Iceland – will there be a Progressive-led coalition with the Independence Party?

The leaders of the Progressive Party and the Independence Party are still optimistic that their Government is just about to come into being or at least soonish. This means that a 1990s Government is almost reborn, though with one noticeable change, Icelandic tycoons like Thor Björgólfsson are rich again, people are again borrowing to buy shares in the capital controls’ fast expanding bubble. But will the two parties really be able to form a Government – and who will pay for the after-party if a bubble is forming?

The new political star in Iceland is undoubtedly Sigmundur Davíð Gunnlaugsson who single-handedly secured his vanishing Progressive Party a remarkable victory. The party, which only last year was nothing but a Cheshire cat grin, is now a big fat cat again. A cat that climbed from miserable ca. 10% in polls last year to 25% in the recent elections. Gunnlaugsson now has to secure the victory by taking the expected jump into the Prime Minister’s office.

With good times returning in Iceland – asset inflation, probably due to the bubble-making side-effects of capital controls – it seems in tune with the times that the Government just about to be born is a remake of former times. A remake though with the clear difference of the Progressives about to become the leading party. Compared to earlier times, the roles are now reversed and the rules of political law in Iceland might be broken: contrary to former times, it is no longer the Independence Party that leads.

The difficult, nigh impossible, choice of the Independence Party

After the elections I was certain the Independence Party would get the mandate to form a Government. After all, they did get most votes and I thought the Progressives would be much less likely to get other parties under their wings. The Progressives were, as I saw it, burdened with unenforceable campaign promises on private debt relief and I thought no party would be willing to tie their political fortune to this promise. I was wrong – they did get the mandate, two of the six parties elected recommended that the Progressives went ahead. They then did get the IP to the negotiation table, attempting to form the only possible two-party coalition.

I still find it difficult to believe the IP will actually go into a Progressive-led Government but then, I might very well be wrong on that one too. Many point out that the IP will feel it has to get into Government, no matter what and not leading it would be a small, or at least a tolerable, price to pay.

My feeling is that were this Government to materialise, Bjarni Benediktsson, its leader, might soon be in the situation David Cameron has been in ever since the Conservatives got to lead a coalition. Both leaders are weak within their own parties. For Cameron, merely getting to lead a coalition and not a majority Government is seen as his failure. For Benediktsson, getting into Government but merely as the second violin, might very well be held against him for the coming years.

No matter what, Benediktsson’s position will be difficult – unless he gets to lead a Government, which for the time being does not seem to be a likely outcome. Certainly, many is his parliamentary group dread being led by the Progressive Party. I still find it difficult to believe that this Government will materialise since I hear voices from the IP saying they could not possibly support such a coalition. But then the option of staying out of Government might focus these minds.

Is there any real progress in the coalition talks?

The two leaders have so far only been willing to say, every other day or so, that the talks are going well and a Government will soon come into being. This weekend, Benediktsson says they were discussing tax system changes, debt relief and the economy in general. Changes to the tax system, not only lower taxes, is an IP campaign promise the party will not back down from, he says. The Progressives did not have a firm stand on this issue but debt relief is not merely the Progressives’ Big Thing but so much did they make of it that it almost is their whole raison d’etre.

The Progressives promised to squeeze ISK300bn out of the estates, i.e. from the foreign creditors owning them, of Glitnir and Kaupthing. This money was/is then to be distributed to households in need. The opponents said this would mostly land with well-off families with high debt but able to pay down their debt, i.e. not the most in need. Their reasonably well-off middle class voters will now be waiting for the cheque and if it doesn’t appear some time soon they will feel betrayed.

If the two leaders are still discussing these key issues and have not reached an agreement one wonders what they have been talking about since the talks started some ten days ago. And why they still feel so optimistic.

Other options?

Theoretically, there are several options open to form a Government of three or more parties. However, nothing seems to be stirring in that direction. The Social democrats, the third largest party, seems to be in tatter after its shattering results. As the left tends to do in Iceland, the party is far from united behind its new leader, Árni Páll Árnason who is not seen to have the authority needed to lead the party into a new Government, were the occasion to rise.

The state of the economy, the damaging capital controls and the advisers

As pointed out on Icelog earlier, the greatest challenge for the next Government is to get Iceland out of the conundrum of capital controls and the challenge of refinancing both sovereign debt and debt of several big entities in the coming years. The Central Bank of Iceland keeps a close eye on the possible side effects such as asset bubble. In its latest report (p. 25-26) on financial stability the CBI points out the risks but its over-all conclusion is that so far all good – no bubble.

Though based on limited data and, to certain degree only anecdotal evidence, I disagree. I think the bubble is building up fast and furiously, as can for example be seen from recent IPOs of two insurance companies, TM and VÍS, whose price has risen respectively by 33.6% and 28.3% though the fundamentals have not changed. Pension Funds’ assets are rising fast – and, most scarily, I am told that banks are again lending companies and individuals to buy shares, something that characterised Icelandic banking before the collapse.

