Search Results

Kaupthing Luxembourg and Banque Havilland – risk, fraud and favoured clients

Banque Havilland has just celebrated its tenth anniversary: it is now ten years since David Rowland bought Kaupthing Luxembourg out of bankruptcy. A failed bank not only tainted by bankruptcy but severely compromised by stark warnings from the regulator, CSSF. Yet, neither the regulator nor the administrators nor later the new owner saw any reason but to keep the Kaupthing Luxembourg manager and key staff. In four criminal cases in Iceland involving Kaupthing the dirty deals were done in the bank’s Luxembourg subsidiary with back-dated documents. Two still-ongoing court cases, which Havilland is pursuing with fervour in Luxembourg, indicate threads between Kaupthing Luxembourg and Havilland, all under the nose of the CSSF.

“The journey started with a clear mission to restructure an existing bank and the ambition of the new shareholder to lay strong foundations, which an international private bank could be built on,” wrote Juho Hiltunen CEO of Banque Havilland on the occasion of Havilland’s 10th anniversary in June this year.

This cryptic description of the origin of Banque Havilland hides the fact that the ‘existing bank’ David Rowland bought was the subsidiary of Kaupthing Luxembourg, granted suspension of payment 9 October 2008, the same day that the mother-company, Kaupthing hf, defaulted in Iceland.

The last year of Kaupthing Luxembourg’s operations had been troubled by serious concerns at the Luxembourg regulator, Commission de Surveillance du Secteur Financier, CSSF, regarding the bank’s risk management and the management’s willingness to move risk from clients onto the bank.

Unperturbed by all of this, Rowland not only bought the bank but kept the key employees, including the bank’s Icelandic director, Magnús Guðmundsson, instrumental in selling Kaupthing Luxembourg to Rowland. Guðmundsson stayed in his job until 2010, when news broke in Iceland he was under investigation, later charged and found guilty in two criminal cases (two are still ongoing) in Iceland, where he has served several prison sentences. He was replaced by Jean-Francois Willems, another Kaupthing Luxembourg manager, CEO of Banque Havilland Group since 2017. Willems was followed by Peter Lang, also an earlier Kaupthing manager. Lang left that position when Banque Havilland was fined by the CSSF for breaches in money laundering procedures.

David Rowland’s reputation in his country of origin, Britain, was far from pristine – in Parliament, he has been called a ‘shady financier.’ However, all that seemed forgotten in 2010 when the media-shy tycoon was set to become treasurer of the Conservative Party, having donated in total £2.8m to the party in less than a year. As the British media revised on Rowland stories, Rowland realised he was too busy to take on the job and stepped out of the spotlight again.

In the Duchy of Luxembourg, Rowland was seen as fit and proper to own a bank. And the bank, CSSF had severely criticised, was seen as fit and proper to receive a state aid in the form of a loan of €320m in order to give the bank a second life.

Criminal investigations in Iceland showed that Kaupthing hf’s dirty deals were consistently carried out in Luxembourg. There were clearly plenty of skeletons in the Kaupthing Luxembourg that Rowland bought. Two still-ongoing legal cases connect Kaupthing and Havilland in an intriguing way.

In December 2018, the CSSF announced that Banque Havilland had been fined €4m and now had “restrictions on part of the international network” for lack of compliance regarding money laundering and terrorist financing, the regulator’s second heftiest fine of this sort. Eight days later the bank announced a new and stronger management team: a new CEO, Lars Rejding from HSBC. It was also said that there were five new members on the independent board but their names were not mentioned. An example of the bank’s rather sparse information policy.

KAUPTHING LUXEMBOURG: RISK, FRAUD AND FAVOURED CLIENTS

2007: CSSF spots serious lack of attention to risk in Kaupthing Luxembourg

On August 25 2008, the CSSF wrote to the Kaupthing Luxembourg management, following up on earlier exchanges. The letter shows that as early as in the summer of 2007, the CSSF was aware of the serious lack of attention to risk. The regulator’s next step, in late April 2008, was to ask for the bank’s credit report, based on the Q1 results, from the bank’s external auditor, KPMG. In the August 2008 letter, the CSSF identified six key issues where Kaupthing Luxembourg was at fault:

1 The CSSF deemed it unacceptable that Kaupthing Luxembourg financed the buying of Kaupthing shares “as this may represent an artificial creation of capital at group level.”

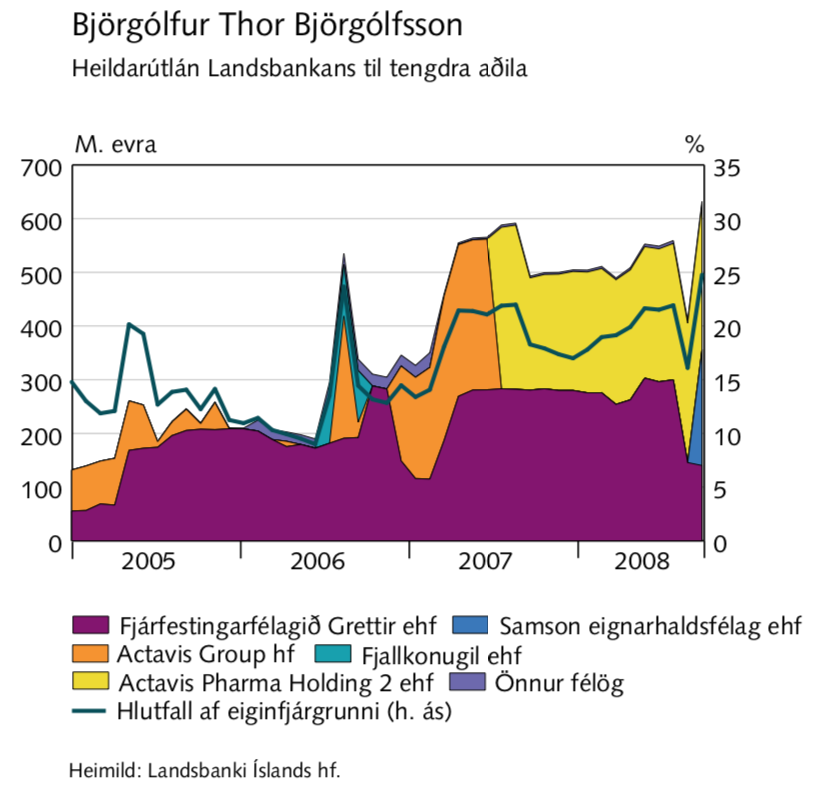

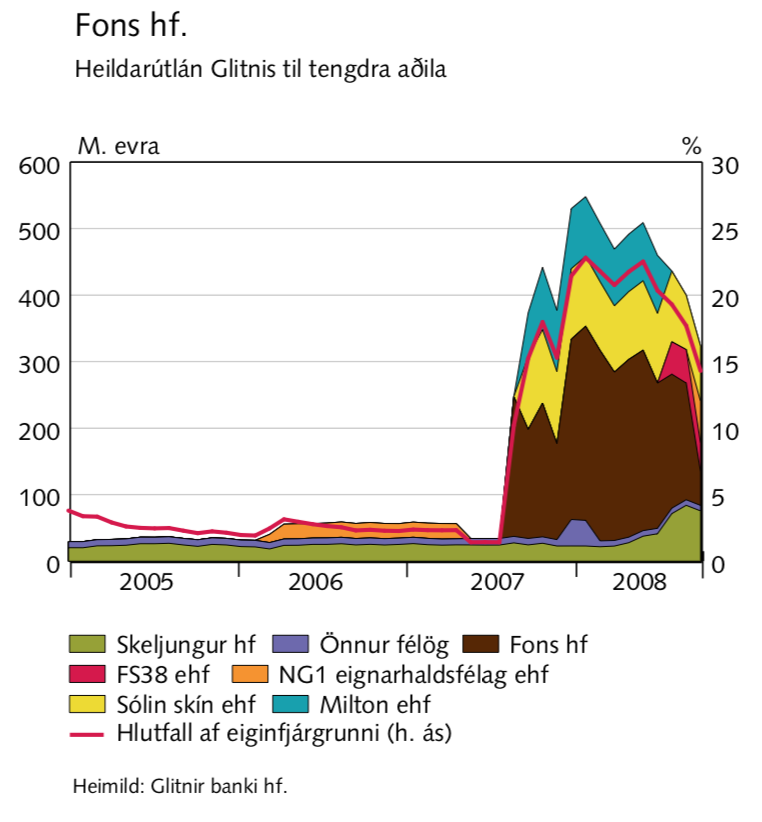

2 Analysing the bank’s loan portfolio, the CSSF concluded that the bank’s activity was more akin to investment banking than private banking as the bulk of credits were “indeed covered by highly concentrated portfolios (for example: (Robert) Tchenguiz, (Kevin) Stanford, (Jón Ásgeir) Johannesson, Grettir (holding company owned by Björgólfur Guðmundsson, Landsbanki’s largest shareholder, together whith his son, Björgólfur Thor Björgólfsson) etc.)” The CSSF saw this “as highly risky and we ask you to reduce it.” This could only continue in exceptional cases where the loans would have a clear maturity (as opposed to bullet loans that were rolled on).

