The al Thani story behind the Kaupthing indictment (updated)

The Office of the Special Prosecutor is indicting Kaupthing’s CEO Hreidar Mar Sigurdsson and Kaupthing’s chairman Sigurdur Einarsson for a breach of fiduciary duty and market manipulation in giving loans to companies related to the so-called ‘al Thani’ case; indicting Kaupthing Luxembourg manager Magnus Gudmundsson for his participation in these loans and Kaupthing’s second largest shareholder Olafur Olafsson for his participation. In addition, Olafsson faces charges of money laundering because he accepted loans to his companies without adequate guarantees.

In September 2008 Kaupthing made much fanfare of the fact that Sheikh Mohammed bin Khalifa al Thani, a Qatari investor related to the Qatar ruler al Thani, bought 5.1% of Kaupthing’s shares. The 5.1% stake in the bank made al Thani Kaupthing’s third largest shareholder, after Olafsson who owned 9.88%. This number, 5.1%, was crucial, meaning that the investment had to be flagged – and would certainly be noticed. Einarsson, Sigurdsson and Olafsson all appeared in the Icelandic media, underlining that the Qatari investment showed the bank’s strong position and promising outlook.

What these three didn’t tell was that Kaupthing lent the al Thani the money to buy the stake in Kaupthing – a well known pattern, not only in Kaupthing but in the other Icelandic banks as well. A few months later, stories appeared in the Icelandic media indicating that al Thani wasn’t risking his own money. More was told in SIC report – and now the OSP writ tells quite a story. A story the four indicted and their defenders will certainly try to quash.

The story told in the OSP writ is that on Sept. 19 Sigurdsson organised that a loan of $50m was paid into a Kaupthing account belonging to Brooks Trading, a BVI company owned by another BVI company, Mink Trading where al Thani was the beneficial owner. Sigurdsson bypassed the bank’s credit committee and was, according to the bank’s own rules, not allowed to authorise on his own a loan of this size. The loan to Brooks was without guarantees and collaterals. This loan, first due on Sept. 29 but referred to Oct. 14 and then to Nov. 11 2008, has never been repaid. – Gudmundsson’s role was to negotiate and organise the payment to Brooks. According to the charges he should have been aware that Sigurdsson was going beyond his authority by instigating the loan.

But this was only the beginning. The next step, on Sept. 29, was to organise two loans, each to the amount of ISK12.8bn, in total ISK25.6bn (now €157m) to two BVI companies, both with accounts in Kaupthing: Serval Trading, belonging to al Thani and Gerland Assets, belonging to Olafsson. These two loans were then channelled into the account of a Cyprus company, Choice Stay. Its beneficial owners are Olafsson, al Thani and another al Thani, Sheikh Sultan al Thani, said to be an investment advisor to al Thani the Kaupthing investor. From Choice Stay the money went into another Kaupthing account, held by Q Iceland Finance, owned by Q Iceland Holding where al Thani was the beneficial owner. It was Q Iceland Finance that then bought the Kaupthing shares. As with the Brooks loan, none have been repaid.

These loans were without appropriate guarantees and collaterals – except for Serval, which had al Thani’s personal guarantee. After noon Wed. Oct. 8, when Kaupthing had collapsed, the US dollar loan to Brooks was sent express to Iceland where it was converted into kronur at the rate of ISK256 to the dollar (twice the going rate in Iceland that day) and used to repay Serval’s loan to Kaupthing – in order to free the Sheik from his personal guarantee.

This is the scheme, as I understand it from the OSP writ. And all this was happening as banks were practically not lending. There was a severe draught in the international financial system.

The Brooks loan is interesting. It can be seen as an “insurance” for al Thani that no matter what, he would never lose a penny. When things did go sour – the bank collapsed and all the rest of it – this money was used to unburden him of his personal guarantee. Otherwise, it would have been money in his pocket. It’s also interesting that the loan was paid out to Brooks on Sept. 19, his investment was announced on Sept. 22 – but the trade wasn’t settled until Sept. 29. This means that his “guarantee” was secured before he took the first steps to become a Kaupthing investor.

