Greek IMF statistician, Andreas Georgiou took over as the new head of ELSTAT, the Greek statistical office, the statistics had already been partly adjusted. It fell to Georgiou to make the final adjustment after he took office in August 2010.

In September 2011, an array of legal investigations of Georgiou and some of his colleagues were opened. The first criminal charges, for alleged inflation of the deficit and for violation of duty, by revising the previously falsified statistics, were brought in 2013. Later, cases against other ELSTAT staff were dropped but the legal case remaining against Georgiou is a civil case, where the plaintiff is Nikos Stroblos, director of Greek national accounts statistics from 2006 to 2010 and still working at ELSTAT.

Stroblos sued Georgiou for slander. Stroblos maintained that when Georgiou made a statement in 2014, defending the revised Greek deficit and debt data for 2006 to 2009 – a revision validated by Eurostat – it had been damaging for Stroblos’ reputation. In 2017, a Greek First Instance Court found Georgiou instead liable for something called “simple slander:” that is, the Court ruled Georgiou had told the truth but by telling the truth he damaged Stroblos’ reputation.

The Court ruled that Georgiou should pay Stroblos a compensation of EUR10,000 plus interest since 2014, pay Stroblos’ legal expenses and publish large part of the court decision in the Greek newspaper Kathimerini, as a ‘public apology.’ A delay in publishing the apology would result in a fine of EUR200 a day.

Georgiou’s appeal of the First Instance Court decision was rejected last winter by an Appeals Court. Now Georgiou has taken his appeal to the Greek Supreme Court. After his appeal was submitted to the Supreme Court, Stroblos presented Georgiou with a demand for immediately fulfilling the 2017 court decision: an immediate payment of EUR18,433 (the original EUR10,000 plus interest), to publish within fifteen days the excerpts of the court decision, with the EUR200 fine a day for any delay.

By the end of a year, this amount will be EUR73,000, rising quickly. If there is no payment in full of the award and any fines, the plaintiff can at any time seize funds or assets Georgiou has in Greece, including the home of Georgiou’s mother, whose home is in Georgiou’s name.

It is interesting to note that Stroblos made this demand two weeks after Georgiou had filed to the Greek Supreme Court a request for annulment of the Appeals Court decision in Stroblos’s case against Georgiou.

Political “heresies”

The Greek government is not an innocent bystander in this civil case. The government has given Stroblos financial support in his case against Georgiou. Georgiou put Greek national accounts in order. Stroblos was working at the Greek statistical office at the time of the falsified accounts. The Greek government has actively supported cases against Georgiou, a civil servant who did his duty in an exemplary way. The government has made no attempt at all to investigate who ordered the national accounts to be falsified and who then carried out that order, not just once but ongoing for about a decade before the final reckoning in autumn of 2009.

Greek political forces have pursued investigations and court cases against Georgiou with the relentlessness of the 17th century Roman Inquisition when Italian political and clerical forces at the time wanted the “heresy” of Galileo Galilei’s heliocentrism stamped out. At the centre of the Greek case is a political battle of corrupt forces holding on to a certain version of the saga of the Greek financial crisis.

As long as the corrupt forces are shown to be so relentless and so strong, Greek civil servants can’t be at ease in doing their job. They can’t be sure that the rule of law will protect them in doing their duty. On the contrary, the lesson they can draw from the Georgiou case is that should they inadvertently go against political interests, they can have years and decades of their lives blighted by legal wrangling with a state that isn’t there to protect correct procedures but to protect corrupt political forces.

As long as the Georgiou case is ongoing, Greece as a modern European democratic country is not in a good place. Human rights of a former public servant have been severely challenged in the Georgiou case.

Empty Greek promises to the EU

However, this story of relentless persecution of the former head of ELSTAT, does not solely touch Greece. It is also a matter for the European Union.

During his time as governor of the European Central Bank, Mario Draghi brought the Georgiou case up in a meeting of EU finance ministers in May 2017, as Icelog has previously reported. Leaked minutes from the Eurogroup meeting 22 May 2017 show that Draghi asked that Greece, as agreed earlier, took action to execute what had already been agreed in the EU programme for Greece: “Current and former ELSTAT presidents should be indemnified against all costs arising from legal actions against them and their staff.” Greek minister of finance Euclid Tsakalotos answered that “On ELSTAT, we are happy for this to become a key deliverable before July.”

This was July 2017 but so far, this promise hasn’t been delivered. The Greek Government indeed perverted the promise to assist “current and former ELSTAT presidents” in legal actions against them. Instead of aiding Georgiou, the provision was used to also fund the misguided efforts of Stroblos in challenging the very statistics the ECB and Eurogroup sought to defend. A shocking perversion of the purpose of these funds.

Statistics are a key tool in any modern country or organisation. Georgiou has had support from the European Parliament and from European and international statistical associations. The American Statistical Association, which has long followed the Georgiou case and supports him fully, has already reacted to this latest turn in the Georgiou case, asking for the persecution to end with a complete exoneration of Georgiou. ASA President Katherine Ensor points out that the latest turn “is also a clear message to Greek official statisticians not to speak up. All this is undoubtedly detrimental for official statistics, evidence-based policymaking and informed democratic processes, not to mention human rights of scientists.”

The European Union is dependent on sound national accounts and statistics from its member countries. It is very worrying that it has not taken a more decisive action in the Georgiou case. The work done by Georgiou at ELSTAT was guided by European Statistical System principles. By allowing Greek political forces to undermine this work and persecute a national statistician, the European Union is undermining its own statistics. The European Union should understand the importance of shielding civil servants in the member states against political forces, undermining the vital tool that statistics are.

*Icelog has followed the Georgiou case from 2015. Here is the last blog on the case, with links to earlier blogs.

Follow me on Twitter for running updates.