3 Private banking loans should have diversified portfolio of quoted securities and be easy to liquidate, based on a formal written procedure as to how that should be done.

4 Personal guarantees from the parent company should be documented in the loan files so that the external auditor and the CSSF could verify how these exposures were collateralised in the parent bank.

5 As the CSSF had already pointed out in July 2007, the indirect concentration risk should not exceed 25% of the bank’s own funds. CSSF concluded that the bank was not complying with that requirement as the indirect risk concentration on Eimskipafélagið hf, owned by Björgólfur Guðmundsson, and on Kaupthing hf, the parent bank, was above this limit.

6 At last, CSSF stated that only quoted securities could be easily liquidated, meaning that securities illiquid in a stress scenario, could not be placed as collateral. CSSF emphasised that securities like Kaupthing hf, Exista hf and Bakkavor Group hf, could not be used as a collateral, exactly the securities that some of Kaupthing’s largest clients were most likely to place as collaterals.

It is worth keeping in mind that the regulator had been studying figures from Q1 2008; in August, when CSSF sent its letter, the Q2 figures were already available: the numbers had changed much for the worse. Unfazed, Kaupthing Luxembourg managers insisted in their answer 18 September 2008 that the regulator was wrong about essential things and they were doing their best to meet the CSSF concerns.

What the CSSF identified: the pattern of “favoured clients”

The CSSF had been crystal clear: after closely analysing the Kaupthing Luxembourg operation it did not like what it saw. Kaupthing’s way of banking, lending clients funds to buy the bank’s shares and absolving certain clients of risk and moving it onto the bank, was not to the CSSF’s liking. What the CSSF had indeed identified was a systematic pattern, explained in detail in the 2010 Icelandic SIC report.

This was the pattern of Kaupthing’s “favoured clients”: Kaupthing defined a certain group of wealthy and risk-willing clients particularly important for the bank. In addition to loans for the client’s own projects, there was an offer of extra loans to invest in Kaupthing shares, with nothing but the shares as collateral. In some cases, Kaupthing set up companies for the client for this purpose, or the bank would use companies, owned by the client, with little or no other assets. The loans were issued against Kaupthing shares, placed in the client’s company.

How this system would have evolved is impossible to say but over the few years this ran, these shareholding companies profited from Kaupthing’s handsome dividend. The loans were normally bullet loans, rolled on, where the client’s benefit was just to collect the dividend at no cost. In some cases, the dividend was partly used to pay off the loan but that was far from being the rule.

What the bank management gained from this “share parking,” was knowing where these shares were, i.e. that they would not be sold or shorted without the management’s knowledge. Kaupthing had to a large extent, directly and indirectly funded the shareholdings of the two largest shareholders, Exista and Ólafur Ólafsson. In addition to these large shareholders there were all the minor ones, funded by Kaupthing. It can be said that the Kaupthing management had de facto complete control over Kaupthing.

All the three largest Icelandic banks practiced the purchase of own shares against loans to a certain degree but only Kaupthing had sat this up as part of its loan offer to wealthy clients. In addition, Kaupthing had funded share purchase for many of its employees.* This activity effectively turned into a gigantic market manipulation machine in 2008, again especially in Kaupthing, as the share price fell but would no doubt have fallen steeper and more rapidly if Kaupthing had not orchestrated this share buying on an almost industrial scale.

The other main characteristic of Kaupthing’s service for the favoured clients was giving them loans with little or no collaterals. This also led to concentrated risk, as pointed out in para 2 and 3 in the CSSF’s letter from August 2008 and later in the SIC report. As one source said to Icelog, for the favoured clients, Kaupthing was like a money-printing machine.

Back-dated documents in Kaupthing

After the Icelandic Kaupthing failed, the Kaupthing Resolution Committee, ResCom, quickly discovered it had a particular problem to deal with. The ResCom had kept some key staff from the failed bank, thinking it would help to have people with intimate knowledge working on the resolution.

A December 23 2008 memorandum from the law firm Weil Gotschal & Manges, hired by the ResCom, pointed out an ensuing problem: lending to companies owned by Robert Tchenguiz, who for a while sat on the board of Exista, Kaupthing’s largest shareholder, had been highly irregular, according to the law firm. As the ResCom would later find out, this irregularity was by no means only related to Tchenguiz but part of the lending to favoured clients.

The law firm pointed out that some employees had been close to these clients or to their closest associates in the bank and advised that all electronic data and hard drives from Sigurður Einarsson, Hreiðar Már Sigurðsson and seven other key employees should be particularly taken care of. Also, it noted that two of those employees, working for the ResCom, should be sacked; it could not be deemed safe that they had access to the failed bank’s documents. The ResCom followed the advice but by then these employees had already had complete access to all material for almost three months.

Criminal cases against Kaupthing managers have exposed examples of back-dated documents, done after the bank failed. According to one such document, Hreiðar Már Sigurðsson was supposed to have signed a document in Reykjavík when he was indeed abroad (from the embezzlement case against HMS). There is also an example of September 2008 minutes of a Kaupthing board meeting being changed after the collapse of Kaupthing. No one has been charged specifically with falsifying documents, but these two examples are not the only examples of evident falsification.

The central role of Kaupthing Luxembourg in Kaupthing hf’s dirty deals

The fully documented stories behind the many dirty deals in Kaupthing first surfaced in April 2010 in the report by the Special Investigative Commission, SIC. Intriguingly, these deals were, almost without exception, executed in Luxembourg.

By the time the SIC published its report, the Icelandic regulator, FME, already had a fairly clear picture of what had been going on in the banks. The fraudulent activities in Kaupthing made that bank unique – and most of these activities involved fraudulent loans to the favoured clients. In January 2010, the Icelandic regulator, FME, sent a letter to the CSSF with the header “Dealings involving Kaupthing banki hf, Kaupthing Bank Luxembourg S.A., Marple Holding S.A., and Lindsor Holdings Corporation.”

Through the dealings of these two companies, Skúli Þorvaldsson profited over the last months before the bank’s collapse by around ISK8bn, at the time over €50m. These trades mainly related to Kaupthing bond trades: bonds were bought at a discount but then sold, even on the same day, at a higher price or a par. Þorvaldsson profited handsomely through these trades, which effectively tunnelled funds from Kaupthing Iceland to Þorvaldsson, via Kaupthing Luxembourg.

Þorvaldsson was already living in Luxembourg when Kaupthing set up its Luxembourg operations in the late 1990s. He quickly bonded with Magnús Guðmundsson; Icelog sources have compared their relationship to that of father and son. When the bank collapse, Þorvaldsson was Kaupthing Luxembourg’s largest individual borrower and, in September 2008, the bank’s eight largest shareholder, owning 3% of Kaupthing hf through one of his companies, Holt Investment Group. At the end of September 2008, Kaupthing’s exposure to Þorvaldsson amounted to €790m. The CSSF would have been fully familiar with the fact that Þorvaldsson’s entire shareholding was funded by Kaupthing loans.

In addition, the FME pointed out that four key Kaupthing Luxembourg employees, inter alia working on those trades, had traded in bonds, financed by Kaupthing loans, profiting personally by hundreds of thousands of euros. Intriguingly, these employees had not previously traded in Kaupthing bonds for their own account. Some of these trades took place days before Kaupthing defaulted, with the FME pointing out that in some cases the deals were back-dated.

The central role of Kaupthing Luxembourg in Kaupthing’s Icelandic criminal cases

Following the first investigations in Iceland, the Office of the Special Prosecutor, OSP, in Iceland, now the County Prosecutor, has in total brought charges in five cases against Kaupthing managers, who have been found guilty in multiple cases: the so-called al Thani case, and the Marple Holding case, connected to Skúli Þorvaldsson, who was charged in that case but found not guilty.

The third is the CLN case, the fourth case is the largest market manipulation ever brought in Iceland. The charges in the fifth case concern pure and simple embezzlement where Hreiðar Már Sigurðsson, at the time the CEO of Kaupthing Group, is charged with orchestrating Kaupthing loans to himself in summer of 2008 in order to sell Kaupthing shares so as to create fraudulent profit for himself. Three of the cases are still ongoing. The two cases, which have ended, the al Thani case and the market manipulation case resulted in heavy sentencing of Sigurðsson, Magnús Guðmundsson and Sigurður Einarsson, as well as other employees.

The first case brought was the al Thani case where Sigurðsson, Guðmundsson, Einarsson and Ólafsson were charged were misleading the market – they had all proclaimed that Sheikh Mohammed Bin Khalifa al Thani had bought shares in the bank without mentioning that the shares were bought with a loan from Kaupthing. The lending issued by the Kaupthing managers was ruled to be breach of fiduciary duty. The hidden deals in this saga were done in Kaupthing Luxembourg. Equally in the Marple case and the CLN case: the dirty deals, at the core of these cases, were done in Kaupthing Luxembourg.