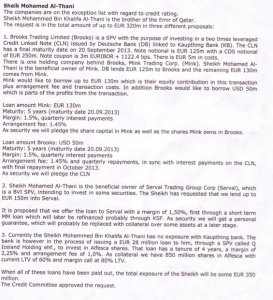

Apparently, Kaupting’s credit committee was in total oblivion of all this. The CC was presented with another version of reality. Below is an excerpt from the minutes regarding the al Thani loan, discussed when the Board of Kaupthing Credit Committee met in London Sept. 24. 2008 (click on the image to enlarge).

Three things to note here: that the $50m loan “is parts of the profits from the transaction.” Second, that al Thani borrowed €28m to invest in Alfesca. It so happens that Alfesca belonged to Olafsson. Al Thani’s acquisition in Alfesca was indeed announced in early summer of 2008 and should, according to rules, have been settled within three months. At the end of Oct. 2008 it was announced that due to the market upheaval in Iceland al Thani was withdrawing his Alfesca investment. Thirdly, it’s interesting to note that Deutsche bank did lend into this scheme – as it also did into another remarkable Kaupthing scheme where the bank lent money to Olafsson and others for CDS trades, to lower the bank’s spread; yet another untold story.

According to the OSP writ, the covenants of the al Thani loans differed from what the CC was told. It’s also interesting to note that the $50m loan to al Thani’s company was paid out on Sept. 19, five days before the CC meeting. This fact doesn’t seem to have been made clear to the CC.

The OSP writ also makes it clear that any eventual profits from the investment would have gone to Choice Stay, owned by Olafsson and the two al Thanis.

Why did al Thani pop up in September 2008? It seems that he was a friend of Olafsson who has is said to have extensive connection in al Thani’s part of world. Olafsson’s Middle East connection are said to go back to the ‘90s when he had to look abroad to finance some of his Icelandic ventures. London is the place to cultivate Middle East connections and that’s also where Olafsson has been living until recently. It is interesting to note that the Financial Times reports on the indictments without mentioning the name of Sheikh al Thani.

The four indicted Icelanders are all living abroad. Sigurdur Einarsson lives in London and it’s not known what he has been doing since Kaupthing collapsed. Hreidar Mar Sigurdsson lives in Luxembourg where he, together with other former Kaupthing managers, runs a company called Consolium. His wife runs a catering company and a hotel in Iceland.

Magnus Gudmundsson also lives in Luxembourg. David Rowland kept him as a manager after buying Kaupthing Luxembourg, now Banque Havilland, but Rowland fired Gudmundsson after Gudmundsson was imprisoned in Iceland for a few days, related to the OSP investigation. In the Icelandic Public Records it’s said that Olafsson lives in the UK but he has now been living in Lausanne for about two years. In Iceland, he has a low profile but is most noted in horse breeding circles, a popular hobby in Iceland. He breeds horses at his Snaefellsnes farm and owns a number of prize-winning horses.

Following the indictment, Olafsson and Sigurdsson have stated that they haven’t done anything wrong and that the al Thani Kaupthing investment was a genuine deal. The case could come up in the District Course in the coming months. But perhaps this isn’t all: it’s likely that there will be further indictment against these four on other questionable issues related to Kaupthing.

*The OSP indictment, in Icelandic.

**Does it matter that the four indicted are all living abroad? When I made an inquiry at the Ministry of Justice in Iceland some time ago whether Icelanders, living abroad but indicted in Iceland, could seek shelter in any country in Europe by refusing to return to Iceland I was told they couldn’t. If an Icelandic citizen is indicted in Iceland and refuses to return, extradition rules will apply. In this case, Iceland would be seeking to have its own citizens extradited and such a request would be met. – It has been noted in Iceland how many of those seen to be involved in the collapse of the banks now live abroad. It can hardly be because they intend to avoid being brought to court – they would have to go farther. Ia it’s more likely they want to avoid unwanted attention. For those with offshore funds it might be easier to access them outside of Iceland rather than in a country fenced off by capital controls.

Follow me on Twitter for running updates.

Very many thanks Sigrun for providing this story as told in the OSP writ for the benefit of those of us unable to read Icelandic. And what a story it is!

One thing you don’t mention is the extradition situation as you say all those indicted are now living outside Iceland?

anrigaut

23 Feb 12 at 7:56 pm

Thanks for asking. I’ve now added an update with an answer to this question.