The capital controls have – again, based on anecdotal evidence – for real changed business activities. I.a. companies are buying assets abroad in order to avoid bringing precious foreign currency back to Iceland. There are rumours of small financial companies specialising in “control-avoidance” measures. And a propos the CBI: persistent rumours say a Progressive-IP coalition would be more than happy to see Governor of the CBI Már Guðmundsson leave but so far, no names are circulating as to who might succeed him.

The CBI offers the possibility of bringing foreign capital into the country for new investments, allowing the investor to exchange half of the funds invested at the more favourable ISK off-shore rate. Consequently, those investors get 20-25% more for their funds than investors using solely domestic funds. This creates inequality in the business community, which in the long run is both unfair and a potential danger to competition.

Talking to a foreign economist recently, he asked why Iceland could not just borrow its way out of the controls, i.e. extending maturities by borrowing to pay off foreign liabilities. After all, Iceland is a fairly sound European country. – The problem is that the potential lenders are among the creditors of the Glitnir and Kaupthing estates who want to see how they fare in getting hold of their assets before agreeing to further lending. In numbers the funds needed are small but they are large, measured against the GDP – somewhere between 60 to 150% of the economy, depending on how the problem is calculated. This, added to a present sovereign debt of a quite reasonable 60%, would take the debt levels uncomfortably high.

If the Progressives get to lead a Government they will have to form a policy not only to fleece the creditors but to maintain a constructive relationship. Since last year, all sorts of people have been coming up with possible solutions to the capital controls. One of those is a banker, Sigurður Hannesson, who earlier worked for Straumur, where Thor Björgólfsson was the largest shareholder, as in Landsbanki (with his father). Hannesson, now running the Jupiter fund, related to MP Bank (where David Rowland is a large shareholder) was against the Icesave agreement and is now said to be advising Gunnlaugsson on the issues regarding the foreign creditors and the estates. – And yes, with the sale of Actavis, Björgólfsson seems to have found his financial ground again though his creditors, such as Deutsche Bank, might also get a cut of his Actavis profits. Yet another sign of things returning to the pre-collapse state.

Although Iceland has returned to growth it will be a struggle in the long run to sustain growth with capital controls. The longer the Icelandic economy has to endure capital controls the greater the danger of permanently changing the business climate – and damaging the economy.

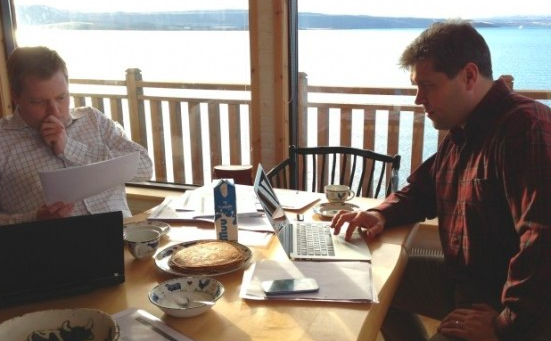

This photo appeared on Rúv last week, with Benediktsson to the right and Gunnlaugsson to the left. The photo is taken by Svanhildur Hólm, Benediktsson’s adviser, during the coalition talks, at the summer house of Benediktsson’s father. Incidentally, both leaders come from wealthy families and having a summer house, as Benediktsson’s family does, on the shores of Þingvallavatn (the lake at Thingvellir) speaks of old wealth and status in Iceland. Later, the two leaders met at the country house of Gunnlaugsson’s father-in-law, a wealthy businessman. Having exhausted family houses outside of Reykjavík the leaders have then been meeting in the capital.

This photo appeared on Rúv last week, with Benediktsson to the right and Gunnlaugsson to the left. The photo is taken by Svanhildur Hólm, Benediktsson’s adviser, during the coalition talks, at the summer house of Benediktsson’s father. Incidentally, both leaders come from wealthy families and having a summer house, as Benediktsson’s family does, on the shores of Þingvallavatn (the lake at Thingvellir) speaks of old wealth and status in Iceland. Later, the two leaders met at the country house of Gunnlaugsson’s father-in-law, a wealthy businessman. Having exhausted family houses outside of Reykjavík the leaders have then been meeting in the capital.

Follow me on Twitter for running updates.

What is happening in the interim? Does Iceland right now have a caretaker government? I mean, who is running Iceland’s affairs until the new government is formed?

Rajan P. Parrikar

14 May 13 at 7:12 pm

While the new one is not in place, the present government is the one voted in in March 2009.

Sigrún Davíðsdóttir

18 May 13 at 11:18 pm

I actually wanted to construct a quick word so as to thank you for some of the lovely steps you are giving out at this site. My long internet look up has now been recognized with really good information to write about with my friends and classmates. I ‘d believe that most of us visitors actually are extremely endowed to exist in a fabulous community with so many special professionals with valuable pointers. I feel truly lucky to have discovered the website page and look forward to so many more exciting minutes reading here. Thanks again for everything.

kyrie 9

18 Jan 24 at 1:18 am

I’m commenting to let you know of the cool experience my cousin’s daughter went through checking your webblog. She noticed a wide variety of issues, including what it’s like to have an excellent coaching heart to have folks clearly gain knowledge of selected tricky subject areas. You actually did more than our desires. Many thanks for providing the valuable, dependable, informative as well as easy guidance on this topic to Janet.

nike dunks

20 Jan 24 at 4:19 am