Hreiðar Már Sigurðsson has been charged in all five cases; Magnús Guðmundsson in four cases and chairman of the board at the time Sigurður Einarsson in two cases. In addition, the bank’s second largest shareholder and one of Kaupthing’s largest borrowers Ólafur Ólafsson was charged and sentenced in the al Thani case.

What the CSSF has been investigating: Lindsor and the untold story of 6 October 2008

One of the few untold stories of the Icelandic banking collapse relates to Kaupthing. On 6 October 2008, the Icelandic Central Bank, CBI, issued a €500m loan to Kaupthing after the CBI governor Davíð Oddsson called the then PM Geir Haarde to get his blessing. This loan was not documented in the normal way: it is unclear where this figure of €500m came from, what its purpose was or how it was then used. As Oddsson nonchalantly confirmed on television the following day, the loan was announced by accident on the day it was issued. The loan was issued on the day the government passed the Emergency Act, in order to take over the banks and manage their default.

On the day that Kaupthing received the CBI loan, Kaupthing issued a loan of €171m to a BVI company, Lindsor Holdings Corporation, incorporated in July 2008 by Kaupthing, owned by Otris, a company owned by some of Kaupthing’s key managers. The largest transfer from Kaupthing October 6 was €225m in relation to Kaupthing Edge deposit holders, who were rapidly withdrawing funds. The second largest transfer was the Lindsor loan.

Having obtained the loan of €171m, Lindsor purchased bonds from Kaupthing entities and from Skúli Þorvaldsson, again via Marple, which seems to have profited by €67.5m from this loan alone. In its January 2010 letter to the CSSF, FME stated it “believes that the purpose of Lindsor was to create a “rubbish bin” that was used to dispose of all of the Kaupthing bonds still on the books of Kaupthing Luxembourg as the mother company, Kaupthing Iceland, was going bankrupt… Lindsor appears to FME to be a way to both reimburse favoured Kaupthing bondholders (Marple and Kaupthing Luxembourg employees) as well as remove losses from the balance sheet of Kaupthing Luxembourg. These losses were transferred to Lindsor, and entity wholly owned by Kaupthing Iceland,” at the time just about to go into default.

In addition, FME pointed out that most of the documents related to these Lindsor transactions had not been signed until December 2008 “but forged to appear as though they had been signed in September 2008. Employees in both Kaupthing Luxembourg and Kaupthing Iceland appear to have been complicit in this forgery.” – Yet another forgery story.

Intriguingly, when the OSP in Iceland decided to investigate Marple Holding, it already had a long-standing relationship with authorities in Luxembourg, having inter alia conducted multiple house searches in Luxembourg, first in 2010, with assistance from the Luxembourg authorities.

The purpose of the FME letter in January 2010 was not only to inform but to encourage the CSSF to open investigations into these trades. It took the CSSF allegedly some years until it started to investigate Lindsor. According to the Icelandic daily Morgunblaðið, the Prosecutor Office in Luxembourg now has the fully investigated case on his desk – the only thing missing is a decision if the case will be prosecuted or not.

Judging from evidence available on Lindsor in Iceland, there certainly seems a strong case to prosecute but the question remains if the investigation wins over the extreme lethargy in the Duchy of Luxembourg in investigating financial institutions.

AND SO, BANQUE HAVILLAND ROSE FROM KAUPTHING LUXEMBOURG’S COMPROMISED BOOKS

Enter the administrators

It is clear, that already in the summer of 2008, before Kaupthing Luxembourg collapsed together with the Icelandic mother company, Luxembourg authorities were fully aware that not everything in the Kaupthing Luxembourg operations had been in accordance with legal requirements and best practice.

On 9 October 2008, Kaupthing hf was put into administration in Iceland. On that same day, Kaupthing Luxembourg was granted suspension of payment for six months with the CSSF appointing administrators: Emmanuelle Caruel-Henniaux from PricewaterhouseCoopers, PWC, and the lawyer Franz Fayot. After Banque Havilland later came into being, PWC became the bank’s auditor. Its auditing fees in 2010 amounted to €422,000. In 2017, the fees had jumped to €1.3m.

Fayot was to play a visible role in the second coming of Kaupthing Luxembourg and has, as PWC, continued to do legal work for Banque Havilland. From 1997 to 2015 Fayot worked for the law firm Elvinger Hoss Prussen, EHP, another name to note; in 2015 Fayot joined the Luxembourg lawyer, Laurent Fisch, setting up FischFayot.

Contrary to the measures taken in Kaupthing Iceland, there was allegedly no visible attempt by the Kaupthing Luxembourg administrators to comparable scrutiny: Magnús Guðmundsson stayed with the bank and worked alongside the administrators with other Kaupthing employees. Their aim seems to have been to make sure that the bank, bursting with skeletons, would be sold on to someone with a certain understanding of Kaupthing’s business model.

The Kaupthing sale could only have happened with the understanding and goodwill of Luxembourg authorities: in spite of knowing of the severe issues and faulty management, the regulator seems to have left the administrators and Kaupthing staff to its own devices. Crucially, the state of Luxembourg was instrumental in giving the bank a second life, as Banque Havilland, by guaranteeing it a state aid of €320m.

JC Flowers, the Libyans and Blackfish Capital

Consequently, right from the beginning, everything was in place to enhance Kaupthing Luxembourg’s appeal for restructuring; the only thing missing was a new owner. The Luxembourg government had already outlined a rescue plan, drawing in the Belgian government, as Kaupthing Luxembourg had operated a subsidiary in Belgium where it marketed its high-interest accounts, Kaupthing Edge.

In a flurry of sales activity, the administrators contacted 40 likely buyers but the call for tender was open for everyone. The investment fund JC Flowers, which earlier had been involved with Kaupthing hf, had briefly shown interest in buying the Luxembourg subsidiary. But already by late 2008, Kaupthing Luxembourg seemed to be firmly on the path of being sold to the Libyan Investment Authority, LIA, the Libyan sovereign wealth fund, at the time firmly under the rule of the country’s leader Muammar Gaddafi.

The LIA certainly had the means to purchase the Luxembourg bank. In the end, however, two things proved an unsurmountable obstacle. The creditors rejected the Libyan plan 16 March 2009, possibly taking the reputational risk into account. And perhaps most importantly, given that the Luxembourg state wanted to enable the purchase with considerable funds, the Luxembourg authorities did in the end balk at the deal with the Libyans but only after months of negotiations.

Blackfish Capital and Jonathan Rowland’s “lieutenant”

In 2008, Michael Wright, a solicitor turned businessman, was working for Jonathan Rowland, son of David Rowland. In an ensuing court case, Wright described his role as being Jonathan’s “lieutenant” in spotting investment opportunities.

By 2013, Wright had fallen out with the Rowlands, later suing father and son in London where he lost his case in 2017. According to the judgement, Wright maintained that he had played a leading role in securing the purchase of Kaupthing Luxembourg for the Rowlands: after being introduced to Sigurður Einarsson or “Siggi” as he called him, already in late 2008, Wright brought the opportunity to purchase Kaupthing Luxembourg to the Rowlands.

The Rowlands admitted that Wright had been involved in “some discussions” with Einarsson and Kaupthing Bank representatives in early 2009 relating to “a proposed transaction concerning bonds,” which did not materialise but that the contact leading to the Rowlands acquiring Kaupthing Luxembourg came “subsequently.” The judge on the case noted that all three men were unreliable witnesses.

As late as March 2009, a deal with the LIA to purchase Kaupthing Luxembourg still seemed on track. According to Kaupthing hf Creditors’ report, updated in March 2009, the government of Luxembourg and a consortium led by the LIA had signed a memorandum of understanding with the aim of enabling Kaupthing Luxembourg to continue its operations. In order to facilitate the restoration, the governments of Luxembourg and Belgium had agreed to lend the bank €600m, enabling the bank to repay its 22,000 retail depositors.

From other sources, Icelog understands that the Rowlands were only contacted after it was clear that neither JC Flowers nor LIA would be buying Kaupthing Luxembourg. The person who contacted the Rowlands, according to Icelog sources, was indeed Magnús Guðmundsson, who had heard that father and son might be looking for a private bank to buy. By early June 2009, the Rowlands’ agreement with the administrators was in place.

Interestingly, there had apparently been some tentative interest from large Kaupthing shareholders – who nota bene had all bought Kaupthing shares with Kaupthing loans. The Guðmundsson brothers, Lýður and Ágúst, who owned Exista, Kaupthing’s largest shareholder, had allegedly been interested in joining David Rowland as minority shareholders but that did not happen. In an open letter to Hreiðar Már Sigurðsson and Magnús Guðmundsson, published in January 2019, Kevin Stanford, once close to the Kaupthing managers, claimed the two bankers did explore the possibility of buying Kaupthing together with the Guðmundsson brothers but the plan was abandoned.

Whatever the reality of these tentative plans, they show that the Kaupthing managers and the largest shareholders focused on keeping Kaupthing Luxembourg alive, caring less for other parts of the bank. That is intriguing, given the role of the Luxembourg subsidiary in Kaupthing’s dirty deals.