Sigrún Davíðsdóttir

23 Feb 12 at 10:21 pm

Exellent story. As a fool who left existing deposits and indeed made additional deposits into a Kaupthing subsiary account on the basis of the September 2008 Al Thani announcement, I hope these (alleged) crooks get everything that is coming to them.

Perhaps the reason that the Financial Times did not mentioned Al-Thani is because UK is becoming increasing reliant on Qatari financing not to mention natural gas.

eveblog

24 Feb 12 at 10:30 am

Hi Sigrún,

I’ve been catching up my reading of your posts as things move along. I have a couple of questions from reading this one. Perhaps you can ask on to the Special Prosecutors for answers.

First, however, in your 4th paragraph you write of the loan you note originated Sept. 19, “This loan, first due on Sept. 9”. I assume the “Sept. 9” is a typo and that “29” was meant. Ten days on would be normal, and would coincide with the “settlement” date you note in your 8th paragraph.

Do you remember the Glitnir situation in September 2008, that led to its destruction? That Glitnir had a loan extension affirmed and confirmed, to settle on the roll-over date, but then Lehman collapsed and the extension was withdrawn? Glitnir “had the loan”, but not finally until the settle date, when, for market circumstances it was withdrawn. All that was very much out in the open, normal business, etc. Do you notice the similarity to the Kaupthing al Thani business you report? Loans being “loans”, but not real loans until finalized in settlement? The settlement date, Sept. 29 was not before the Credit Committee meeting on Sept 24, which would put the real loan after, and with that “loan” “called” on the same date would make it not a real loan, but a place-holder, a fix of the arranging done before, with the real lending occurring then.

That sort of thing is not uncommon in dealings world-wide. Are pieces missing, or is the SPO separating corollary events for stage-effects or misunderstanding?

Next, I am confused by the allegation of “money-laundering” in a case where it appears the first allegation is that no money was received, that all the money was Kaupthing’s, lent to and through special purpose vehicles to purchase Kaupthing shares (which, absent payment of the loan amounts from the purchaser, from outside Kaupthing, would remain Kaupthing-owned and so collateral for their purchase-price value). Kaupthing’s money would be, presumably, ‘clean’, and so not in need of laundry, so it would only be outside money (from al Thani?) that would potentially be dirty. Thus, though spv-shuffling is used to scrub the trail of money from illicit origins, the money has to come in from somewhere, or have gone out to get dirtied, then come back.

Can you find out if something got left out, or if someone saw an spv-shuffle and thought “Washing-machine!” and forgot to check further?

Thanks.

RLD

R.L.Dogh

26 Feb 12 at 1:04 am

[…] : http://uti.is/2012/02/osp-brings-charges-in-the-al-thani-case/ & The al Thani story behind the Kaupthing indictment […]

A sheikh for all seasons « Fisec's Weblog

5 Mar 12 at 8:31 pm

[…] Special Prosecutor in Iceland has brought charges against four Icelanders, as earlier reported on Icelog.* Deutsche is not implied in this […]

Deutsche Bank and its (alleged) failure to recognise up to $12bn losses at Sigrún Davíðsdóttir's Icelog

6 Dec 12 at 10:07 am

[…] addition to this case, the OSP has brought charges against Kaupthing managers in the so-called al Thani case. So far, Landsbanki managers or major shareholders of Landsbanki have not been […]

OSP charges Jon Asgeir Johannesson, Larus Welding and two Glitnir employees at Sigrún Davíðsdóttir's Icelog

16 Dec 12 at 10:24 pm

[…] and Barclays contacts with another al Thani and Qatari investors. As recounted in some details here, with Kaupthing documents, the Kaupthing saga with the Qatari investor, who bought shares in […]

Barclays, Kaupthing and the Qatari investors – updated at Sigrún Davíðsdóttir's Icelog

3 Feb 13 at 2:29 pm

[…] This loan was allegedly behind the purchase of Kaupthing shares in September 2008. As reported earlier on Icelog the Office of the Special Prosecutor has charged three former Kaupthing managers and […]

Kaupthing Winding-Up Board settles with Sheikh al Thani at Sigrún Davíðsdóttir's Icelog