The €320m Luxembourg state aid for restructuring

From contemplating a loan of €600m, as the Kaupthing hf creditors had been led to believe, the final figure was a still generous €320m. Led by Luxembourg, with half of the funds provided by the Belgian government through an inter-state loan, the deal was finalised 10 June 2009. The sum of €320m was decided since €310m was deemed to cover the liquidity shortfall with €10m extra as a margin.

In December 2008, the Kaupthing Luxembourg shares had been moved to a new company, Luton Investments (now BH Holdings), set up by a BVI nominee company, Quebec Nominees Limited that Kaupthing Luxembourg had often used (and most likely owned).

Rowland took Luton Investments over in May 2009. On 10 July, Rowland increased its capital by the agreed amount of €50m, raising its capital to the agreed figure, according to the restructuring plan. Rowland also pledged to add further €25 to 75m in liquidity. The private banking activities and the deposits, at 13 March 2009 €275 to 325m, were taken over by Rowland’s Blackfish Capital, and registered as a new bank, Banque Havilland. Its starting balance was €1.3bn, €750 to 800m of which were existing commitments to the Luxembourg Central Bank, BCL.

Part of Rowland’s lot was also Kaupthing Luxembourg’s entire infrastructure, including headquarters and IT system. With Kaupthing’s staff of 100 employees, Banque Havilland had from the beginning funding, infrastructure and staff to ensure a smooth transition from the old Kaupthing Luxembourg to the new Banque Havilland.

On July 9 2009, the European Commission gave its approval of the state aid. It indicates that the Banque Havilland’s main source of income during its early years, was indeed the money coming from the Luxembourg state.

Pillar Securitisation

Banque Havilland’s €1.3bn starting balance was only around half of old Kaupthing Luxembourg’s balance sheet. The rest, €1.2bn, more or less the old bank’s lending operations, for which no buyer was found, was placed in a new company, Pillar Securitisation, in order to be sold over the coming years, to pay off the main creditors: the Luxembourg state, the Luxembourg deposit guarantee fund, AGDL, Luxembourg Deposit Guarantee Association (funded by retail banks), and Kaupthing Luxembourg’s inter-bank creditors.

Having received a banking licence, Banque Havilland came into being on July 10 2009: Luton Investments, the sole owner of Kaupthing Luxembourg, was split in two, Banque Havilland, the “living” bank and Pillar Securitisation, the “dead” bank. Crucially, Pillar was de facto not a separate unit: it had no staff but was run in-house by Banque Havilland, residing at the Banque Havilland address at 35A avenue J.F. Kennedy, formerly the premises of Kaupthing Luxembourg.

The proceeds of Pillar were vital for the recovery of creditors since asset sales of that company determine their recovery. The main creditors were the two governments that lent into the restructuring. The loan was divided into a super-senior tranche of €210m and a senior tranche of €110m, split in two to repay the two states, Luxembourg and Belgium. The same was for the AGDL, and the around €300m it covered as deposits were transferred: AGDL received bonds in return.

Having scrutinised the state loans to Kaupthing Luxembourg, the European Commission ruled that the loans amounted to state aid: after all, no commercial bank would have agreed to a non-interest loan to a bank during suspension of payment. These advantages were conferred to Blackfish Capital via the state-aided restructuring plan. However, the Commission was equally clear that this state aid was compatible with the Treaty, which does allow for a remedy caused by “serious disturbance in the economy of a Member State.”

Interestingly, the original plan was to wind Pillar down in just a few years; ten years later, that goal has still not been reached.

ROWLAND, THE BANK OWNER

What Rowland bought: CSSF’s concerns and Kaupthinking in practice

By buying a failed bank, Rowland showed he was not too bothered about reputational risk. By keeping the ex-manager of Kaupthing Luxembourg, Magnús Guðmundsson and his staff, he also showed that he was not worried about Kaupthing’s activities. True, much of that story was not public at the time. Rowland would however have heard of CSSF’s serious concern in summer of 2008, before the bank failed. Concern, related to risky loans to large shareholders and related parties, that would have leapt out of the books on due diligence.

Although the CSSF had been chasing Kaupthing for credit risk and over-exposure to large clients and shareholders, the regulator was apparently as unbothered as the administrators that the Kaupthing managers were in charge of the bank during its suspension of payment.

Not only did CSSF apparently not follow up on earlier worries but the Luxembourg state decided to facilitate the bank’s second life with loans, notably without making it a condition that the management should be changed.

In Banque Havilland’s 2010 annual accounts, COO Venetia Lean (Rowland’s daughter) and CFO Jean-Francois Willems stated in their introduction that the bank would focus on retaining clients who met “strategic requirements… Towards the end of the year the family started to introduce members of its network to the Bank and we are working on the development of co-investment products whereby clients have the opportunity to invest alongside the family.” This focus, on co-investing with the family, is no longer mentioned.

Rowland’s first foreign investments after Luxembourg: Belarus and Iceland

In November 2010, Banque Havilland embarked on its first foreign venture, in Belarus: ‘the first Belarusian foreign direct investment fund,’ apparently a short-lived joint-venture with the Russian Sberbank Group. The press release seems to have disappeared from the Havilland website.

From 2011 to 2015 Banque Havilland expanded both in Luxembourg and abroad, i.e. in Monaco, London, Moscow, Liechtenstein, Switzerland and Nassau, either by buying banks or opening offices. The expansion in Monaco, Liechtenstein and Switzerland were done inter alia by buying Banque Pasche in these three locations. In the London office it set up a partnership with 1858Ltd in order to add art consultancy to its services.

Rowland’s interest for Icelandic investments did not end with Kaupthing Luxembourg. Contrary to most other foreign investors at the time, Rowland did not seem unduly worried by capital controls in Iceland, in place since autumn 2008. In the spring of 2011, it transpired that he had bought just under 10% of shares in the Icelandic MP Bank, which he held through a family-owned company, Linley Limited, represented on the MP board by Michael Wright.

MP Bank was named after its founder Margeir Pétursson, a Grand Master in chess, who set it up in 1999. In 2005, Pétursson was interested in expanding abroad but rather than following Icelandic bankers to the neighbouring countries, he made use of his knowledge of Russian and bought Lviv Bank in Ukraine. MP Bank survived the banking collapse in 2008 but was struggling. By 2010, the bank was no longer under Pétursson’s control and he left the board. In early 2011 the bank was split in two, with Pétursson still running that part owning the bank’s foreign assets.

At the time Rowland bought shares in MP Bank the bank was being revived with new capital and new shareholders. Another new foreign shareholder, who bought a stake in MP, equal to Rowland’s, was the ex-Kaupthing client, Joe Lewis, who, with Kaupthing loan to buy shares in Kaupthing and scantily covered loans, fitted the characteristics of a favoured client.

Enic was a holding company Lewis co-owned with Daniel Levy through which they held their trophy asset, Tottenham Hotspur. Kaupthing Singer & Friedlander, KSF, Kaupthing’s UK subsidiary, had issued a loan of €121.9 million to Enic, with shares in the football club as collateral. Kaupthing deemed the club was worth €89m, which meant the loan was only party covered in addition to the collateral being highly illiquid. Yet, the rating of the collateral on Kaupthing books was ‘good’ as Kaupthing had “confidence in the informal support of the principals.” According to the loan book “Joe Lewis is reputedly extremely wealthy and a target for doing further business with.”

Kaupthing, Banque Havilland and Kvika

In 2009, the former KSF director Ármann Þorvaldsson published a book, Frozen Assets, about his Kaupthing life. In it, he tells, almost with palpable nostalgia, of sitting on Lewis’ yacht in June 2007, discussing further projects; Þorvaldsson was keen to build a stronger relationship with the man estimated to be one of the 20 richest people in the UK. What ties were being forged on the yacht is anyone’s guess.

Rowland was clearly as unworried about MP Bank’s reputation – at the time, involved in some court cases – as he had been about Kaupthing Luxembourg’s reputational risk. In 2014, MP Bank and Virðing, an Icelandic asset management company with numerous ex-Kaupthing employees, attempted to merge with MP Bank, giving rise to rumours in Iceland that a new Kaupthing was in the making. The merger floundered. In the summer of 2015, both Rowland and Lewis apparently sold their stakes to Straumur, another resurrected Icelandic investment bank. Yet, according to Linley Limited 2015 annual accounts, the MP Bank shares were written down that year and Rowland is no longer a shareholder in the bank.

After the Straumur purchase in 2015, MP Bank changed its name to Kvika. As Virðing and Kvika did indeed merge in 2017, the former director of KSF, Ármann Þorvaldsson became CEO of Kvika until he recently demoted himself by swapping places with Kvika’s deputy CEO Marínó Örn Tryggvason, another ex-Kaupthing employee, and moved to London in order to focus on Kvika London. The question is if Kaupthing’s former clients in London will be tempted to bank with Kvika. One of them has already stated to Icelog that he will not be switching to Kvika.

Out of the three largest Icelandic banks, that collapsed in October 2008, Kaupthing, or rather Kaupthing-related people, both managers and shareholders, seem to be the only ones who keep giving the idea that Kaupthing-connections are still alive and meaningful. These musings reverberate in the Icelandic media from time to time.

THE KAUPTHING SKELETONS IN BANQUE HAVILLAND

The Kaupthing – Banque Havilland link: Immo-Croissance

One link that connects old Kaupthing with Banque Havilland is the real estate company, Immo-Croissance, founded in 1988. By the time, Immo-Croissance attracted Icelandic attention, it owned two prime assets in Luxembourg, Villa Churchill and a building, set for demolition, on Boulevard Royal, where the land was the valuable asset. In 2008, Jón Ásgeir Jóhannesson, the Icelandic businessman of Baugur-fame and a long-time large borrower of Kaupthing and all other Icelandic banks, had set his eyes on Immo-Croissance.

Jóhannesson had hoovered up real estate companies here and there, most notably in Denmark, where he had been on a wild shopping spree, all merrily funded by the three Icelandic banks. Interestingly, he used Kaupthing Luxembourg for this transaction – Kaupthing put up a loan of €122m – although a consortium under Jóhannesson’s control had been the largest shareholder in Glitnir since spring 2007.

In November 2007, Immo-Croissance’s board reflected the Baugur ownership as Baugur-related directors took seat on the board, together with Kaupthing employee Jean-François Willems. Under Baugur-ownership, Immo-Croissance apparently went on a bit of a cruise through several Baugur-owned companies. In June 2008, a Baugur Group company, BG Real Estate Europe, merged with Immo-Croissance, whereby magically the €122m loan to buy Immo-Croissance landed on Immo-Croissance own books.

But as with so many purchases by the Kaupthing’s favoured clients, Baugur’s purchase depended entirely on Kaupthing’s funding. By the end of September 2008, Baugur was in dire straits and Immo-Croissance was sold, or somehow passed on to SK Lux, a company belonging to the Kaupthing Luxembourg’s largest borrower, Skúli Þorvaldsson.

According to Icelog sources in Luxembourg, familiar with the Immo-Croissance deals in 2008, the SK Lux purchase of Immo-Croissance left all the risk with Kaupthing Luxembourg, a consistent pattern in deals financed by Kaupthing for the bank’s favoured clients.

The second and third life of Immo-Croissance

A key person in the Immo-Croissance saga, as in the origin of Banque Havilland, is the lawyer Franz Fayot, Kaupthing Luxembourg’s administrator until the bank was sold in summer of 2009. It was during his time as administrator of Kaupthing Luxembourg that Immo-Croissance was put up for sale, as SK Lux defaulted when the Kaupthing loan came to maturity at the end of October 2008.

At the time, Dexia was interested in buying Immo-Croissance. Its offer was a set-off against Kaupthing debt to Dexia, in addition to a cash payment. Kaupthing Luxembourg however preferred to sell to an Italian businessman Umberto Ronsisvalle and his company, R Capital. Guðmundsson arranged the deal for Ronsisvalle through Consolium, a Luxembourg company set up by an Icelandic company, later taken over by Guðmundsson and a few other ex-Kaupthing bankers. Consolioum went through name changes, with some of the bankers’ wives later taking over the ownership as the bankers got indicted or were at risk from being indicted in Iceland.

Ronsisvalle offered €5.5m. In addition, Immo-Croissance would get a loan from Kaupthing Luxembourg of €123m to refinance the earlier loan. This time however the loan was against proper guarantees, not like the earlier loan to the Icelandic Immo-Croissance owners, where no guarantees to speak of were in place.

By the end of January 2009, Umberto Ronsisvalle was in charge of Immo-Croissance but only for some months. By early summer 2009, the Kaupthing-related directors were again in charge, amongst them Jean-François Willems.

The unexpected turn of events took place in early 2009. Ronsisvalle paid the €5.5m but asked for some payment extension since he had problems in moving funds. He had understood that Kaupthing had agreed but hours after he provided the funds, Kaupthing changed its mind: it announced the loan was in default and moved to take a legal action to seize not only Immo-Croissance but also the collaterals, getting hold of €35m. The thrust of Kaupthing’s legal action was that Ronsisvalle had tried to take over Immo-Croissance without paying for it.

Early on, a judge refuted this Kaupthing allegation, pointing out that there was both the down-payment of €5.5m and the guarantees, contrary to earlier arrangements. Ronsisvalle’s side of event is that Kaupthing manipulated a default in order to get hold of the cash and the collaterals, in addition to keeping the assets in Immo-Croissance, a saga followed by the Luxembourg Land.

Havilland, Immo-Croissance and EHP

The lawyer for Kaupthing in the Immo-Croissance case was Pierre Elvinger from the legal firm Elvinger Hoss Prussen, EHP, where Franz Fayot worked prior to taking on the administration of Kaupthing. As the case has stretched over a decade now, Pillar Securitisation replaced the old Kaupthing Luxembourg in the Immo-Croissance chain of legal cases. Franz Fayot has been a lawyer for Havilland in these cases.

In 2013, the case had reached a point where a judge had ordered Pillar to hand back Immo-Croissance to Ronsisvalle, its legal owner according to the judge. The problem was that in the meantime, Pillar had sold the company’s two most valuable assets, Villa Churchill and the building on Boulevard Royal.

In an article in Land, in July 2013, it was pointed out that Villa Churchill was sold to a company owned by three partners at EHP. The Boulevard Royal asset was sold to Banque de Luxembourg, a private bank where one EHP partner was a member of the board. In both cases, questions were raised regarding the price and a friendly deal.

EHP complained about the reporting and its comment was published in Land: EHP pointed out that Fayot ceased to be administrator as Banque Havilland and Pillar Securitisation came in to being in July 2009, whereas the two assets were sold in 2010. Also, that the price had to be agreed on by Immo-Croissance owner, Pillar Securitisation, i.e. the Pillar creditors’ committee.

What the law firm does not mention is that Fayot has stayed in business relationship with Banque Havilland, inter alia as a lawyer for Banque Havilland, for example in the Immo-Croissance cases and in a case against a Kaupthing employee whom Havilland has kept in a legal battle for over a decade.

Court cases related to this action are still ongoing but Ronsisvalle has so far won at every stage and has regained control of the company after fighting in court for years. He is now involved in a legal battle with Banque Havilland and Pillar regarding the assets sold. Since Immo-Croissance was placed in Pillar Securitisation, the outcome could in the end spell losses for the creditors of Pillar, mainly the two governments that provided the state-aid, which made Kaupthing Luxembourg an attractive and largely risk-free purchase.

The ex-Kaupthing employee hounded by Banque Havilland

On 9 October 2008, the day of Kaupthing Luxembourg’s default, the bank’s risk manager resigned. In his opinion, the bank had paid far too little attention to his warnings on exposures to the large favoured clients, with equally little notice being taken to the CSSF’s warnings on the same issues. The attitude of the bank’s management seemed to be that it could not care less.

In his resignation letter, the risk manager referred to the CSSF August letter to the Kaupthing management. In spite of the warnings, Kaupthing had, according to the risk manager, not taken any measures to diminish the risk, thus probably aggravating the bank’s situation. And by doing nothing, the bank had cast shadow over the reputation of both the bank itself and its risk professionals.

In addition, the bank had not dedicated enough resources to its risk management, leaving it both lacking in personnel and IT solutions. This had also led to the standards of risk management, as expressed in the bank’s Handbook, being wholly unachievable. All of this had become much more pressing since the bank’s liquidity position had turned dramatically for the worse after 3 October 2008.

As he had resigned by putting forth a harsh criticism of the bank, effectively making himself an internal whistle-blower, he expected to be contacted by the CSSF. When that did not happen, he did contact the regulator. It turned out that the letter had not been passed on to the CSSF and no one there was particularly interested in meeting him. After pressing his point, the risk manager did get a meeting with the CSSF, which showed remarkable little enthusiasm for his message.

The CSSF, in August 2008 so critical of the Kaupthing Luxembourg management, now seemed wholly uninterested in the bank. That is rather remarkable, given that the state of Luxembourg had risked millions of euros to revive the bank, now run by the bankers that the CSSF had earlier criticised.

Baseless accusations of hacking and theft of documents

The risk manager heard nothing further from the CSSF nor from the administrators but strangely enough he got a letter from Magnús Guðmundsson, with the Kaupthing logo as if nothing had happened. He finally brought his case to Labour Court in Luxembourg both to assert that he had had the right to resign and to get a final salary settlement with Kaupthing Luxembourg.

Although the risk manager quit Kaupthing around nine months before Banque Havilland came into being, that bank counter-sued the risk manager for hacking, theft of documents and breach of banking secrecy. Interestingly these allegations were raised in 2010, after the risk manager had been called in as a witness by the UK Serious Fraud Office and the Icelandic OSP.

The hacking and theft allegations ended with a judgment in 2015, where the risk manager won the case. The judge found that the risk manager had obtained these documents as part of his duties and could legitimately hold them as evidence in the Labour Court case. This case had delayed the Labour Court case, which then could only be brought to court by the end of 2017, a still ongoing case.