8 Feb 13 at 4:32 pm

[…] allegedly channeled $50m, an in-advance profit, to a company controlled by the Sheikh. As reported earlier on Icelog the Office of the Special Prosecutor in Iceland has charged ex Kaupthing managers – […]

More on Barclays and Kaupthing Middle East investors at Sigrún Davíðsdóttir's Icelog

11 Feb 13 at 9:42 pm

[…] case has been extensively dealt with on Icelog, i.a. here. The interesting UK angle to the story is that there are striking parallels of this loan story – […]

The al Thani Kaupthing case on the horizon at Sigrún Davíðsdóttir's Icelog

7 Mar 13 at 9:17 am

[…] earlier blogs where the al Thani case is mentioned – and here is the story behind the charges in the al Thani […]

The latest on the al Thani case at Sigrún Davíðsdóttir's Icelog

14 Apr 13 at 10:21 pm

[…] detailed in an earlier Icelog the core of the al Thani case were loans to Ólafsson and Sheikh Mohammed bin Khalifa al Thani, a […]

Supreme Court rules in al Thani case: imprisonment confirmed at Sigrún Davíðsdóttir's Icelog

12 Feb 15 at 5:02 pm

[…] four prisoners, sentenced in the so-called al Thani case, are not the first sentenced in relation to the banking collapse but they are the first to […]

What money can’t buy: extra services in an Icelandic prison at Sigrún Davíðsdóttir's Icelog

27 Nov 15 at 4:26 pm

[…] Ólafur Ólafsson was sentenced in February 2015 to 4 1/2 years in prison in the so-called al Thani case. After a change in the law on imprisonment shortened the time prisoners have to spend in prison […]

Where but in Iceland… at Sigrún Davíðsdóttir's Icelog

23 May 16 at 10:06 pm

[…] to 4 to 5 1/2 years in prison for fraudulent lending and market manipulation (see my overview here). SFO is now bringing ex CEO John Varley and three senior Barclays bankers to court on July 3 on […]

The Icelandic al Thani case and the British al Thani / Barclays case at Sigrún Davíðsdóttir's Icelog

26 Jun 17 at 9:23 pm

There are actually a variety of particulars like that to take into consideration. That is a great level to deliver up. I supply the ideas above as general inspiration but clearly there are questions like the one you deliver up the place the most important factor shall be working in sincere good faith. I don?t know if greatest practices have emerged round things like that, but I am sure that your job is clearly recognized as a good game. Both girls and boys feel the impression of just a moment抯 pleasure, for the remainder of their lives.

off white clothing

20 Oct 23 at 7:08 am

I have to show my gratitude for your kind-heartedness supporting persons who absolutely need help on your issue. Your real commitment to getting the solution all over appeared to be exceptionally beneficial and have continuously enabled guys and women just like me to achieve their aims. Your own important key points indicates this much a person like me and further more to my colleagues. Many thanks; from each one of us.

kyrie shoes

18 Jan 24 at 12:45 pm

I wish to show my gratitude for your kindness for those individuals that have the need for help on this field. Your special commitment to getting the solution all through had become wonderfully informative and have made somebody just like me to realize their goals. Your entire interesting tutorial indicates so much to me and additionally to my colleagues. Warm regards; from everyone of us.

kd shoes

19 Jan 24 at 2:46 pm

I must voice my affection for your kind-heartedness giving support to men who must have guidance on that area. Your personal commitment to getting the solution along became extremely invaluable and have usually encouraged associates like me to get to their dreams. Your personal informative instruction denotes a whole lot a person like me and especially to my office workers. Thank you; from each one of us.

kyrie 8

21 Jan 24 at 7:12 pm

I wish to express my appreciation to this writer just for bailing me out of this type of dilemma. As a result of surfing around through the internet and seeing suggestions that were not pleasant, I assumed my life was over. Being alive devoid of the approaches to the difficulties you have resolved by way of your entire article content is a serious case, and the kind which might have in a wrong way affected my entire career if I had not discovered your blog post. The capability and kindness in dealing with almost everything was tremendous. I am not sure what I would’ve done if I hadn’t encountered such a thing like this. I can at this time relish my future. Thanks very much for this expert and sensible guide. I won’t be reluctant to endorse your site to anybody who ought to have tips about this matter.

nike dunks

23 Jan 24 at 11:13 pm