Technically, the labour case was part of the liabilities that Banque Havilland took over and litigations take time. The remarkable thing is that Banque Havilland has pursued the case without any regard for the evidence of illegalities taking place in Kaupthing as well as not paying consideration to the fact that the CSSF had severely criticised Kaupthing’s management.

After all the risk manager had quit Kauthing as he felt he could no longer work with the management the CSSF had found to be failing. Using the courts to harass people is a common tactic, used to the fullest in this case. Havilland has pursued the case forcefully, which is why the case is still doing the rounds in the various courts of Luxembourg thus undermining the risk manager both financially and in terms of his professional reputation.

If a Banque Havilland employee has ever contemplated criticising the bank or in any way bringing up anything about the bank, this case shows how the Havilland owners might react. It is not certain that the attitude of Luxembourg authorities regarding whistle-blowers rhyme with European legislation.

Luxembourg, the rotten heart of financial Europe

The ongoing legal wrangling with the risk manager and the Immo-Croissance are two stories that embody the strong and long-lived ties between Kaupthing Luxembourg and Banque Havilland. Both Franz Fayot and Pierre Elvinger from EHP, the company that still resides in Villa Churchill bought out of Immo-Croissance, have represented Banque Havilland in court.

Quite remarkably, the CSSF lost all interest in Kaupthing Luxembourg, after the bank failed. Instead, it chose to lend funds to its new owners, who had less than a stellar reputation. Owners, who kept the Kaupthing management, that had given rise to the CSSF’s earlier concerns.

In addition, after knowing full well what had gone on in Kaupthing Luxembourg and being fully informed about the criminal cases in Iceland, the Luxembourg Prosecutor, now seems to be dithering as to bringing a case related to Lindsor Holding, not to mention other cases that were never investigated.

This is the state of affairs in Luxembourg, still the rotten heart of financial Europe.

Follow me on Twitter for running updates.

The still untold story of the Kaupthing loan

Of the known unknowns of the Icelandic banking collapse in early October 2008, the most intriguing story is the €500m emergency loan issued to Kaupthing by the Icelandic Central Bank. In the early hours of 6 October 2008, the prime minister and other leading ministers had realised that the only thing to do was to put in place the Emergency Act, enabling the authorities to take over the banks. Yet, on that same day, the CBI shovelled €500m from the fast depleting foreign currency reserve into Kaupthing although the governor of the CBI at the time did not believe Kaupthing would ever be able to repay the loan. The CBI has now published a much delayed report on the loan: it leaves all the fundamental questions unanswered and adds one question to the sorry saga: is it ever a good idea to let an organisation investigate itself?

“What are we doing? We are deciding we’re not paying the debt of spendthrifts… We are not going to pay other people’s debts. We are not going to pay debt of the banks that have been somewhat reckless.’ This is how the then governor of the Central Bank, Davíð Oddsson, explained in an interview 7 October 2008 the drastic measures Icelandic authorities had taken with the Emergency Act the day before.

The governor was also asked about a certain loan to Kaupthing. He explained that the information had been made public by mistake the previous day; a so-called bridge loan amounting to €500m to be repaid in a few days. In the unlikely circumstances that the bank would default on the loan, the CBI had a good collateral, the Danish FIH Bank, a Kaupthing subsidiary.

The day before appearing on television, the governor had described this loan rather differently. In a telephone conversation with then prime minster Geir Haarde, Oddsson sought the agreement of the prime minister for the loan, which they had apparently discussed earlier.

Intriguingly, Oddsson made the call not from his office but the office of another employee, where Oddsson knew the call could be recorded. That recording remained a mystery for years as the CBI refused to release it, claiming it contained sensitive information. In November 2011, Morgunblaðið, where the editor is a certain Davíð Oddsson, published a transcript of the call. Haarde expressed his annoyance but no measures were taken against the paper for the publication of material it could not explain how it had obtained.

In the phone call 6 October 2008, Oddsson emphasised that the loan was risky and would most likely be of some relief for Kaupthing for only four or five days, adding: “I don’t expect we will get this money back. They say they will repay us in four or five days but I think that’s untrue or let’s say wishful thinking.”

That inkling proved to be correct – less than 48 hours after receiving the loan, Kaupthing was in default. Neither Oddsson nor Haarde have ever explained why the loan was issued.

Now a report (only in Icelandic) on the loan saga, published by the CBI 27 May shows that there is no documentation to be found at the CBI on the loan: nothing that explains why the loan was issued, what it was intended for nor properly how Kaupthing made use of it. Worse is, that the new report fails standards set in other reports, most recently a report on how Kaupthing was bought in 2003 on false premises. The obvious question is: was it ever justified that the CBI would write a report on its own deeds?

The unannounced report and its unclear goal

In the new report, CBI governor Már Guðmundsson says in his preface that the work on the report started four years ago. As far as I can see, there is no press release on the CBI website to announce that the CBI is now embarking clarifying its €500m loan to Kaupthing nor has this ever been mentioned in the bank’s annual reports.

When I checked my emails, I can see that I first heard about the report in late 2016: I wrote to the bank’s spokesman in November 2016 asking him about the report I had then just heard Guðmundsson mention in the media, also when it could be expected. The answer was that the bank was waiting for the final results of the sale of the FIH. I mentioned that the sale, which was obviously going to incur losses for the bank, was the result of the loan – the interesting bit was why the loan was issued.

Over the years, my inquiries into the report-in-making have usually been answered by pointing out that the final result of the FIH sale – which happened in 2010 – was still due.

In his preface, governor Guðmundsson writes that since the collapse, the bank has been focused on the present and the future, rather than the past. Also, that the FIH sale had been a complicated issue and those working on it had been very busy doing other things. I have to say that I find it beneath the dignity of the bank to explain the long conception time by saying that CBI employees have been busy. It just gives the sense that this report was far from any priority at the CBI.

From the preface, it is clear that to begin with the report was meant to focus on the loss-incurring FIH sale. Only after receiving a query from prime minister Katrín Jakobsdóttir as late as November 2018 on how Kaupthing made use of the loan, i.e. where the funds flowed, the bank had set about to make inquiries to clarify this issue.

This indicates that there was no proper plan to begin with but to focus on the FIH sale, not on the real issue: why did the CBI lend Kaupthing €500m when the governor was clear the loan was a risk and would not be repaid?

No paper trail, no documentation at the CBI

As pointed out in the CBI report there is indeed no paper trail of the loan, no documentation, nothing, at the bank. The report emphasises that everything regarding the loan seems to have been planned outside the bank. Therefore, the report has nothing to add on why the loan was issued, why the loan figure was €500m, what it was intended to do etc.

There have been indications earlier, that the documentation regarding the loan, the collateral, interest rates etc. was only made some days after the loan was issued, i.e. that the loan document was back-dated. Again, this is not mentioned in the CBI report and what exactly is on paper is not clear. It is however clear that there is no paper trail as to how the loan came into being, i.e. there is a lacuna at the bank regarding this loan, which the governor at the time suspected, so as not to say knew, would not be repaid.

The report states that decisions regarding the Kaupthing loan were taken outside of the bank, explaining the lack of documentation at the bank. However, it does not make it entirely clear if ever there was a documentation, which then has disappeared or if there really never were any documents at all in the bank.

Since the lacuna must have been clear from early on, the CBI knew from early on that by only focusing on documents in the bank, nothing much would come out of its investigation. Why it did not try to turn to other sources, such as the FME, which took a back-up of all the banks right after they failed or the Kaupthing estate, indicates that publishing a report with nothing in it, did not feel too disturbing.

Where did the loan end up?

Already in earlier criminal cases against Kaupthing managers, notably the CLN case, evidence emerged as to how some of the €500m were used, or rather how funds were allocated on 6 October 2008 as the collapse of Kaupthing was imminent. There has however not been any comprehensive overview of transactions in Kaupthing these days, i.e. how did Kaupthing allocate funds from 6 October 2008, when the loan was issued.

Interestingly, we know that as the bank was stumbling to default, the Kaupthing managers had their eyes on making payments to fulfil the bank’s obligations in the CLN transactions, in total €50m. Also, Kaupthing issued a loan to a company called Lindsor Holding Corporation, a total of €171m. Lindsor was owned by some Kaupthing employees and amongst other things used to buy bonds from Skúli Þorvaldsson, an Icelandic businessman living in Luxembourg, with strong ties to Kaupthing. This diminished Þorvaldsson’s losses but increased Kaupthing’s losses.

Lindsor is the only Icelandic entity being investigated by Luxembourg authorities. Over two years ago it seemed that criminal charges might soon be brought in that case but since then, total silence. Yet another example of the extreme lethargy in the Duchy when it comes to investigating banks (see here blogs related to Lindsor).

The CBI report mentions these two loans but in its overview of outgoings it does not list the Lindsor loan, only the CLN transactions. This, in addition to the single highest payment €225m to deposit holders in Kaupthing Edge, €170m to Nordic central banks, €42m REPO payments to two European banks, €203m in foreign currency transactions – and then, the only novelty in the CBI report: 400-500 “small transactions” according to the CBI report, i.e. lower than €10m, in total €114,5m.

It is not clear why the Lindsor loan is mentioned but not added to the list. Also, there is no further information regarding the “small transactions” – who were the beneficiaries, individuals or companies, who owned the companies, how many transactions at around €8 to €10m etc.?

A bank is rarely a good collateral

In his preface, governor Már Guðmundsson concludes that in hindsight, the lending was miscalculated. However, the lending was not miscalculated only in hindsight: the governor at the time did not believe the loan would ever be repaid.

Governor Guðmundsson also claims that one lesson from the Kaupthing loan saga is that shares in a foreign bank do not constitute a good collateral. In my opinion, this is too limited a lesson: a bank, domestic or foreign, is not a good collateral.

In evaluating collateral, not only its monetary value is of importance but also how quickly and easily it can be sold. A bank makes a bad collateral as it can hardly ever be a quick sale and it is also costly to sell. For good reasons, central banks do not normally accept a bank as a collateral; they prefer assets that can be sold easily and quickly at not too high a cost.

I have not scrutinised that part of the report, which deals with the loss-incurring sale of the FIH bank as I have very little insight into that story. The sale itself turned into quite a saga in Denmark, covered by the Danish media.

Poorly planned and sloppily executed work

To my mind, it is beneath the dignity of the bank to publish this report as so much is lacking. The long time it took to write it cannot be excused by CBI employees being busy; it just shows that writing the report was never a priority.

If the CBI concluded it did not have the authority to ask for further information, it should have turned to the Prime Minister Office to suggest the report should be written by someone with the proper authority to do so. Indeed, it is a fundamental question why the CBI was allowed to handle this investigation, an untrustworthy move from the beginning.

Almost eleven years after the banking collapse in early October 2008, one key story of these days is still untold. The CBI is clearly uninterested in the story. The question is if the political powers in Iceland are equally uninterested.

*I have long been interested in this loan, see here a blog from 2013 on the CBI loan to Kaupthing.

Follow me on Twitter for running updates.

The two Al Thani cases, Qatari investors and Western banks

At the height of the banking crisis in 2008, Qatari investors stepped in to invest in two European banks – Barclays and Kaupthing. Later, these investments were and are the focus of criminal charges, not against the investors but the bankers, who orchestrated the investments. Both cases show that the Qatari investors were intent on profiting not only from the investments but also from hidden fees and sham arrangements. “A sham agreement requires two parties;” if the defendants were dishonest, so were the other party, the Qatari investors,” said Justice Jay during the Barclays trial recently. – This is not only relevant in connection to stories from 2008 but raises impertinent questions regarding Qatari investments in Deutsche Bank and other banks.

In autumn 2008, many Western banks were forced to seek emergency loans from governments. Three banks – Barclays, Deutsche Bank and Credit Suisse – were boastful of the fact that they did not need government funding. As has now become abundantly clear, all three tapped heavily into US measures to save US banks and foreign banks operating in the US. Even more to brag about was the fact that Barclays and Credit Suisse were able to raise funds in the market: Qatari investors were crucial in saving the two banks. Admittedly investment at a high price but these were singularly difficult times.

The Barclays investors were two Royal Qataris. Sheikh Hamad bin Jassim bin Jabr Al Thani, at the time Qatari’s prime minister, also known by his initials, HBJ. In 2013, The Independent dubbed him “the man who bought London” where he has invested both through his private companies and Qatar Investment Authority, QIA. His co-investor was Sheikh Mohammed Bin Khalifa Al Thani who in 2008 also invested in Kaupthing. Barclays paid them £66m for bringing along Sheikh Mansour Bin Zayed al Nahyan, well known in the UK for high octane investments such as Manchester City Football Club, another 2008 investment of his.

The Barclays Qatar story took a different turn in 2012 when the Serious Fraud Office, SFO, opened a criminal investigation into the Barclays deal with the Qataris: the price for the investment was even higher than previously disclosed as Barclays had kept quiet about two “Advisory Services Agreements.” On the basis of these agreements, Barclays paid the Qatari investors and Sheikh Mansour £322m; allegedly, no advice was given. The four Barclays bankers – Barclays CEO at-the-time John Varley and then-senior executives Roger Jenkins, Richard Boath and Tom Kalaris – who orchestrated the payments are now fighting criminal charges in court. Intriguingly, charges against Barclays PLC concerning a loan of $3bn to the Qatari investors were dismissed last year by the High Court.

In Iceland, the Special Prosecutors has exposed another Qatari investment saga, at the core of a criminal case against three Kaupthing bankers and the bank’s second largest investor. It turned out that a Qatari investment in Kaupthing in September 2008 was entirely funded by Kaupthing. Sheikh Khalifa was not charged but charges brought against three Kaupthing bankers and Ólafur Ólafsson, the second largest shareholder at the time, all of them sentenced to lengthy prison sentences.

Now, to the plights of Deutsche Bank. It survived 2008, much thanks to US funding but in 2014 Deutsche Bank was lacking capital; luckily, Sheikh Hamad bin Jassim bin Jabr Al Thani and Sheikh Mohammed Bin Khalifa Al Thani started investing in the bank, eventually becoming the bank’s largest investors. Now, as the German government hopes that a merger between two weak banks, Deutsche Bank and Commerzbank, might (contrary to evidence and experience) make a strong bank, the Qatari investors have indicated they might be ready to invest further.

Intriguingly, two criminal cases regarding Qatari investments show hidden deals the banks did with the Qataris to meet their demands for benefits beyond what investors could normally expect. The question is if these hidden favours were only relevant for these two cases – or if they are general indications of Qatari investors’ preferences in doing deals. If so, it raises questions regarding other Qatari investments in European banks.

Kaupthing and the Qatari investment in September 2008

After a tsunami of bad news in 2008, the one good news for Kaupthing came in September, miraculously a week after the collapse of Lehman Brothers: Sheikh Mohammed Bin Khalifa Al Thani, of the Qatari ruling family, had privately invested in Kaupthing. The investment amounted to 5.01%, just above the 5% threshold that triggered a notification to the Icelandic stock exchange, securing media attention. This investment made the Sheikh Kaupthing’s third largest investor and the only major foreign investor.

In a statement, the Sheikh claimed he had followed Kaupthing closely for some time and was satisfied of its performance and good management team. Chairman of Kaupthing Sigurður Einarsson said at the time that the bank’s strategy to diversify the shareholder base was paying off. To Icelandic media Kaupthing’s CEO Hreiðar Már Sigurðsson said this showed investors had faith in the bank.

But this investment was not enough to save the bank: in the second week of October 2008, Kaupthing collapsed, together with 90% of the Icelandic financial system.

The Kaupthing undisclosed loan and fees behind the Qatari investment

Only months later, rumours were circulating that the Qatari investment in Kaupthing had not been quite what it seemed to be. In April 2010, when the Icelandic Special Investigative Commission, SIC, published its report one of its many colourful stories recounted the reality behind this Qatari investment in Kaupthing: it had been entirely funded by Kaupthing and Sheikh Mohammed Bin Khalifa Al Thani had apparently only lent his name to this Kaupthing PR stunt. The go-between was Ólafur Ólafsson, Kaupthing’s second largest investor.

The mechanism was that Kaupthing lent funds to an Icelandic company owned by the Sheikh. In addition, Kaupthing issued a loan of $50m, labelled as advance profit, to another company owned by the Sheikh. The three Kaupthing bankers involved in the transaction – Hreiðar Már Sigurðsson, Sigurður Einarsson and Kaupthing Luxembourg’s director Magnús Guðmundsson – and also Ólafur Ólafsson were charged for breach of fiduciary duty and market manipulation and sentenced to between three and five and half years in prison (further on Icelog on the Icelandic al Thani case). Although the case was called “the Al Thani case,” the Sheikh was not charged with any wrongdoing.

Kaupthing had further plans of joint ventures with the Sheikh. In summer 2008 there had been an announcement, duly noted in the Icelandic media, that the Sheikh was investing in Alfesca, owned by Ólafsson. According to the SIC report, also here the plan was that Kaupthing would finance Sheikh Al Thani’s Alfesca investment.

In August and September 2008 Kaupthing, advise by Deutsche Bank, financed credit linked notes, CLN, transactions linked to Kaupthing’s credit default swaps, CDS, in order to influence, or rather manipulate, the CDS spreads. Two rounds of transactions were carried out: first via companies owned by a group of Kaupthing clients, then on behalf of Ólafur Ólafsson. A third round was planned, via a company owned by Sheikh Mohammed Bin Khalifa Al Thani, mimicking the earlier transactions, again with Deutsche Bank. Neither the Sheikh’s involvement with Alfesca nor the CDS trades happen as Kaupthing had run out of time and money (further on the CDS saga, see Icelog).

Barclays and Qatari investors in June and October 2008

Kaupthing was a small fry in the financial ocean, Barclays a much bigger fish. Already in spring of 2008, funding worries at Barclays were rising – the share price was falling, market conditions worsening. As Marcus Agius, Barclays chairman of the Barclays’ board 2006 to 2012, recently a witness for the prosecution in the criminal case against the four Barclays bankers, explained in court 19 February 2019, Barclays wanted to be ahead of the market, i.e. adequately capitalised: in the summer of 2008 it was time to raise capital, in fierce competition with other banks.

Consequently, Barclays decided to raise capital and underwriting was arranged. As summerised in Barclays 2008 Annual Report: On 22nd July 2008, Barclays PLC raised approximately £3,969m (before issue costs) through the issue of 1,407.4 million new ordinary shares at £2.82 per share in a placing to Qatar Investment Authority, Challenger Universal Limited (a company representing the beneficial interests of His Excellency Sheikh Hamad Bin Jassim Bin Jabr Al-Thani, the Chairman of Qatar Holding LLC, and his family), China Development Bank, Temasek Holdings (Private) Limited and certain leading institutional shareholders and other investors, which shares were available for clawback in full by means of an open offer to existing shareholders. Valid applications under the open offer were received from qualifying shareholders in respect of approximately 267 million new ordinary shares in aggregate, representing 19.0 per cent. of the shares offered pursuant to the open offer. Accordingly, the remaining 1,140.3 million shares were allocated to the various investors with whom they had been conditionally placed.

The Qatari investors were new to Barclays. At the time, Barclays’ top management saw it as highly beneficial for the bank to attract major investors from the Middle East, according to Agius. Keen to expand, the bank aimed at being a global player. The Qatari connection fitted the bank’s vision of its goal in the international world of finance.

The second round in autumn 2008 – the “tart” and the Sheikh

In autumn 2008, market conditions went from worrying to worse than anyone had thought possible, according to Agius’ witness statement in court. There were only two options: accept state funding or try another capital raising. Barclays hoped to again raise capital from the Qataris.

This time, the Qataris brought another Middle Eastern investor to the table, Sheikh Mansour Bin Zayed al Nahyan. Interestingly, there was some confusion if an Abu Dhabi public body was investing or if Sheikh Mansour was investing privately as Barclays publicly stated to begin with. In the end, the investor turned out to be International Petroleum Company where Sheikh Mansour was a chairman.

The Abu Dhabi investment saga is an even more colourful financial thriller than the Qatari saga. An independent financier Amanda Staveley advised Sheikh Mansour and got at least 30m of the £110m Sheikh Mansour allegedly got in fees from Barclays. In addition, Staveley’s company has sued Barclays for fees of £720m plus interests and cost, potentially well over £1bn,in relations to Sheikh Mansour’s investment. Her case is on hold until the criminal case against the Barclays four is brought to an end.

Somewhat ungracefully, the Barclays bankers referred to Staveley as a “tart” in a telephone recording played at the Southwark County Court recently during the Barclays trial. Intriguingly, this name-calling came from one of the charged bankers, Roger Jenkins, who argued for £25m bonus for 2008 as he had been instrumental in bringing in the Sheikhs, rather belittling Staveley’s part in it.

Barclays’ cash call of £6.1bn in times of panic

There was panic in the autumn air of 2008. Barclays fought to raise capital in order to avoid making use of the 8 October 2008 banking package, in total a staggering £500bn on offer from the government; for comparison, the total government annual spending was 618bn. One condition: participating banks would have to sign up to an agreement with the FSA on executive pay and dividend, making it rather unappealing for the well-paid Barclays bankers.

After some hesitation from the Gulf investors – they allegedly left the negotiations but returned – the bank could finally put out an innocuous statement on 31 October 2008 that Barclays had “held discussions in recent days with Qatar Holding LLC and entities representing the beneficial interests of HH Sheikh Mansour Bin Zayed Al Nahyan (“the Investors”) who agreed … to invest substantial funds into Barclays.”

As summerised in Barclays 2008 Annual Report, Barclays would issue “£4,050m of 9.75% Mandatorily Convertible Notes (MCNs) maturing on 30th September 2009 to Qatar Holding LLC, Challenger Universal Limited and entities representing the beneficial interests of HH Sheikh Mansour Bin Zayed Al Nahyan … and existing institutional shareholders and other institutional investors. If not converted at the holders’ option beforehand, these instruments mandatorily convert to ordinary shares of Barclays PLC on 30th June 2009. The conversion price is £1.53276 and, after taking into account MCNs that were converted on or before 31st December 2008, will result in the issue of 2,642 million new ordinary shares.”

Further, Barclays issued warrants on 31 October 2008 “in conjunction with a simultaneous issue of Reserve Capital Instruments [RCI] issued by Barclays Bank PLC … to subscribe for up to 1,516.9 million new ordinary shares at a price of £1.97775 to Qatar Holding LLC and HH Sheikh Mansour Bin Zayed Al Nahyan. The warrants may be exercised at any time up to close of business on 31st October 2013.” – Qatar Holding now held 6.4% of Barclays shares.

Expensive and unpopular funding

Fund raising in these tumultuous times, as banks were scurrying for government money, might have looked like quite a feat. But the reception to Barclays fundraising was disappointing: the news came as a surprise to the market and existing shareholders were dismayed; also because the fund raising had not been a normal process, Agius said in court.

Reaching the agreement with the Sheikhs had been tough. In an email to Roger Jenkins John Varley said the Qataris and Sheikh Mansour had had “too good a deal.” It did in fact prove difficult to get shareholders to agree; many of the smaller shareholders were very upset.

At least one large shareholder in Barclays voiced concern publicly: though at the time not knowing how high the cost was indeed for Barclays, the pension fund Scottish Widows claimed the capital raising had been driven through at a high cost, just to avoid state ownership and its effect on bonuses. However, by the end of November Barclays shareholders had agreed to the capital raising.

In his foreword to the Barclays 2008 Annual Report, Agius acknowledged the anger the capital raising had caused among shareholders: “…we also recognised that some of our shareholders were unhappy about some aspects of the November capital raising. This unhappiness is a matter of great regret to us.” Further, Agius set out to explain the process and the great care taken by the board to make these difficult decisions “…as we sought to react to the circumstances prevailing at the time. The Board regrets, however, that the capital raising denied Barclays existing shareholders their full rights of pre-emption and that our private shareholders were not able to participate in the raising.”

It was indeed an expensive undertaking: the official terms seemed quite generous, 2% on the RCIs, 4% on the MCNs, as Agius pointed out in court. The RCIs carried interests of 14% until June this year, 2019, (see 2008 Annual Report p.228) when the rate would be 13.4% on top of three months LIBOR. The initial coupon was deemed to carry a cost of 10% after tax for Barclays. In addition, there was a disclosed fee of £66m to the Qatari investors, for having introduced Sheikh Mansour.

The undisclosed fees of £322m for the Sheikhs – and a Barclays loan to the investors

What Agius and others at the bank say they did not know was that the cost of extracting investment from the Qatari and Abu Dhabi Sheikhs were even higher than disclosed. The four Barclays bankers agreed to fees totalling £322m, to be paid over 60 months, hidden in two so-called “Advisory Services Agreements,” ASAs, now the focus of the SFO case against the Barclays four.

What transpires from the Barclays court case is that the three Sheikhs wanted fees for investing; the original figure floated was £600m. It was not trivial to dress up the agreed fee as anything remotely acceptable: after all, these three investors were getting fees no other investors were offered. When the “Advisory Services Agreements” surfaced in communication between the Barclays bankers and the Qataris negotiating on behalf of the Middle Eastern investors as a way for Barclays to pay the companies investing, it turned out that Sheikh Hamad bin Jassim bin Jabr Al Thani also wanted fees for his personal investment.

The bankers saw the absurdity in an ASA with a prime minister: he could not be an adviser to Barclays any more than a US president could be an adviser to JP Morgan! The solution was to increase the total payment for the ASAs to QIA: there would probably be some means to get the extra funds from QIA to its chairman, Sheikh Hamad bin Jassim bin Jabr Al Thani.

The thrust of the criminal case against the four Barclays bankers is if the fees were paid for real service, if any services were given in return for the exorbitant fees. So far, witnesses have not been aware of any services given; indeed, Agius and other witnesses were not aware of the ASAs until some years later, when the they surfaced in relation to the SFO investigation.

It is also known that the Qatari investors got a loan of $3bn from Barclays at the time, which is interesting given the Kaupthing story. This information surfaced in SFO charges against Barclays bank itself; this case was however dismissed in May 2018 by the Crown Court; in October 2018 the High Court ruled against SFO’s application to reinstate the case.

Deutsche Bank – another big bank at the mercy of Qatari investors

Deutsche Bank survived the 2008 crisis through the open funding route in the US. As Adam Tooze points out: In Europe, the bullish CEOs of Deutsche Bank and Barclays claimed exceptional status because they avoided taking aid from their national governments. What the Fed data reveal is the hollowness of those boasts.” Fed records show “the liquidity support provided to a bank like Barclays on a daily basis, revealing a first hump of Fed Borrowing during the Bear Stearns crisis and a second in the aftermath of Lehman (p.218).”